“Every business needs an angel.”

This was the advice given by John May, Chair-Emeritus of the Angel Capital Association and Co-Chairman of the World Business Angel Association, to 20 of the best African and Caribbean mobile software entrepreneurs from infoDev’s network of mLabs, mHubs and partner incubators.

Last November, this lucky group gathered at infoDev’s Mobile Startup Camp to learn, refine their product strategies, and hone their pitches to angel investors. They received one-on-one mentorship from John and a team of other experts on raising early stage financing from angels.

However, many more talented entrepreneurs did not have this unique chance. In addition, many high net worth individuals who are curious about investing in startups in their communities or in their countries of origin, simply don’t know where to start when it comes to angel investing. “Angels” play a significant role in helping new businesses get off the ground. Research in the U.S. indicates that start-ups funded by angel investors provided about 274,800 new jobs in 2012, or about 4.1 jobs per investment.

The number of business registrations is often used to gauge startup activity in a country. In Sub-Saharan Africa, the Middle East, and North Africa, new businesses are registered at lower rates per capita than in higher-income countries. One of the reasons for this is the lack of early-stage financing coupled with mentoring, such as that provided by angels. If successful entrepreneurs and wealthy individuals could help startups bridge the early-stage financing gap in these markets, new, innovation-driven firms could create millions of high-value jobs each year and help improve industry competitiveness.

Download the guidebook at: http://bit.ly/angelgrp

Download the guidebook at: http://bit.ly/angelgrp

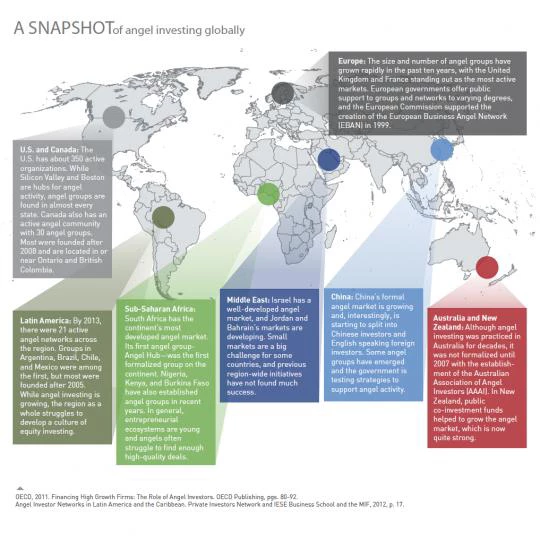

The barrier between matching promising opportunities with the investments they need at the early stages of growth is often caused by a general lack of awareness of a number of key aspects of angel investing: from the roles angels play in a fledgling business, to the mechanics of setting up an angel network, to the variety of possible investment vehicles, to the inspiring examples and lessons from angel activity all over the world.

While individual angels are incredibly important, there is only so much one person can do alone. Angel groups, which pool the resources and knowledge of their members, can overcome many limitations associated with solo financing and investing in risky environments. In this regard, angel groups can be helpful in the following ways:

- As a network of networks, an angel group can access a higher number of deals, especially when groups are recognized as having a particular investment focus.

- Groups can aggregate resources to secure staff, interns, and facilities to enhance the deal process.

- Angel groups have more efficient deal screening and valuation processes that allow for multiple “checks and balances” since the members possess diverse and often complementary information about the team, market, and business model.

- By combining resources of individual investors, angel groups can make larger investments, giving the startup more stability at the most critical stages of business development.

- Angel groups allow individuals to participate in a higher number of deals, thus diversifying their risk.

- New members can learn about all aspects and steps of investing from experienced angel investors.

- The pooling of investment capital gives angels greater economic power and influence, which enhances their position in an investment terms negotiation.

- Angel groups provide the intangible values of camaraderie and sharing of common goals.

- Angel groups can have an influential voice collectively when raising regulatory and policy issues with government and can contribute to the creation of new and better policies.

This year, we are thrilled to present our guide for Creating Your Own Angel Investor Group, which aims to educate entrepreneurs and angels from around the globe. It offers hands-on examples and useful templates, such as financial worksheets, application forms, term sheets, contracts, and checklists.

The publication is a substantial update of the original Kauffman Foundation’s 2004 guidebook, which targeted a U.S. audience. This international edition is written specifically for newcomers to angel investing, and highlights the successes and challenges of angel groups in emerging and frontier markets.

The reader is invited to discover the steps needed to assess one’s community, identify risks, and addresses factors that may lead to failure. Practical advice for setting up and running an angel network is illustrated from examples of new angels from around the world. More technical topics about the investment process (such as due diligence, valuation, and deal structuring) are addressed briefly, and readers are directed to materials and courses with more thorough guidance on these issues.

The guidebook’s editor, Laura Baker, interviewed more than 30 people from 20 countries for this state-of-the-art publication.

“The research uncovered a high demand by new angels for investment guidance. Typically, a community had one or two champions who were committed to formalizing angel investing in their countries, but they ran into problems caused by a lack of awareness of angel investing among financiers, entrepreneurs, and governments,” notes Laura.

We hope that Creating Your Own Angel Investor Group: A Guide for Emerging and Frontier Markets will help to address such challenges and inspire a new global generation of business angels to develop rich, local entrepreneurial ecosystems.

Join the Conversation