Over the last two decades the number of investment promotion agencies (IPAs) has mushroomed from only a few dozen in the early 1980s to roughly 250 agencies worldwide today. Despite this growth, relatively little attention has been paid towards whether or not investment promotion agencies actually have an impact on the growth in FDI to a location.

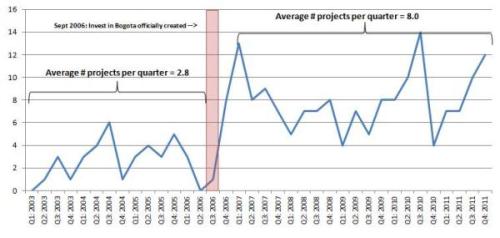

Figure 1: Bogota, Colombia # of inbound FDI projects (by quarter) between 2003-2011

Source: fDi Markets Database, Authors Calculations

Only a few studies have attempted to analyze their impact. A 2000 study that looked at data from the United States Census Bureau found that countries that did active investment promotion received 45.3 percent more FDI flows than those that didn’t. Another study on eight countries’ investment patterns in different US states found that states with established, fulltime IPAs also had higher stocks of FDI. Finally, more recent work using data from the Global Investment Promotion Benchmarking report suggests that FDI inflows increased in the countries and sectors that IPAs targeted by more than twice as much as non-targeted sectors.

Yet these studies have been of the cross-sectional variety. Almost no attention has been paid to the impact individual IPAs have had on attracting FDI to specific locations. Our new research is attempting to rectify that gap using the case of Invest in Bogota, which is the IPA for the city of Bogota, Colombia. Using FDI project data from 2003-2011, and quasi-experimental econometric techniques, preliminary findings suggest that Invest in Bogota had a significant impact on the number of FDI projects that flowed into the city after the agency was created, even after controlling for other key determinants of attracting FDI such as market size and potential, infrastructure, labor quality and security. After the creation of Invest in Bogota in September 2006, the number of investment projects in the city more than tripled. The average number of projects per quarter jumped from 2.8 between the first quarter of 2003 and third quarter of 2006 to an average of 8 projects per quarter from the third quarter of 2006 to the fourth quarter of 2011 (Figure1).

It seems that Invest in Bogota has made a difference in the flow of FDI to the city and the increase in private sector activity overall. Today, there are more than 1,205 multinational corporations registered in Bogota. This is up from 679 in 2006. Since it launched, Invest in Bogotá has facilitated more than $280 million USD in foreign investment in hotels, BPO/call centers, logistics and manufacturing. These investments have already generated more than 3,600 new technical jobs in the city and once completed could generate many more.

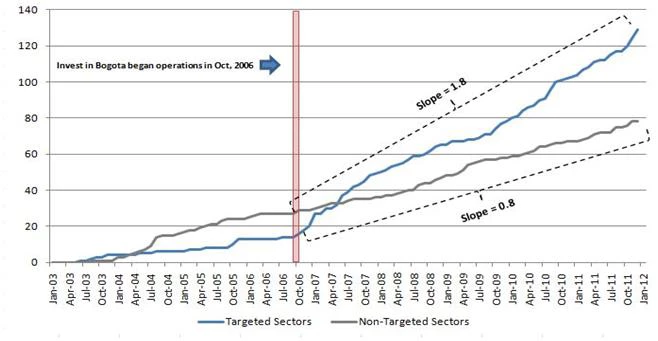

The impact has been most pronounced in the sectors that have been targeted as priority areas by the IPA. In the targeted sectors such as BPO/Shared Services, Healthcare, IT/Software and Oil & Gas Offshore Services, Bogota saw a dramatic jump in the number of investment projects compared to non-targeted sectors (Figure 2). This was in a large part thanks to the knowledge the staff built on these sectors by performing sector studies and developing value propositions, marketing materials, brochures and web products designed to reach investors. Thanks to these efforts, big projects with big impact such as Convergys’ regional call center, Siemens’ new manufacturing facility and Kimberly-Clark’s R&D center have all come to Bogota.

Figure 2: Bogota, Colombia # of inbound FDI projects (cumulative) by targeted and non-targeted sectors between 2003-2011

Source: fDi Markets Database, Authors Calculations

Our findings suggest that when done proactively with sector focus and a high level of professionalism, government or private sector investment promotion activities can impact economic development by helping to increase the flow of productivity-enhancing FDI and jobs into a location. However, this paper is still a work in progress so your thoughts would be much appreciated. I look forward to your comments.

Join the Conversation