What can host countries do to manage risks and attract other private investors?

Investors want to ensure that their investment will be subject to predictable and stable rules and are well-protected from arbitrary government conduct. One fundamental set of tools that governments often use is to provide explicit protection for investments through investment treaties and laws.

In a recent working paper, we analyze where BRI countries are in providing protection to investments through these tools, using a database on the near universe of investments laws and International Investment Agreements (IIAs) from 21 sample BRI countries.* Following the convention in the legal and international political economy literature, we construct quantitative measures of protection based on coding the textual content of 17 domestic investment laws and 648 international investment agreements. In addition to protection, we include a “balance” analysis on exceptions and carve-outs that explicitly allow States room for legitimate regulatory actions.

What are our main findings?

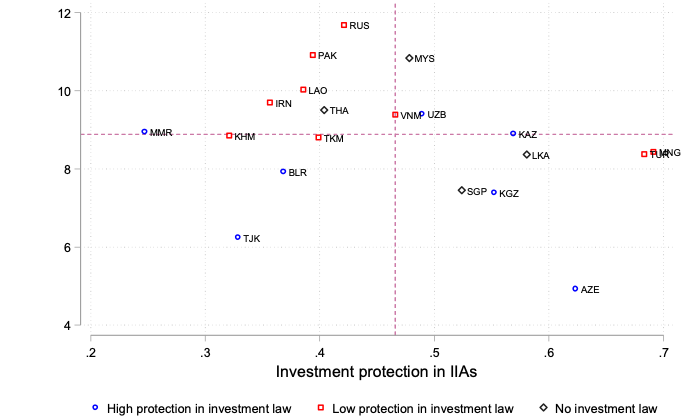

Our results show that the level of protection is uneven across legal instruments (IIAs and investment laws), countries, and within the same project corridor. We find meaningful variations in the constructed protection score across the sample investment laws and IIAs. At the country level, there is an interesting typology of the sample BRI economies (Figure 1). One notable group of countries has a high level of pipeline investments but low legal protection in both investment laws and IIAs (the top left quadrant). These countries can de-risk investments through improvements in their legal instruments.

Figure 1 – Legal investment protection and on-going/pipeline BRI investments by China

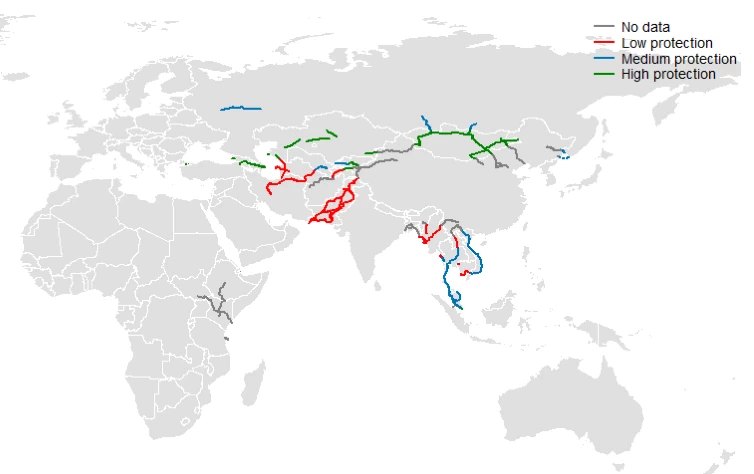

Since many BRI projects are cross-border and depend on the completion of infrastructure along an entire network, improving investment protection is only effective if it addresses the weakest places in an interconnected corridor. Variations in legal investment protection at the country level translate to varying levels of potential risks within BRI projects. For example, the Samarkand-Mashad rail upgrade passes through Uzbekistan, Turkmenistan, and Iran, whose protection levels range from medium to low (Figure 2).

Figure 2 - IIA protection along BRI rail routes

Note: IIA protection is the protection score aggregated over all partner countries. Low, medium, high protection levels are defined by the 33rd and 67th percentiles protection scores in the sample.

So, what drives the differences in overall protection?

We find that differences in overall protection are driven by both substantive variations in standard of treatment and availability of mechanisms to resolve disputes, as well as who countries signed treaties with. Differences in standard of treatment – that is, obligations on host countries regarding the “treatment” they must guarantee to investments - are driven for example, by provisions on expropriation and transfers. Of particular importance is the consistently low score on transparency across all investment laws reviewed. Given the lack of clarity on the overall institutional framework governing BRI projects, this lack of guarantee on transparency can exemplify risk for global investors. Weak protection can also be driven by the network of IIAs partners that countries have. Increasing coverage of IIAs with strategic partners can significantly expand protection for potential investors.

Quality of legal protections is only as strong as the mechanisms to enforce them. Challenges in enforcement due to lack of effective institutions and court systems in many of these countries poses an additional layer of risk for investors. Two- thirds of our sample countries rank below the global 40th percentile in the World Governance Indicator’s Rule of Law index. Weak enforcement is reflected through cases of legal violations: 12 of the 21 sample countries have at least 4 or more Investor-State disputes. Even when investors receive favorable arbitral awards, enforcement of these awards itself can be challenging.

How can countries better address investment risks?

Countries can improve investment protection in several ways. With respect to IIAs, countries with fewer agreements may consider negotiating more with strategically relevant partners (large economies). Countries with old generation IIAs and dated investment laws may consider systematically modernizing these instruments. Provisions on transparency need to be strengthened across the board in both laws and treaties.

Alongside strengthening the protection levels provided in the legal instruments, countries should also consider explicit provisions to give themselves some policy and regulatory flexibility. For some countries, given both the pipeline for BRI projects (not yet materialized) as well as high reliance on debt financing, it is important to upgrade their investment protection frameworks, alongside systematically ensuring sufficient balance.

Measures to address the lack of enforcement should be implemented- such as access to effective dispute resolution mechanisms and membership of relevant international conventions. Further, it’s important to strengthen the capacity of government agencies to understand legal commitments to investors, ensure effective enforcement, as well as improve overall service delivery to investors. Soft initiatives like information sharing platforms and publishing guides on applicable laws and regulations can help bridge information asymmetry and bring about more clarity and predictability for investors.

*Note: While investment protection is determined by a multitude of other legal instruments, we focus on domestic investment laws and IIAs, both of which are fairly standardized instruments presenting the fundamental principles of investment protection in a country’s investment policy regime. We focus on countries along the overland corridors. See the working paper for the detailed sample description.

Join the Conversation