"In Chad, young people increasingly turn to innovative entrepreneurship but often become demoralized when confronted with the common issue of lack of early-stage financing.” This is how Parfait Djimnade, co-founder of Agro Business Tchad, a leading e-commerce agribusiness and social enterprise in Chad, described the challenge many aspiring entrepreneurs face in securing the necessary capital to fund and grow their start-ups, specifically in the Sahel and West Africa.

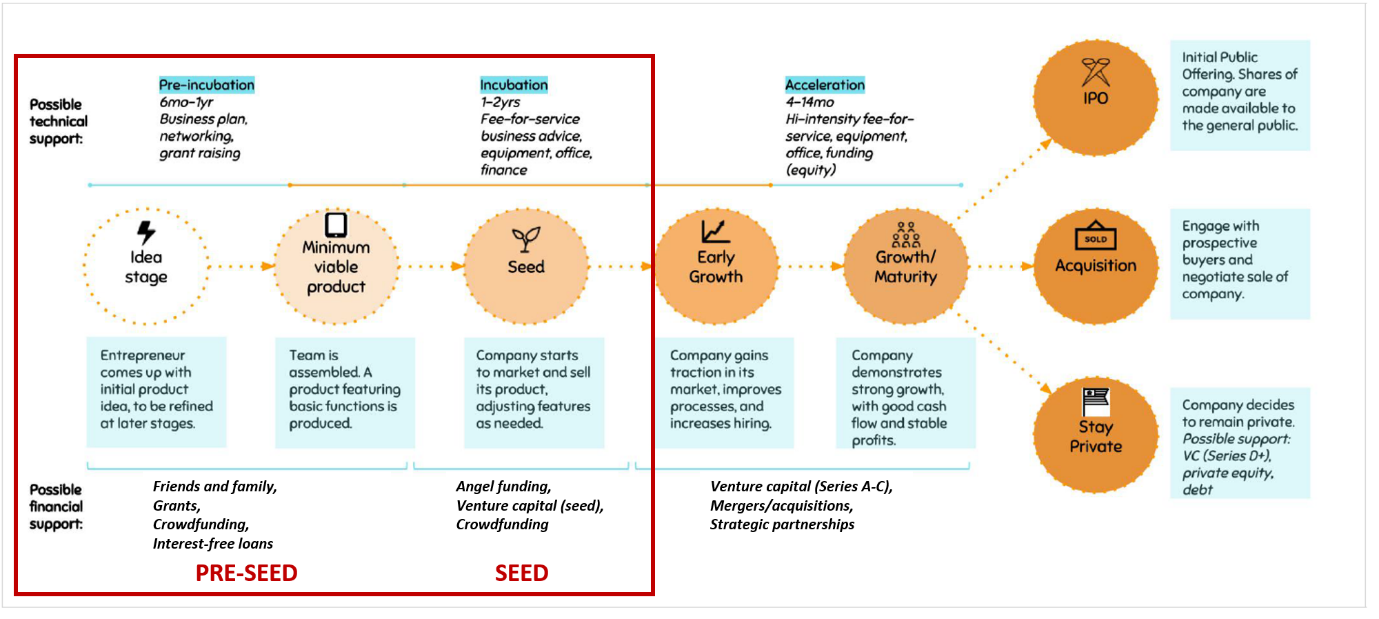

The frustration Parfait highlights is common across the Africa region, where more than 40 percent of entrepreneurs cite access to finance as the major factor limiting their growth, according to World Bank Enterprise Surveys. West African start-ups and innovative young SMEs are indeed facing the classic ‘valley of death’ — the space between where the entrepreneur’s own resources from family and friends (“love money”) gets depleted and when the company is financially viable enough to attract later-stage investment and financing available on the market. The shortage of financing in the market starts from the pre-seed stage (US$20,000) to early-venture capital stage (US$1 million).

In short, a “new” class of financial instruments must emerge to provide the pre-seed and seed capital these early-stage businesses need. Initiative France, for example, serves as a good case study for pre-seed capital, not only providing interest-free loans on a large scale from US$20,000 to $150,000 to entrepreneurs at the idea stage, but also supporting them technically and connecting them with potential seed investors. Their model, which facilitated the financing of 16,000 businesses and the creation of more than 44,000 jobs in France in 2016 alone, is now being replicated in Tunisia, Burkina Faso, Chad, and Mali, with repayment rates constantly above 90%. Afric’Innov, discussed in our recent blog post, also plans to deploy the instrument through its incubators network, after testing it in Benin (Etrilabs), Burkina Faso (La Fabrique), Niger (CIPMEN), and Senegal (CTIC Dakar).

Alternatively, donation crowdfunding — the use of online platforms to raise money from a large base of people — can represent another source of financing to cover African start-ups’ working capital and pre-seed financing needs. This has been gaining increasing traction in Africa, despite the lack of a legal and regulatory framework. In Mauritania for example, budding entrepreneurs pitch their ideas on GoomFund, raising up to a few thousand US dollars via SMS.

Known as crowd-equity, crowdfunding can also cover larger capital needs if equity-based which is demonstrated by the pan-African platform Afrikwity that provides between US$200,000 and $1 million to African innovative start-ups and SMEs, typically from the African diaspora living in Europe.

The rise of investment funds and business angels has significant potential on a broader scale to address seed capital needs, but they remain scarce in Africa. While it is true that the region’s recent economic performance has made it an increasingly attractive destination for investment, much of the investor attention has been on larger companies in just a few countries (primarily South Africa, Kenya and Nigeria), and in a select few sectors where start-ups cannot compete (particularly natural resources and telecommunications).

Nevertheless, a handful of equity investors have started to pave the way for investments in early-stage growth businesses in West Africa. Sponsored by the impact investment firm Investisseurs & Partenaires (I&P), Teranga Capital in Senegal, Sinergi in Niger and Burkina, and Comoe Capital in Cote d’Ivoire, these investors have taken (minority) shares from US$100,000 to $300,000 in small and growing businesses and provided them with close management and governance support.

The African Business Angels Network (ABAN), meanwhile, is a pan-African non-profit that supports the creation and growth of angel investor networks such as Ivoire Angels or Lagos Angel Network - LAN, capable of investing up to tens of thousands of dollars in startups. Tomi Davies, co-founder and President of ABAN, noted the following during the African Angel Investor Summit 2017, “Angel investing requires patience. Wolves hunt in packs. That is what angel investing is all about. We are more likely to succeed if we join a group and we invest in a portfolio.”

A degree of public intervention is required to help these new players emerge and invest in under-served segments, sectors and geographies. In order to partially fill the market gap and allow the private sector to fill the remaining gap (‘crowding-in’), capital can be provided to funds investing equity/quasi-equity seed capital in startups. Other interventions include covering the management fees, in particular the costs of establishing the funds, through grants.

Once the pre-seed and seed capital needs are covered, support services can be provided to bring the start-ups to investment-readiness for the next rounds, to build mature pipelines for venture capital funds. That is what the World Bank piloted with XL Africa, the pan-African post accelerator program supporting later stage digital start-ups. Through world-class mentoring, a tailored online curriculum and an intensive two-week residency, XL Africa helped 20 high-potential digital start-ups – including the e-commerce platform Coin from Francophone West Africa – raise Series A investment up to US$1.5 million.

These complementary interventions provide a few examples of an innovative “cascade” approach (mobilizing financing for development) that the World Bank Group now can implement on a larger scale in West Africa to catalyze growth.

Join the Conversation