South Korea today has the fourth largest economy in Asia, is a member of the OECD’s “Rich Club,” and is part of the G20. Despite sharp economic shocks emanating from the Asian financial crisis in the late 1990s, the global financial crisis in 2008, and the more recent slowdown in the Chinese economy – Korea has bounced back and continues to grow.

So it’s hard to imagine that some 70 years ago, Korea’s future looked very bleak – and akin to many of the excruciatingly difficult post-conflict environments that we face today.

To briefly summarize Korea’s post-World War II history: a 1947 report on Korea commissioned by U.S. President Truman concluded, “South Korea, [as] basically an agricultural area, does not have the overall economic resources to sustain its economy without external assistance …. Prospects for developing sizeable exports are slight ….. The establishment of a self-sustaining economy in South Korea is not feasible.” Then the Korean War compounded these problems – resulting in massive damage to both the north and the south – with destroyed infrastructure, a loss of skilled workers, a million South Koreans killed, and as much as one-quarter of the country’s population refugees.

We have many lessons to learn from Korea – particularly as our institution, the World Bank, increasingly focuses on post-conflict and fragile environments.

Although South Korea is known for its large scale “Chaebols,” which have dominated much of its political and economic life – less well known is the considerable support that the government has provided to small and medium scale enterprises (SMEs). As in most countries, Korean SMEs play a pivotal role in the national economy, accounting for 99% of all enterprises (3 million SMEs), over 80% of all employees (10.8 million employees), and almost 48% of total national production.

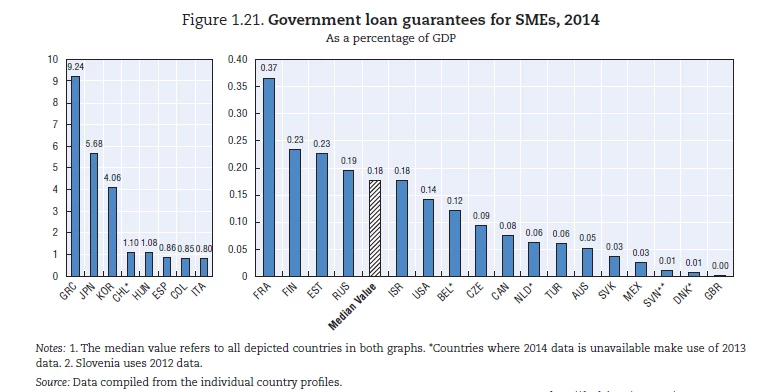

A main policy tool for supporting Korean SMEs has been Korea’s Credit Guarantee Agency (KODIT), which is one of the largest credit guarantee schemes (CGSs) in the world – guaranteeing a portfolio of around $44 billion.

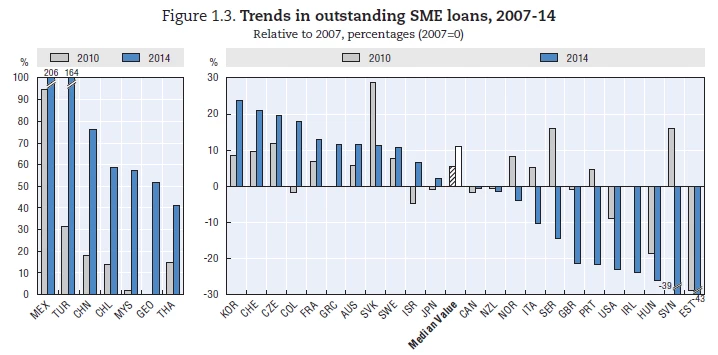

I visited Seoul in May this year to give a Key Note Address at KODIT’s 40th anniversary. The visit was timely as credit guarantee schemes are capturing increasing interest around the world as bank lending to SMEs struggles to return to pre-2007 crisis levels. By contrast, according to the OECD, Korea has experienced a healthy growth in SME lending since 2007 – boosted by the support provided by credit guarantees . The two graphs below from the OECD’s “2015 Score Board” show the high sustained levels of SME lending in Korea – as well as the significant overall size of KODIT.

Unlike many SME support schemes that governments are now keen to push – including directed lending programs, subsidized interest rate schemes, or central bank breaks on reserve requirement holdings for commercial banks – credit guarantee schemes are considered more market friendly as they combine a subsidy element with market-based arrangements for credit allocation. The best of these credit guarantee schemes are designed to increase overall levels of lending to SMEs , reduce their collateral requirements, and reduce the interest rate charged on such loans.

Figure 1: Trends in Outstanding SME Loans, 2007-14

Relative to 2007, percentages (2007=0)

Figure 2: Government Loan Guarantees for SMEs, 2014

As a percentage of GDP

This is but one area where Korea has excelled and demonstrated how to provide prudent, yet effective, support to a key segment of the national economy. The World Bank’s ongoing relationship with the Government of Korea and the establishment of an office in the country will help us leverage this real-world experience so Korea can share its own phenomenal economic growth story with the rest of the world and bring lessons from the real-world interventions that have made this success story possible.

Join the Conversation