Women in a grain market in Kota, Rajasthan.

Strengthening competition policy is an under-acknowledged but potentially cost-effective way to boost the incomes of the poor. Greater competition between firms has the potential to boost growth through its impact on productivity, and it is increasingly acknowledged as a driver of welfare in the long term.

Despite that fact, competition reforms are notoriously difficult to implement. One of the reasons is opposition from interested groups that stand to lose out from these reforms in the short term – and a frequent lack of evidence or voice on the side of those who could gain from the direct effects of more competition.

What is the evidence on the direct impact of competition on the poorest in society, and what do we still need to learn?

A recent review of the evidence by the World Bank Group (WBG) seeks to answer these questions. The review follows two basic ideas. First: Competition policy has the greatest impact on the poor when it is applied to sectors in which the poor are most engaged as consumers, producers and employees. Second: Competition policy should have a progressive impact on welfare distribution in sectors where less-well-off households are more engaged relative to richer households.

Several sectors stand out as being particularly important here.

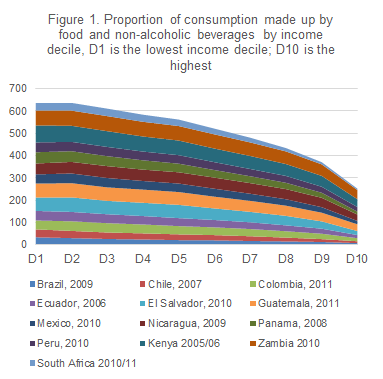

- Food products and non-alcoholic beverages are by far the most important sector for poor consumers in terms of their share of the consumption basket. They also make up a relatively higher proportion of the consumption basket of the least-well-off households. (See Figure 1, below. Source: WBG computations based on household survey data.)

- The retail sector is also important for consumers as the final segment of the food and beverages value chain. It is also a significant employer of the poor.

- Services such as transport and telecommunications play an important dynamic role in combatting poverty and reducing inequality. Better informed and more mobile consumers are more able to switch suppliers, thus moderating suppliers' market power. Services are also an important input for entrepreneurs.

- Other agri-inputs, such as fertilizer and seed, are key for the incomes of small agricultural producers.

In many cases, markets that are important for the poor are particularly prone to anticompetitive behavior or are subject to anticompetitive regulations.

Services like telecommunications and transport, characterized by market segments with natural monopolies and network effects, are prone to generate dominant players which are then more likely to abuse their dominance. Pro-competition ex ante regulation becomes critical in these cases.

Staple foods and agri-inputs display characteristics that are known to facilitate the formation of and the longevity of cartels, as do services like transport. For example, they are generally relatively homogenous products and suppliers’ cost structures tend to be relatively symmetric. In fact, in some cases, it is precisely because the poor are buyers of these goods that suppliers may be able to exercise their market power. Poorer households tend to have relatively inelastic demand and to lack buyer power. Moreover, anticompetitive regulations and import barriers that raise prices are more likely to be present in agricultural goods, where they are justified as protection for low-income producers. New statistics generated by the WBG for Latin America and South Africa suggests that cartels in these focal sectors are relatively common — particularly in food and transport.

A lack of competition in food markets disproportionately harms poor consumers.

In South Africa, WBG research shows that poverty stood to fall by 0.4 percentage points by tackling only four cartels: those in wheat, maize, poultry and pharmaceuticals. The income effect for the lowest-income decile would have been 3.4 times that of the richest.

Similarly, state-imposed barriers to competition can lead to the same effects as anticompetitive behavior by private firms. Regulations that restrict entry in retail markets can generate losses for consumers of food products through higher prices. There is also recent evidence from experimental and quasi-experimental settings in the Dominican Republic and Mexico that increasing competition through entry in retail markets boosts the welfare of low-income households through its effect on prices, as well as on the quality and variety of goods.

Government interventions in food markets, such as import tariffs or minimum support prices, are typically justified as mechanisms to increase the incomes of agricultural producers. But they often ultimately harm the poor. This is because they raise food prices for consumers - and most empirical analyses suggest that the poor tend to be net consumers of food rather than net producers. Research from Kenya, taking into account the dual role of households as producers and consumers, found that competition reforms that reduce the prices of sugar and maize would cut poverty by 1.5 percent and 1.8 percent, respectively.

A lack of competition in key input markets and among downstream buyers can perpetuate poverty.

The welfare of low-income producers can be supported by boosting competition in input markets. For example, returns to smallholder farmers are harmed by international fertilizer cartels which, during the period from 1990-2010, raised prices of chemical fertilizers by an average of 17 percent globally. In addition, anticompetitive behavior among downstream buyers artificially depresses prices received by small producers. For instance, collusion among three large buyers in wheat auctions in India was found to depress the prices paid to farmers close to the “Minimum Support Price” offered by the government. Tackling such practices can also help boost welfare.

More competitive markets tend to bolster job growth over the longer term.

The relationship between competition and employment outcomes is more complex. Product-market reform tends to lift employment on aggregate and increase returns to labor in the long term. The basic intuition is that more intense competition reduces prices toward marginal cost, increasing the output demanded by consumers and, therefore, the labor demanded by producers. Higher labor productivity, driven by competition, leads to higher wages. However, employment outcomes in the short term are less clear-cut, as are the longer-term impacts on income inequality.

One shortcoming of the evidence on employment is that it largely relates to developed countries. This highlights an important gap in the literature. There is ample scope for further research in this area. In forthcoming blog posts, we'll discuss the opportunities for future work to help better identify the links between competition and poverty.

Join the Conversation