Broadly taken, Latin America and the Caribbean (LAC) weathered the turmoil of the global economic crisis fairly well. After the region’s GDP growth slowed notably in 2008, and fell to negative levels in 2009, growth returned to relatively robust, positive rates by 2010. What’s more, this bounce-back in GDP aligned closely with trends in the private sector.

Value added, as a percentage of GDP, in both manufacturing and services, returned quickly from negative levels in 2009 to positive growth by 2010; over the same period, government consumption remained comparatively flat.

In other words, if you want to understand LAC’s recent pattern of economic growth, look at the private sector.

Data from the World Bank Group’s Enterprise Surveys put together a wealth of information, gathered directly from private sector firms’ experiences, to create a picture of the business environment around the world. For our recent work in LAC, the project surveyed nearly 15,000 business owners and top managers in 31 countries, including interviews conducted by re-visiting thousands of businesses in 15 countries, where the surveys were also conducted in 2006.

All together, the data – collected in 31 LAC countries, throughout 2010 and 2011 – enable us to look beyond macro-level indicators to the characteristics of the region’s private sector economy, only a few years removed from a sweeping global economic crisis.

At first glance, LAC’s private sector is not unlike other regions in the developing world. More than 9 out of 10 businesses are small- or medium-sized enterprises (SMEs) with fewer than 100 employees; elsewhere in the developing world this number is closer to 93%. Additionally, 71% of LAC businesses are in the services sector, not substantially different from the 68% average outside of the region.

Yet there are also distinct aspects of LAC’s private sector worth noting:

• Businesses in LAC tend to be older (74% have been in operation for 10 years or more) than in other regions. Even among typically younger SMEs, only 27% of businesses with fewer than 100 employees have been operating for less than a decade; elsewhere, 45% of SMEs have been open for business for less than ten years.

• Formal firms in LAC report high competition with informal firms. Only in Sub-Saharan Africa is the proportion of firms competing with informal firms (66%) higher than in LAC (64%).

• The region’s manufacturers have a comparatively high dependency on supplies from abroad: 71% of the region’s manufacturers rely on materials and supplies from other countries, a level markedly higher than the global average of 61%.

So how do these observations shed light on broader economic patterns?

For one thing, having two waves of comparable data allows us to look at market exit rates – that is the proportion of businesses leaving LAC’s private sector. Between 2006 and 2010, one quarter of firms exited the market (Figure 1). And these exit rates trended clearly with the size of the businesses interviewed. Not surprisingly, the rate of market exit among SMEs (26%) was notably larger than that for businesses with 100 or more employees (17%).

Figure 1

Source: Enterprise Surveys (Included: Argentina,Bolivia,Chile, Colombia, Ecuador, El Salvador, Guatemala, Honduras, Mexico, Nicaragua, Panama, Paraguay, Peru, Uruguay, and Venezuela)

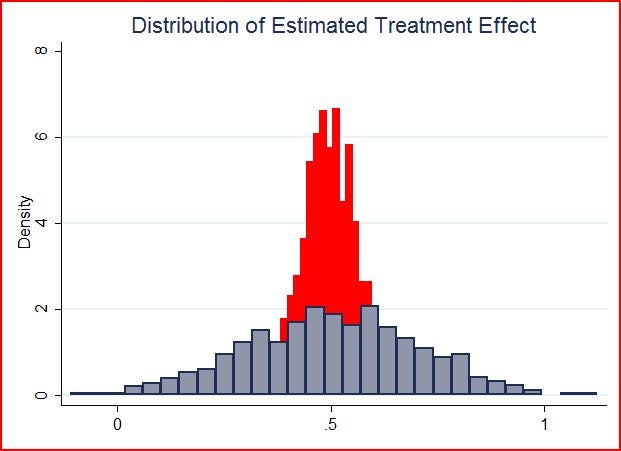

With these rates in mind, we can also say something about the experiences of individual firms in the broader economic context. Among manufacturers, businesses that remained in the market had higher sales per worker compared to those that exited the market. These ‘surviving’ firms, moreover, increased their productivity (in constant dollars) from when they were first interviewed until the second round of the survey (figure 2).

Figure 2

Source: Enterprise Surveys & World Development Indicators

This pattern holds in the service sector, too: though the difference in sales per worker was much smaller, surviving service firms increased their productivity by a substantial amount by the time of the second round of the survey (figure 3).

Figure 3

Source: Enterprise Surveys & World Development Indicators

Of course, the data only provide two snapshots in time, and it would be premature to draw conclusions of causality. Nonetheless, we can identify distinct characteristics of firms exiting the market.

As it turns out, a more robust look at these patterns confirms initial observations: firms that were more productive (in terms of sales per worker) in the first round of the surveys were more likely to remain in business as of 2010. Also, small and younger firms are significantly more likely to exit the market: an expected outcome, as older and larger firms likely have greater amounts of experience, connections, and know-how to survive in the market. As expected, businesses that were credit constrained –those that were unable or discouraged to seek and obtain credit while needing it– were also more likely to exit the market.

The data tell a clear story of market efficiency. Less productive and smaller firms are more likely to exit the market; meanwhile productive firms are able to survive and grow. This is only underscored by the fact that LAC’s private sector is composed of mostly older, larger firms and that a substantial portion of the economy is made up of businesses that choose to not (or are unable to) become formal, presumably operating at lower levels of productivity.

Taken together, these results develop a nuanced picture of the private sector in LAC, adding insight to broader trends. While the region as a whole fared comparatively well through economic crisis, notable structural factors – including high levels of informality and a high dependency on foreign inputs – persist in the region, potentially increasing exposure to external shocks and compromising future private-sector growth.

Over the next few months, the Enterprise Surveys team will be releasing a series of Topic Analysis Notes on What Businesses Experience in the Latin American and Caribbean Region. These notes dig deeper into the nature of the private sector in LAC to add insight on several topics including gender, job creation, innovation, and others. For more information, visit the Enterprise Surveys Topic Analysis page and like us on Facebook.

Join the Conversation