The financial system is going through a period of rapid innovation that is disintermediating the financial services value chain. This can have significant benefits for financial inclusion- providing access to, and enabling active usage of, affordable financial products and services to all individuals while supporting a diverse and competitive marketplace.

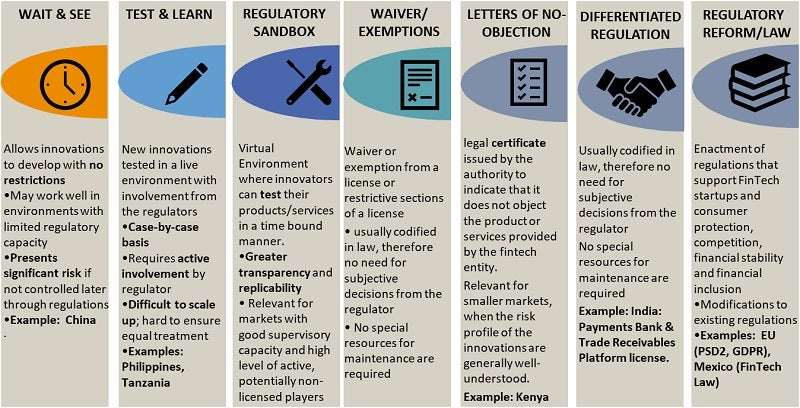

Financial regulators around the world are looking for more flexible ways to engage with fintech companies while being mindful of the inherent risks. Although the importance of interacting with this sector is widely accepted, the most appropriate instrument to do so is still being determined.

A tool that has become increasingly popular and synonymous with innovation is the ‘Regulatory Sandbox’. While nuances exist, they are fundamentally a regulator-controlled environment that allows participants to test their products, services and business models. However, Sandboxes are only one of several tools that regulators can use and have both benefits and challenges associated with them.

Sandboxes are a signal to the industry that the regulators are willing to engage with them; they distill evidence-based results which could potentially influence future supervisory methodology or even have implications for the regulatory perimeter. For firms, Sandboxes offer a faster route to market and a better understanding of regulatory hurdles they need to cross.

Legal Mandate- Sandboxes may not be as easy to set up in a civil law jurisdiction as compared to those operating under common law. Although there are cases of Sandboxes being set up in both types of jurisdictions, the competition mandate in jurisdictions such as Singapore and the UK have actively propelled the environments in those regions to promote market development.

Capacity- Sandboxes can be extremely resource-intensive. For example, the UK FCA’s Innovate has nearly 40 staff and while not solely involved in the running of the Sandbox alone, they provide policy and operational support to the framework.

Regulator Co-ordination: Often, there are several regulators within the same jurisdiction who are responsible for related but distinct supervisory activities. With the new business models introduced by fintechs, there is often uncertainty regarding the remit they fall into which can potentially be exacerbated if there is a lack of co-ordination between the separate regulators.

Maturity of Market: For a Sandbox to function effectively, the existence of a functioning and mature entrepreneurial environment is vital. Most Sandboxes will only admit those firms that have a viable product, enabling them to test the feasibility of their business model. For those markets where the fintech ecosystem is still nascent, other fintech tools might be a better fit.

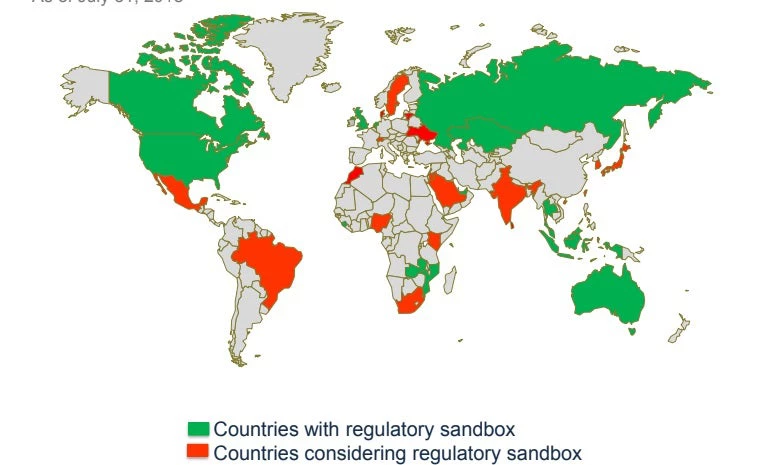

At last count, over 30 jurisdictions had created, or announced their intention to create, regulatory sandboxes primarily for fintech, with more in the pipeline.

Before a jurisdiction decides to embark down the route of creating a Regulatory Sandbox, authorities should step back and objectively review the environment in which they operate, the maturity of the market and their primary objective (s); be it increasing competition, fostering an environment for innovation or increasing financial inclusion to understand the most relevant tool to achieve these outcomes.

Sandboxes can provide valuable insights based on empirical evidence and can support a fundamental transformation of the regulatory process, however there is a risk of them being viewed as the lone solution to enable fintech.

Sandboxes alone are not a complete solution for engaging with emerging technologies and regulators can learn a great deal simply by engaging collaboratively with the sector and being open to dialogue with new market players. Proportional and judgement-based supervision supported by advice units and informal consultations can both engage with a wide cross-section of market players and can potentially sieve those products that might need further structured sandbox testing, hence bolstering and enabling the market for innovation.

Join the Conversation