Talk about timing! This week has seen back-to-back initiatives that underscore the growing importance of Islamic finance – and the significant role that the World Bank Group can play in unleashing its potential for financing international development.

This Tuesday, October 29, Prime Minister David Cameron of the United Kingdom announced that the U.K. will become the first non-Muslim country to issue a Sukuk or Islamic bond, with a £200 million issue planned for early 2014. Cameron also announced plans for a new Islamic index on the London Stock Exchange. These initiatives are all part of a grand plan by the U.K. government to turn London into a global capital of Islamic finance.

The very next day, on Wednesday, October 30, World Bank Group President Jim Kim inaugurated the World Bank Global Islamic Finance Center in Istanbul. Envisioned as a knowledge hub for developing Islamic finance globally, the center will conduct research and training as well as provide technical assistance and advisory services to World Bank Group client countries interested in developing Islamic financial institutions and markets.

The center is the result of a unique collaboration between the Turkish government, Turkish private-sector entities and the Bank Group, aiming to create a “center of excellence” for the development of Islamic finance.

The center “is a symbol of the Bank Group’s objective of developing Islamic finance, and maximizing its contribution to poverty alleviation and shared prosperity in client countries,” said President Kim.

The direct link of Islamic finance to physical assets, and the use of profit- and loss-sharing arrangements, encourage the provision of financing for infrastructure projects and innovative enterprises that can increase output and generate jobs. In addition, Islamic finance encourages partnership-style financing, which could be useful in improving financial access for the underserved segments of society, such as poor households, SMEs and farmers.

As Islamic finance continues its remarkable growth and becomes increasingly globalized, addressing the various challenges facing the industry becomes critical to the fulfillment of its potential. There is a need to strengthen its legal foundations; develop robust regulatory and supervisory frameworks; adopt accounting and auditing standards; and improve transparency and governance practices. Developing market instruments and enhancing the capacity of Islamic finance professionals (and their regulators) will also be critical.

It is therefore appropriate that the new center will emphasize the generation, sharing and deployment of cutting-edge practical knowledge on how to make Islamic finance more relevant for inclusive growth and poverty alleviation in developing and emerging markets. This is an excellent example of the World Bank Group's new vision of becoming a “Solutions Bank,” focused on forging partnerships and supporting transformational engagements to address development challenges in the Bank Group’s client countries.

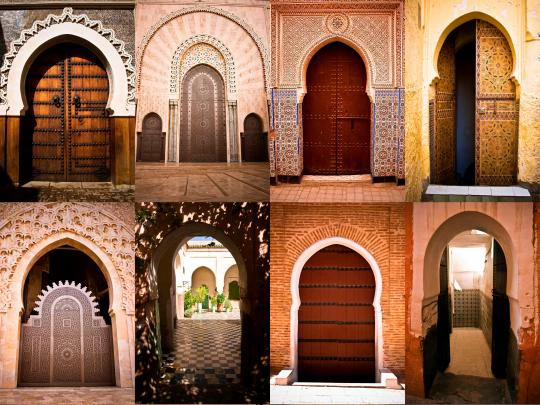

Photo credit: Istock.com/gioadventures

Join the Conversation