For several decades, manufacturing in the automotive sector has made a strong contribution to spurring national growth, to promoting technology acquisition, and to raising incomes for workers across skill levels in developing economies as well as in developed nations. In India – the world’s sixth-largest producer of cars, where the automotive sector has been growing but at well below its tremendous potential – productivity levels would need to increase rapidly. A wave of autonomous functionality in vehicles and other technology-driven disruptions are not far away with the involvement of tech giants like Google, Tesla, and Uber. This makes the need to improve productivity in order to respond quickly to changing environments even more critical for traditional automakers.

Some long-awaited reforms in India to improve automotive manufacturing performance came through this year. In July, the Government of India implemented a unified Goods and Services Tax (GST) regime to replace the multiple taxes that had been levied, in the past, by the state and central governments. This makes for a more integrated market, with uniformity in tax rates where automakers will be helped by easier compliance, the removal of cascading effect of taxes and the reduction of the costs of doing business. Reinforcing this, the union budget allocation in February allows for more investments in roads and highways, farm-friendly policies and income-tax reform for the middle class. Those steps will increase demand for small passenger vehicles and for the farm-equipment segment. This is all good news for the automakers in India.

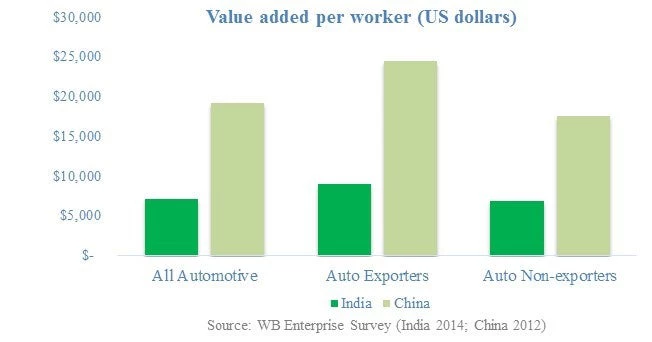

Still, much more needs to be done to increase overall productivity in this job-creating and technology-rich sector. According to a recently published report by the World Bank Group, entitled “Automotive in South Asia: From Fringe to Global,” productivity (measured by value added per worker) in India’s auto sector remains less than one-third the level of China. From 1993 to 2004, the growth rate of Total Factor Productivity in China’s automotive sector was 6.1 percent per year, compared to only 1.1 percent in India. The growth rate of labor productivity was 9.8 percent per year in China, compared to 3.1 percent in India. Even though India has been increasing production of units at 11 percent to 15 percent per year (from 2005 through 2015) , it could do much better on improving productivity levels.

The auto industry in India is organized in tiers with the presence of automakers (also called Original Equipment Manufacturers, or OEMs who are assemblers or the final customers in manufacturing) and suppliers moving from complex jobs to simpler ones along the value chain (also called Tier 1, Tier 2 and Tier 3 suppliers), similar to the pattern that is occurring elsewhere in the world. Below is a summary of how the Indian auto sector (for both OEMs and auto-parts suppliers) fare on the key drivers of productivity.

Achieving size and scale: Even though the relationship between scale and productivity is well acknowledged in this capital-intensive sector, only four of India’s 18 OEMs operate at the industry standard of 100,000 units per model. In China, by contrast, 25 of 27 automakers are functioning above that level. Maruti-Suzuki and Hyundai are among the exceptions in India: They have achieved scale by adopting a high-volume strategy focused on a relatively limited range of models within the small passenger vehicles segment.

Fostering a competitive external environment, including incentives to integrate into Global Value Chains (GVCs): This is closely related to the scale issue. While some Indian auto-parts suppliers are participating in GVCs that are focused on end markets in North America and Europe, most OEMs do not export, even though they have excess capacity and they confront no tariff or non-tariff barriers that hinder exports. Behind this disproportionate focus on the domestic market is the high import tariff on finished products: With tariffs of 60 percent or more, OEMs focus on the domestic market at the expense of exports, as demonstrated by India’s growing production but low share in global exports (less than 1 percent in 2014). Limited competition from imports has played a role in reducing the incentive for local automakers to achieve higher productivity. By contrast, the auto-parts sector, which was subject to liberalization in the 1990s, has performed better in GVCs.

Focusing investments in innovation, design and R&D: For global Tier 1 firms, design capabilities are becoming critical factors in the selection of Tier 2 subcontractors. Markets in the Slovak Republic, Brazil and Poland have already witnessed a demotion of local Tier 1s into Tier 2s and Tier 3s. Yet local suppliers in India are not investing fast enough in acquiring those abilities, and continue to rely primarily on build-to-print models. The average expenditure on R&D and design capabilities in Indian auto firms ranges between zero and 2 percent of sales: That is lower than the global average of 5 percent.

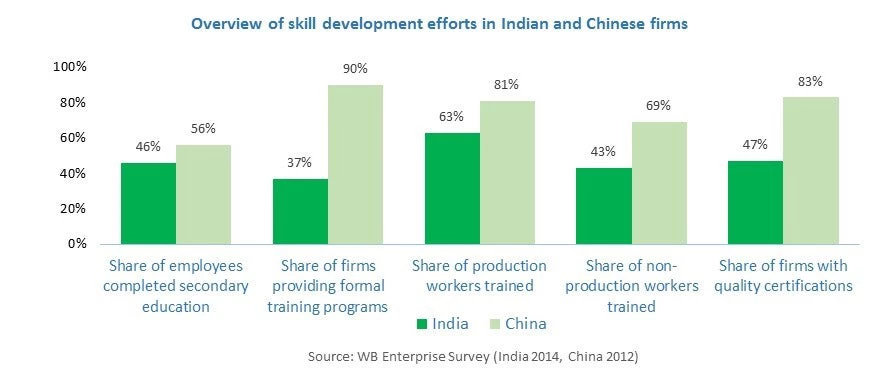

Maintaining high levels of quality control among suppliers and investing in skills of workers: Between 60 percent and 70 percent of the costs of a car occur at the level of Tier 2 and Tier 3 suppliers, where quality control tends to be uneven. Although a few suppliers in India are nearing world-class standards, production systems were not always set up to ensure that defects can be identified and that debugging can be done in time to contain the ripple effect of mistakes, which can lead to high rejection rates and a negative impact on profits. A related issue is the low level of formal training for managerial staff, where large skill gaps are a real challenge for this sector. Only 43 percent of non-production workers in India’s automotive sector are formally trained, compared to nearly 70 percent in China. Only 47 percent of auto firms in India have internationally recognized quality certification, compared to 83 percent in China.

Concentrating agglomeration and spatial arrangement in clusters: Co-location is important to success in this sector, and more than 80 percent of auto firms in India are focused within clusters, including export-processing zones (EPZs) or industrial parks, compared to 55 percent in other manufacturing industries. Being located in clusters is positively associated with greater success in navigating business-climate issues, with lower operating costs and with higher capacity utilization. However, a great deal remains to be done to develop linkages between Small and Medium-Sized Enterprises (SMEs) and lead firms (OEMs and Tier 1s typically). More data on agglomeration and its effects on productivity are discussed in the flagship study on South Asia’s competitiveness.

Policy reforms can help India spread world-class capabilities that now exist in a few firms throughout the automotive sector and move up the global value chain by promoting greater innovation, investment in R&D and product commercialization. A gradual reduction of import tariffs, in the automaking sector, on Completely Built Units (CBUs) – far from leading to the debilitation of an industry – could be a powerful catalyst to its global success and to the spread of world-class capabilities in the value chain. Rapid convergence toward international environmental and safety standards would further encourage automotive firms in India to align with international good practices. Supporting programs for innovative design and R&D activities in the value chain, including for hybrid and electric cars, will enable the region to fulfill its great potential in this rapidly transforming industry. Further assistance to develop linkages between SMEs and OEMs/Tier 1s located in EPZs/clusters would increase the competitiveness of the middle segment of the value chain.

Such policy reforms can help India strengthen its position in the automotive sector, move toward a “resilient, productivity-driven, global-value-chain-focused model,” and create new jobs for the millions of young workers who are joining the labor force every year.

This blog post is the first part of a two-part analysis of the competitiveness of the automotive sector in India. The second blog post can be found here. The full report on automotive-sector competitiveness in South Asia can be downloaded here. The full volume on South Asia’s competitiveness can be downloaded here.

Join the Conversation