By 2030, almost 60 percent of 8.3 billion people will live in cities, according to UN estimates.

Almost 1400 of the world’s cities will have half a million or more inhabitants.

Cities can connect people with opportunities, incubate innovation and foster growth, but they require urban planning, infrastructure, transport and housing.

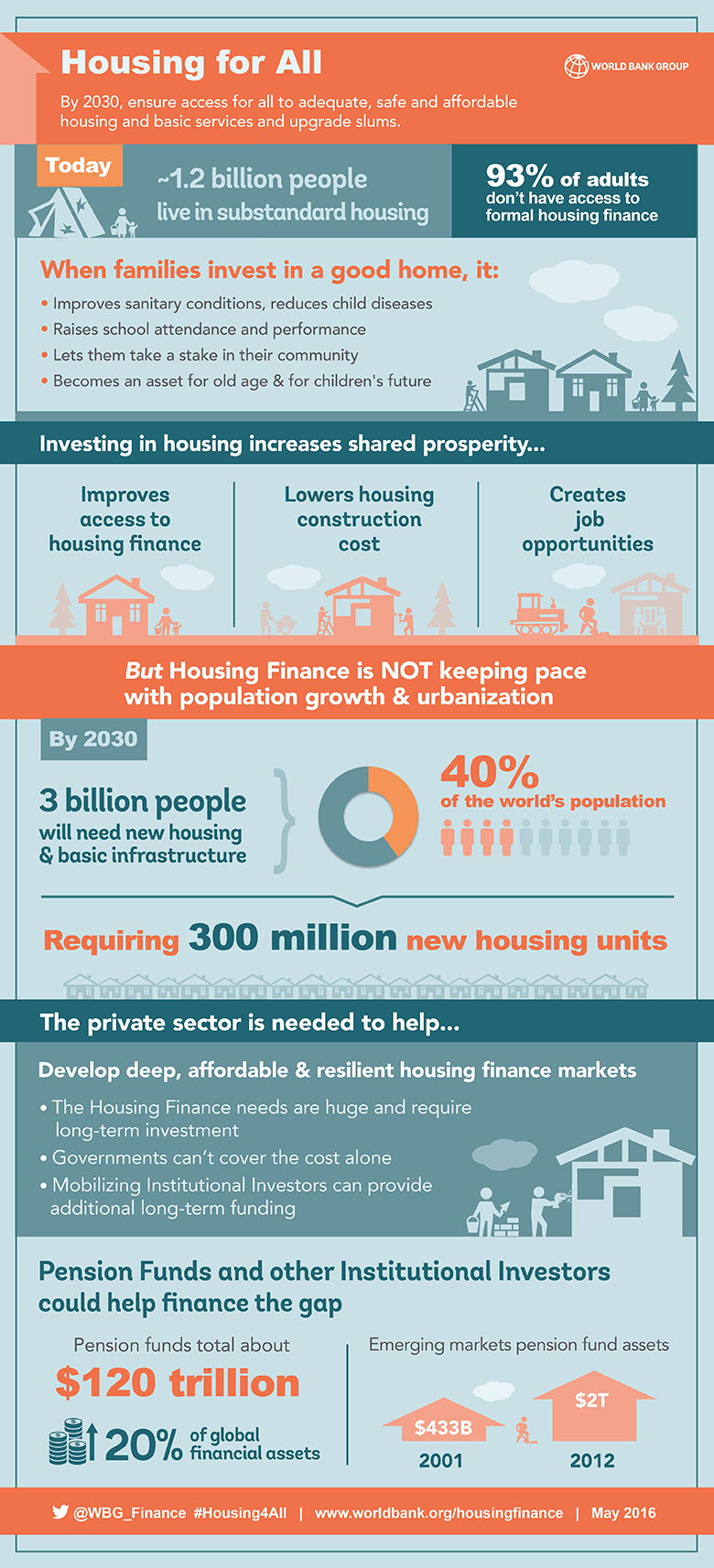

Providing people with access to decent and affordable housing is one of the targets under the Sustainable Development Goals. Goal 11 focuses on making cities sustainable.

When families invest in a good home, their living conditions improve and they take a stake in their community. A house also becomes an asset for their old age and for their children’s future.

Investing in housing also increases shared prosperity, since construction generates jobs and economic growth.

However, population growth and urbanization, especially in Africa and Asia, are putting pressure on housing delivery systems, which are often informal or rely on the state. By 2030 Africa will have more than 50 percent of its population living in cities.

Where formal housing can’t be supplied, informal housing quickly fills the gaps and slums proliferate, creating new development challenges.

While developing countries have made great progress in improving the framework for housing and housing finance, a significant gap remains to access to affordable housing. In many IDA countries, there’s a need to develop mortgage solutions, including for lower-income households who often work in the informal sector.

Three billion people will need new housing by 2030. Can we achieve this goal? Here are three reasons why we can.

1. The annual investment to new housing needed represents just 0.7% of global GDP

We will need 300 million new homes by 2030, or roughly 21 million new homes per year, according to UN Population’s data.

Building a new decent home with durable materials and necessary utility connections and services costs about US$25,000, which translates into US$525 billion per year.

A more concrete way to understand the scale of this investment is in terms of the GDP.

Global GDP was just over US$73 trillion in 2015, according to the IMF. This means that the world, as a whole, would need to invest annually around 0.7% of the GDP for house construction to meet the housing goal.

2. Falling poverty and rising incomes make housing more affordable

Poverty levels are a quarter of what they were in 1990 and account for 9.6% of the global population living below the poverty line.

Today, a household income of $10 a day could translate into a possible loan of as much as $15,000 (assuming 2 earners, 15 year loan at 5% with 40% of income used to service loan), which is certainly sufficient to construct a decent house. Where fiscal capacity allows, this could be supplemented with land allocations or targeted smart subsidies for the neediest, combined with solid financial inclusion programs.

3. India has set a 2022 Housing for All goal

India faces one of the toughest housing challenges, but is taking an uncompromising ambitious approach. The country set its own goal of achieving Housing for All by 2022.

The India Low Income Housing Finance project is challenging lenders to innovate. The World Bank Group is working with the government and the National Housing Bank to extend access to loans to people working in the informal sector, or those who don’t possess a formal property title but still have some form of property rights which can be used as collateral. Lenders are using new technology to better serve borrowers and developers are looking at new construction models to bring down costs. But ultimately, it’s the prospect of being able to serve a huge untapped market that is driving the private sector to innovate.

What works in India has tremendous potential to be effective in Bangladesh, Indonesia, Philippines and many countries in Africa where reconciling informal incomes with formal lending is still a struggle.

If the goal is possible, the question is how?

Having an efficient and inclusive financial system, a stable macro economy, access to long-term funding and strong land rights are all prerequisites to creating proper conditions for housing finance.

However, housing and infrastructure construction also requires a vast, long-term investment that governments can’t shoulder alone.

In addition to investing in construction, building materials and private housing development, the World Bank Group is helping countries address housing challenges by improving city planning, building regulations and access to land, investing in pro-poor infrastructure and slum upgrading, and strengthening residential rental markets.

The 7th Global Housing Finance conference, which got underway today, focuses on finding solutions to make housing more affordable, including mobilizing private sector financing to meet the housing needs.

While the global housing needs may be daunting, the #Housing4All goal is reachable if we work together and innovate.

Join the Conversation