Despite transformative innovations in digital technologies, the digital divide is still substantial. What can be done to spread digital dividends - that is, the broader development benefits of digital technologies – more widely? How can digital technologies contribute to the World Bank Group’s twin goals of eradicating extreme poverty and increasing shared prosperity?

As this year’s World Development Report on “Digital Dividends” notes, digital finance is likely to play a key role in answering these questions. One of the main messages of the report is that digital development is not a matter of access alone.

Digital connectivity is key, but it is only a starting point for successful digital development. It is as important to strengthen other factors that interact with technology - such as responsible regulation and accountable institutions - in order to make digital technologies work for the poor. The World Development Report calls these other factors the ‘analog complements’ to digital technologies, which fall into three categories: regulation, skills, and institutions.

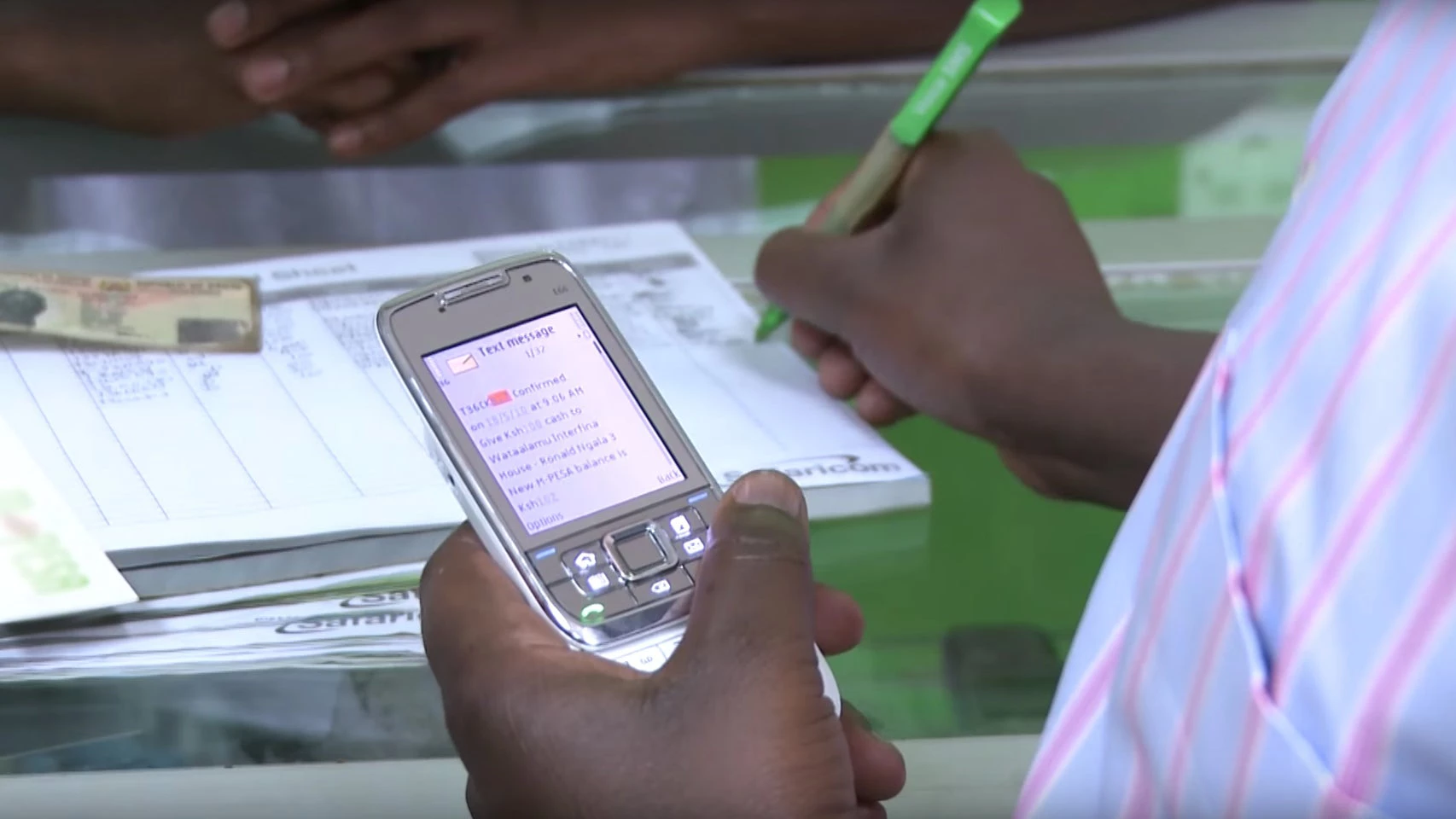

We work on a closely related issue – the global divide in financial inclusion, and how to use digital financial technologies to close it.

Financial inclusion means that appropriate financial services and products – including savings, payments, credit, and insurance –are readily available to adults of all income groups, at a cost affordable to the customer and sustainable for the provider, and provided in a responsible manner. The benefits of financial inclusion are wide-ranging: it helps people better manage their lives, smooth their cash flows, overcome income shocks, and invest in their skills, health, or new businesses.

In 2013, the World Bank Group and its partners set an ambitious goal to achieve Universal Financial Access for adults by 2020, defined as adults worldwide having access to an account to send and receive payments, and store money. While not an end-in-itself, the transaction account often is a key stepping stone to broader financial inclusion.

The report’s focus on ‘analog components’ of digital development aligns with our efforts to support an appropriate enabling framework for greater financial access and financial inclusion: Achieving digital connectivity for all is important, but to maximize digital dividends, we need to look beyond internet access. Likewise, achieving universal financial access is important, but to maximize the benefits from financial inclusion, including through digital technologies, we need to look beyond account access.

Earlier this year, we hosted a workshop to scope the agenda of a new workstream on digital finance as part of the Financial Inclusion Support Framework (FISF). The workshop, which brought together experts from the Bank Group, NGOs and foundations, regulators, and the private sector, sought to develop policy insights about how technological innovations can lead to greater financial inclusion.

Digital finance is one of the fastest-moving, most disruptive industries globally, which is reinventing traditional business models of the financial sector. Global investment in fintech ventures grew by over 200% to $12.2 billion in 2014, compared to 63% growth in overall venture-investments, according to Accenture.

In preparation for the workshop, we identified four developments in digital technologies as particularly relevant for financial inclusion:

- Disaggregation of the Value Chain: New players, including non-banks and non-MNOs (mobile network operators), increasingly offer financial products and services directly to customers or offer services such as data analytics, credit scoring, and payment mechanisms to financial service providers.

- Opening of Platforms and Application Programming Interfaces (APIs): APIs enable new applications to be built on top of pre-existing products, thereby capitalizing on the product’s existing customer base. Open platforms and open APIs, which are still relatively rare, hold the potential to facilitate access to a broad range of products and services, and thus enhance financial inclusion.

- Use of Alternative Information: Digitally collected data, including e-commerce and mobile transaction histories, can complement or substitute traditional methods of client identification and credit risk assessment. Biometric data, such as fingerprints and iris scans, allows providers to meet due diligence requirements for customers with insufficient traditional forms of identification.

- Customization: Better data collection and analytics inform more accurate customer segmentation and human-centered product design, such as clearer user interfaces or targeted alerts and notices to consumers.

During the daylong workshop, participants explored three different categories of policy implications to enhance financial inclusion:

- Removing barriers to financial access and inclusion

- Designing policy incentives to enhance inclusion, e.g. tax incentives

- Mitigating risks, such as fraud and mis-selling of inappropriate products, data security, and technical vulnerabilities around data sharing.

Data ownership was another regulatory issue that was discussed with potentially large implications for development impacts: Does the current model (providers own client data) fit the needs of a fully inclusive financial sector? Could and should regulators allow customers to own their data, or at least mandate providers to share data, when requested by the customer?

The expansion of digital finance and the participation of specialized new players also creates new risks that need to be identified, managed, and mitigated. Traditional financial regulation is often not designed to deal with these innovations. Yet, customers need to be protected from risks such as fraud and mis-selling, especially those who have little experience with the regulated financial sector.

The workshop helped identify policy implications of innovative developments in digital finance that have the potential to enhance financial inclusion. The insights gained will inform the analytical framework for our upcoming research on digital financial inclusion, with the objective to provide policy guidance to inform global policymakers, regulators, and other stakeholders.

More about: Financial Inclusion and Universal Financial Acess 2020

Join the Conversation