Economic analysis suggests that the next impetus for growth in India's economy will come from micro, small, medium-size enterprises (MSMEs) and startups.

A slew of programs announced in recent years have fostered a more favorable business environment for financial technology – or fintech – models to emerge in the MSME lending space – in India.

This need for technology disruption in formal debt financing has been underscored by a credit gap – estimated at US$230 billion in 2017 – coupled with demand and supply-side issues in financing for MSMEs. Credit availability globally has shrunk in the last decade in the aftermath of the global financial crisis of 2007-2008 and the subsequent heightened regulations.

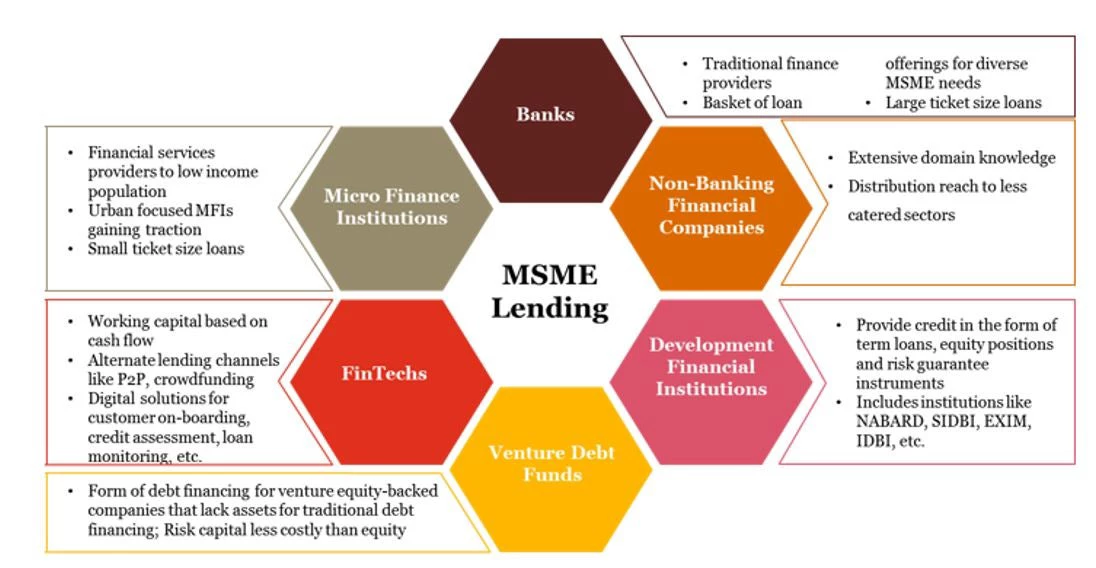

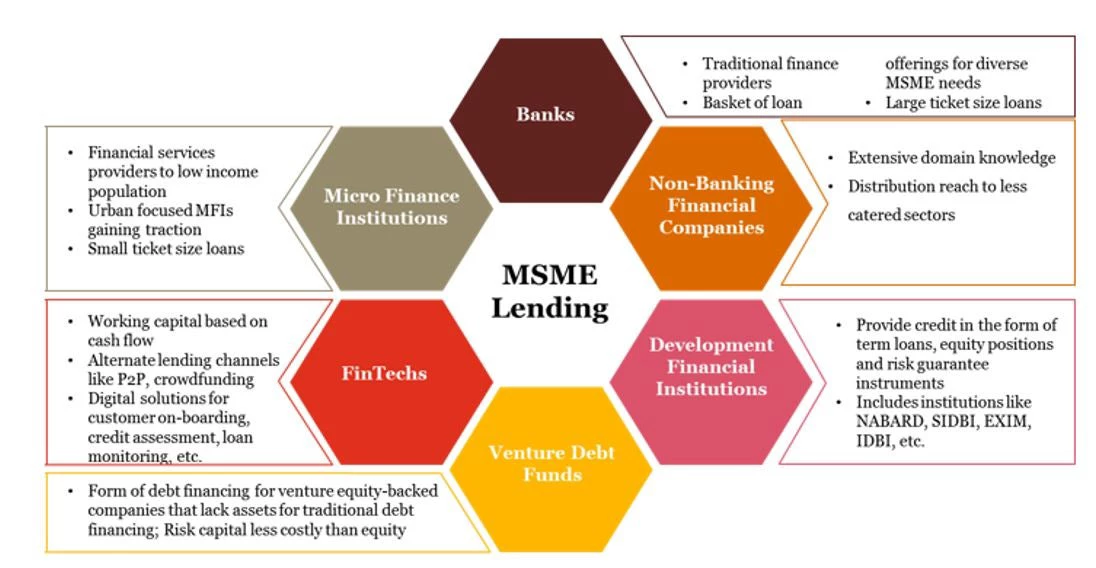

Figure 1: Key players in the MSME lending space in India (source WBG study on Fintech for MSMES in India, 2017)

In India, the GoI, via India Stack and the JAM (short for Jan Dhan-Aadhaar-Mobile) Trinity, is supporting digitization and the fintech industry. IndiaStack is a set of APIs that allows governments, businesses, startups and developers to utilize a unique digital Infrastructure to solve India’s hard problems towards presence-less, paperless, and cashless service delivery. JAM Trinity refers to the government of India initiative to link Jan Dhan accounts, Mobile numbers and Aadhar cards of Indians to plug the leakages of government subsidies.

MSME banking is likely to be the fourth-largest sector to be “disrupted” by fintech in the next five years after consumer banking, payments, and investment/ wealth management (PwC 2016 Global fintech Survey report).

Fintech companies are offering solutions that can substantially improve efficiencies at every step of the lending process. Fintech models can provide end-to-end solutions for the lending value chain or “full stack lending models” such as peer-to-peer (P2P) lending, marketplace lending, crowdfunding, invoice based financing and so forth.

Currently, fintech companies provide small-ticket loans and are focused on MSMEs that have limited credit history and need formal funding.

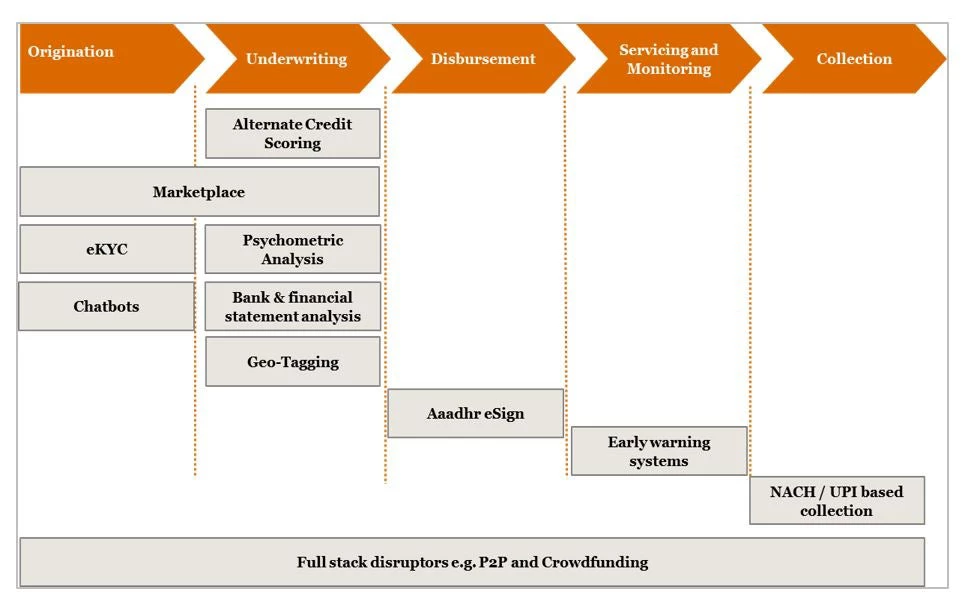

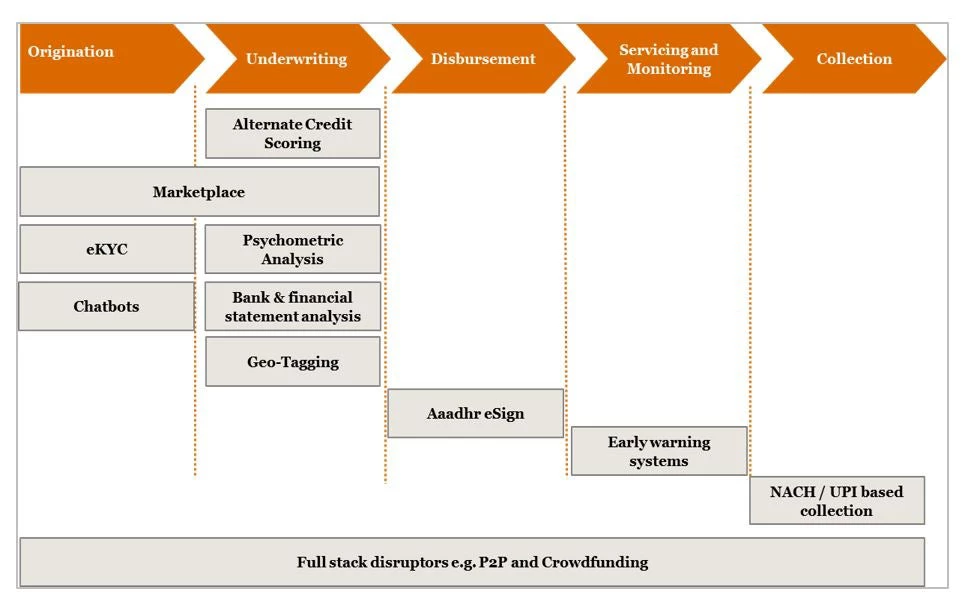

Figure 2- Fintech solutions that can be applied at each step of the value chain (sourceWBG study on Fintech for MSMES in India, 2017)

In India, the World Bank Group has been supporting fintech for MSME lending through the financing and knowledge partnership with the Small Industries Development Bank of India (SIDBI). A recent scoping study on “Fintech solutions to support SIDBI” mapped relevant models and existing frameworks for MSME lending to see how they may fit under SIDBI’s lending strategy and processes, including the design of a specific-fintech product proposition focused on early-stage MSMEs/ Entrepreneurs.

The study emphasizes fintech solutions that promote full stack lending models, building partnerships with the existing fintech companies in India and taking up the policy advocacy role for fintech companies toward their strategic positioning with stakeholders.

The Bank project is also supporting SIDBI to revamp its Udyami Mitra lending portal where the MSME borrowers can apply for different types of bank loans and obtain offers from multiple banks on one platform.

Successful partnerships between fintechs and traditional financial institutions like SIDBI could be a game changer for MSME lending in India:

• Use fintech solutions to improve lending process and outreach

• Finance MSMEs (co-lending, on-lending, guarantee mechanisms etc.)

• Leverage together fintech solutions for outreach to MSMEs (for instance through P2P lending and marketplace lending)

A slew of programs announced in recent years have fostered a more favorable business environment for financial technology – or fintech – models to emerge in the MSME lending space – in India.

This need for technology disruption in formal debt financing has been underscored by a credit gap – estimated at US$230 billion in 2017 – coupled with demand and supply-side issues in financing for MSMEs. Credit availability globally has shrunk in the last decade in the aftermath of the global financial crisis of 2007-2008 and the subsequent heightened regulations.

Figure 1: Key players in the MSME lending space in India (source WBG study on Fintech for MSMES in India, 2017)

In India, the GoI, via India Stack and the JAM (short for Jan Dhan-Aadhaar-Mobile) Trinity, is supporting digitization and the fintech industry. IndiaStack is a set of APIs that allows governments, businesses, startups and developers to utilize a unique digital Infrastructure to solve India’s hard problems towards presence-less, paperless, and cashless service delivery. JAM Trinity refers to the government of India initiative to link Jan Dhan accounts, Mobile numbers and Aadhar cards of Indians to plug the leakages of government subsidies.

MSME banking is likely to be the fourth-largest sector to be “disrupted” by fintech in the next five years after consumer banking, payments, and investment/ wealth management (PwC 2016 Global fintech Survey report).

Fintech companies are offering solutions that can substantially improve efficiencies at every step of the lending process. Fintech models can provide end-to-end solutions for the lending value chain or “full stack lending models” such as peer-to-peer (P2P) lending, marketplace lending, crowdfunding, invoice based financing and so forth.

Currently, fintech companies provide small-ticket loans and are focused on MSMEs that have limited credit history and need formal funding.

Figure 2- Fintech solutions that can be applied at each step of the value chain (sourceWBG study on Fintech for MSMES in India, 2017)

In India, the World Bank Group has been supporting fintech for MSME lending through the financing and knowledge partnership with the Small Industries Development Bank of India (SIDBI). A recent scoping study on “Fintech solutions to support SIDBI” mapped relevant models and existing frameworks for MSME lending to see how they may fit under SIDBI’s lending strategy and processes, including the design of a specific-fintech product proposition focused on early-stage MSMEs/ Entrepreneurs.

The study emphasizes fintech solutions that promote full stack lending models, building partnerships with the existing fintech companies in India and taking up the policy advocacy role for fintech companies toward their strategic positioning with stakeholders.

The Bank project is also supporting SIDBI to revamp its Udyami Mitra lending portal where the MSME borrowers can apply for different types of bank loans and obtain offers from multiple banks on one platform.

Successful partnerships between fintechs and traditional financial institutions like SIDBI could be a game changer for MSME lending in India:

• Use fintech solutions to improve lending process and outreach

• Finance MSMEs (co-lending, on-lending, guarantee mechanisms etc.)

• Leverage together fintech solutions for outreach to MSMEs (for instance through P2P lending and marketplace lending)

Given fintech’s potential for transformative results, by supporting creation of enabling environment and meaningful partnerships between traditional financial institutions and fintech, the World Bank is helping fintech industry achieve scale.

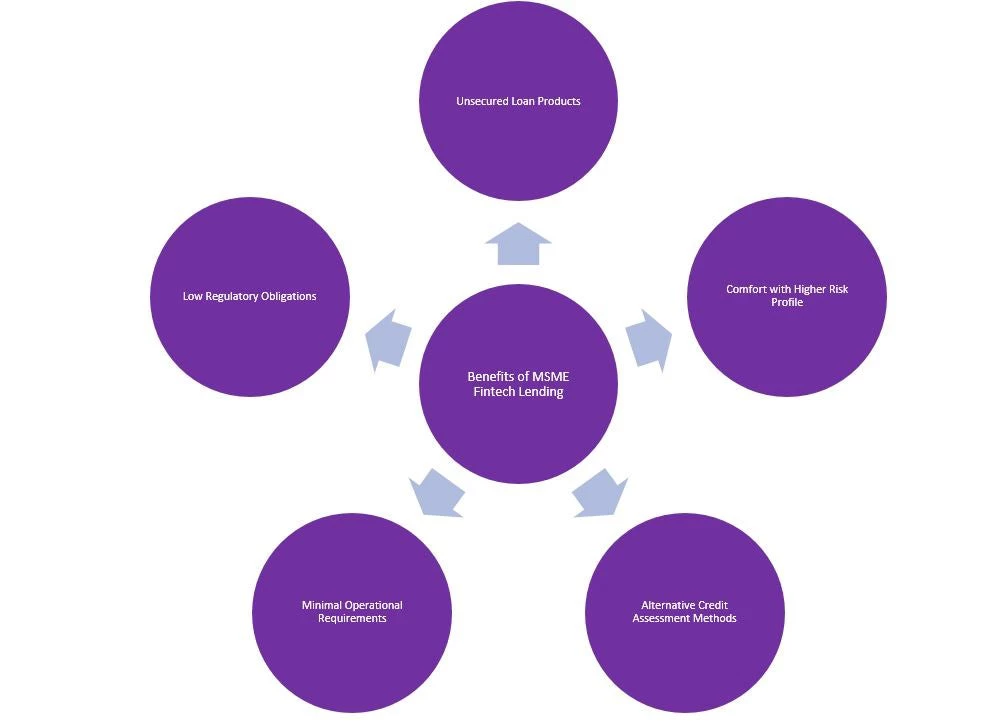

Figure 3: Benefits of fintech for MSME Lending (Source: WEF (2015), WBG-Intellecap Analysis)

Join the Conversation