Tech startups and business angels are not what comes to mind when thinking of the Czech Republic (CR). Instead, this small central European country is known for its beer, scenic bridges crossing the Vltava river, and existential writers. Not so easy to add “vibrant entrepreneurial hub” to the list as it celebrates the 100th anniversary of Czechoslovakia. Nevertheless, that's exactly what the CR policymakers intend to do.

CR has what it takes to be an entrepreneurial hub for Central Europe

The Czech economy is enjoying a strong economic performance and currently rocks the lowest unemployment rate in the EU (around 4%). It ranks 31st out of 137 countries on the Global Competitiveness Index (GCI – 2017/18) and 14th in Europe on the Global Innovation Index, behind Austria but above Slovakia, Poland, and Romania. The influx of Foreign Direct Investment (FDI) over the last two decades has transformed the economy into a manufacturing and logistics hub and integrated it into the European and global supply chains. Although the country is ranked as a moderate innovator, Prague is listed as a strong innovator on the European Commission’s Regional Innovation Scorecard (RIS 2017).

But the challenges persist as very few CR high-growth firms have been able to attract the needed equity financing and achieve profitable exits—locally and in Europe. Using the criteria of employment growth, the CR ranks above the European average in terms of the share of high-growth companies. Nevertheless, there have only been a few successful technology firm exits, such as AVG (which went public at the New York Stock Exchange in 2012 and was later sold to Avast Software in 2016) and Cognitive Security (sold to CISCO in 2013).

The question remains, how can local and “smart” business angels nurture and scale more high-growth firms to achieve profitable exits and generate positive economic spillovers?

What we know about the CR business angels and their activities

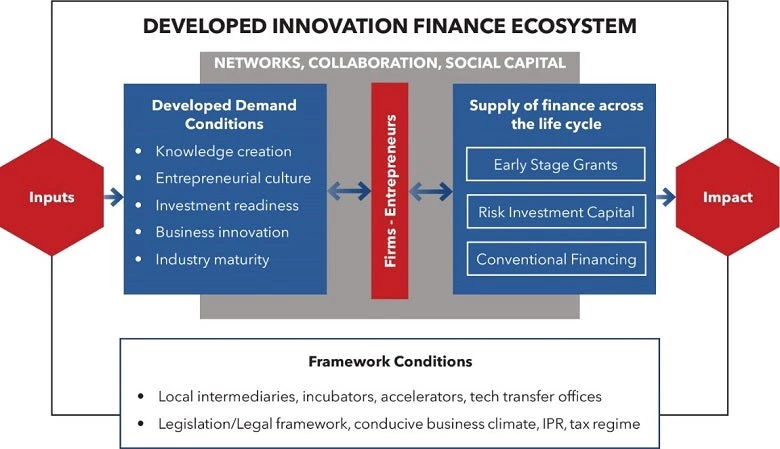

Over the last year, our team took a systematic look at the current level and type of business angel activities in the CR and the different challenges and opportunities affecting its demand and supply. We adopted a comprehensive innovation finance ecosystem framework (figure 1) centered around firms and entrepreneurs to guide our analysis and prepared the first diagnostic study to assess the demand for, or supply of, equity investments in the Czech Republic.

Figure 1. Framework of analysis for the innovation finance ecosystem

Source: World Bank Group

The study titled “Stimulating Business Angels in the Czech Republic”, characterizes the angel ecosystem as “emerging with potential for growth”. All market players are active including investors, founders, intermediaries, and government agencies. Although the aggregate amounts invested and the number of investors is small, availability of funding does not seem to be a [significant] problem for entrepreneurs.

However, there is a concentration of capital with a few angel investors and companies, mainly in Prague, targeting the ICT sector. Compared to more developed markets, there is very little business angel networks or syndication. This domination by a small number of “super angels” and funds that make large investments and a few number of deals constitute a risk for the future development of the risk investment market.

There is a credible deal flow of investable companies (evident by deals being made) but this falls short of representing a critical mass. Areas of potential growth include science and technology university-based spinouts as well as female entrepreneurs (and investors). Some improvements could be made on the operating business environment especially through addressing the administrative burden related to starting a business, bankruptcy costs, and offering stock options. Finally, there is lack of certainty to whether or not public investment readiness programs address the appeal of a startup’s proposition to investors and investor engagement.

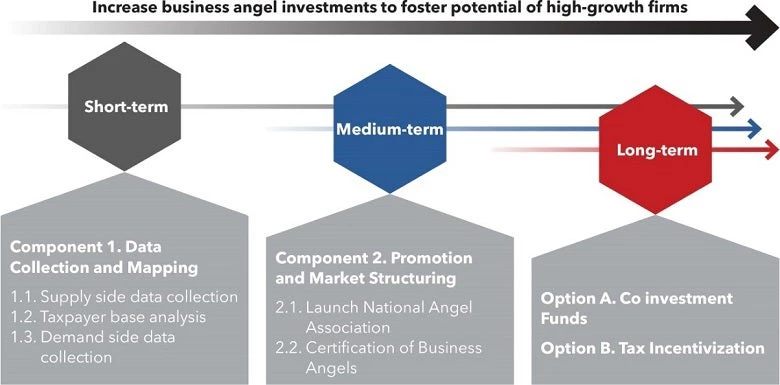

The diagnostic recommends a phased and incremental policy approach to increase business angel investments and foster high-growth firms in the CR (figure 2).

In the near term, it is important to take the pulse of the market by developing a baseline of its size and existing investment activities and opportunities. The suggested data collection methods aim to institute a systematic and periodic measurement of market activities and investment opportunities to inform decision making, policymakers and investors. The Scottish Enterprise Annual Risk Capital Market survey is a good suggested model for taking the pulse of the market.

Figure 2. Recommended Policy Actions for Stimulating CR Business Angels

Source: World Bank Group

In the medium term, the policy objective is to increase the number of business angels, strengthen the capability of angels, and improve the connection between investors and founders to facilitate deal-making. To professionalize the market and reduce the risk of over concentration, it is important that CR angels organize into networks or syndicates and be represented by a national angel association. Priority tasks for the association include promotion, advocacy, capacity and effectiveness building of active angels, and establishing business angel networks.

In the long term, the CR can adopt, mechanisms already developed in more established markets, such as co-investment funds and tax incentives, to leverage individual deals, stimulate investor behavior changes, encourage new entrants, and diversify angel investments into underserved and high potential sectors. There are important pre-requisites that need to be established first, such as information flow, an existing level of angel activity, and conducive legal framework conditions for equity financing.

Adopting a structured and incremental approach to developing the angel market will help firms and entrepreneurs leverage the Czech Republic’s innovation potentials and become a leading innovator in Central Europe. Who wouldn't want to live and build a startup in beautiful Prague anyways?

Join the Conversation