Since the birth of the GATT in 1947, multilateral negotiations have focused primarily on reducing barriers to trade for specific products and sectors: tariffs, subsidies, and different types of nontariff barriers. However, a new report by the World Economic Forum, in collaboration with Bain & Company and the World Bank, entitled Enabling Trade: Valuing Growth Opportunities, reveals that reducing supply chain barriers could increase global GDP up to six times more than removing all import tariffs. Estimates suggest that an ambitious improvement in two key components of supply chain barriers – border administration and transport and communications infrastructure – with all countries raising their performance halfway to global best practice (as observed in Singapore), would lead to an increase of approximately $2.6 trillion (4.7%) in global GDP and $1.6 trillion (14.5%) in global exports. By contrast, the gains available from complete worldwide tariff elimination amount to no more than $400 billion (0.7%) in global GDP and $1.1 trillion (10.1%) in global exports.

Focus Shift: Services, border efficiencies, enabling environment – a holistic approach

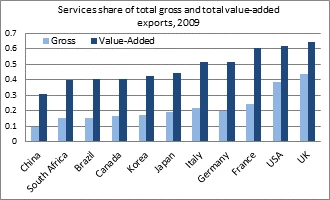

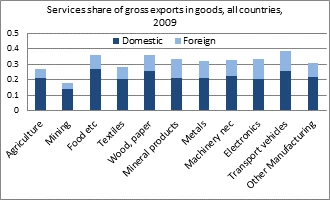

Given the importance of addressing value chain barriers, it is time for a shift in policy focus. The elements of a new trade policy are evident – if trade in value-added is primarily about trade in tasks, then services are a key component. Indeed, the OECD/WTO Trade in Value Added database reveals that accounting for the value added by services that is embodied in the production of goods greatly increases the significance of services in international trade (see charts). Services comprise about two-thirds of GDP in most developed economies. However, based on gross terms, trade in services typically accounts for less than one-quarter of total trade. If we account for the value added by services in the production of goods, though, we see that the service sector contributes over 50% of total exports in the United States, the United Kingdom, France, Germany and Italy and nearly one-third in China (first chart), with a significant contribution (typically one-third) across all manufactured goods (second chart), provided by both foreign and domestic service providers. The importance of services in global trade suggests they should be front and center in national trade strategy discussions and international negotiations, as barriers to trade and investment will impact value chain performance and potential. But multilateral services negotiations have made little progress since the establishment of the General Agreement on Trade in Services as part of the Uruguay Round.

If the growth of value chains means moving goods more easily across borders, a priority focus should be on policies that matter from a logistics perspective. This spans a number of the policy areas that are being negotiated in the WTO and in regional trade agreements, including border management (customs clearance-related policies – “trade facilitation”), technical barriers to trade (product standards), and transport and distribution services. The bottom line is that to have the greatest impact, all of these policy areas need to be approached holistically. An approach that centers on all of the policies that have a major impact on the efficiency of value chains will improve a country’s competitiveness.

This approach could also significantly enhance the commercial relevance of trade agreements. To date, international trade negotiations have taken a silo approach, with each policy area being addressed separately in piecemeal fashion. Thus, in the WTO’s Doha Round, despite being part of the so-called “single undertaking,” talks on trade facilitation are separate from negotiations on services and each service sector is considered separately from each other. Key sectors for supply chains, such as air and maritime transport, are handled in other fora or absent from negotiations altogether. The same is often true in regional trade agreements. Efforts to reduce trade barriers should better reflect reality: processing and transport of goods are performed as an interdependent chain, and any broken link will introduce discontinuity.

An important question is whether an integrated, “whole of the supply chain” approach that includes services is best pursued through a cross-cutting/horizontal approach or if initiatives that target specific sectors, such as electronics or textiles, may yield better results. Bottlenecks may be very value-chain specific – automotive chains are very different from textiles – and the political economy forces that drive policies are likely to differ with the level of logistics performance and the potential to increase trade in the short to medium term. While a differentiated approach makes sense conceptually, in practice certain common commitments could be applicable to all and could be pursued through international agreement so that the resulting value chains can be truly global.

A specific option that could be considered is to negotiate an International Supply Chain Agreement (ISCA)[1]. This could follow the negotiating precedents provided by the Information Technology Agreement and the WTO agreements on basic telecommunications and on financial services. A distinguishing feature of these agreements is that they apply on a most-favored-nation basis so that all countries, whether they join the ISCA or not, would benefit from the outcome of negotiations. An alternative approach is to limit benefits to signatories in those areas where this is permitted by the WTO. Even a nondiscriminatory approach may in practice exclude non-signatories that do not satisfy minimum regulatory standards, suggesting that members of an ISCA should provide assistance to nonmembers to help them to benefit from its provisions.

Progress to improve border management and regulation of services related to the smooth operation of the value chain need not wait for international agreement. There is much that national governments can and should do to improve the logistics environment in their own countries, as this is expected to generate significant positive growth effects on their economies. However, the benefits of such reforms for each individual country and the global economy would be significantly magnified if all countries collectively moved towards more efficient policies.

[1] Nakatomi, M., “Concept Paper for International Supply Chain Agreement (ISCA): Toward improving global supply chain by issues-based Plurilateral Approach”, Geneva: International Centre for Trade and Sustainable Development, 29 October 2012.

Join the Conversation