Effective management of retirement savings is fast becoming an important agenda in many countries due to a rapidly ageing population. In addition to fulfilling this critical function, pension funds, which are theoretically long-only investors, perform an important role by providing long-term financing and liquidity to the rest of the financial system.

These large institutional investors are often thought of as stabilizers for the financial system and are expected to behave in a patient, counter-cyclical manner, making the most of cyclically low valuations to seek attractive investment opportunities. Moreover, since pension funds are expected to invest with a long-term perspective, these institutions have generally not been thought of as adding to systemic risk.

This belief has recently started to come under question.[1] A large theoretical literature has emerged which looks at how short-term considerations among these large institutional traders might arise because of reputational concerns as well as through other incentives via market and regulatory monitoring. In particular this literature stresses that in the face of such considerations, managers might have incentives to mimic others or in other words herd towards common assets. Given the sizable wealth they manage, such herding behavior can potentially have large effects on asset prices both in the short and long run. This blog highlights the findings in our recent empirical work (WPS 7239), which utilizes a natural experiment associated with a policy change in the Colombian pension fund industry to study the asset price implications of relative performance concerns among pension fund managers.

While there have been numerous attempts to identify and quantify the effects of herding behavior on asset prices,[2] empirically measuring herding has proven to be extremely difficult. Herding has usually been measured as trade clustering. However, since decision clustering may be because of various reasons other than herding, it is hard to distinguish actual herding from spurious herding. Furthermore, the motive behind the desire to herd is also very important in governing the effects on asset prices. For example, if institutions herd due to informational motives, such herding may promote price discovery, faster adjustment of fundamental information into securities and more efficient markets. Conversely, if institutional investors systematically overlook their own private signals and trade with the crowd, prices may move away from fundamental values and display excess volatility. In this sense, relative performance concerns and incentives to track peer-group benchmarks among institutional investors may result in market failures and increase systemic risk.

To isolate the component of demand, which arises solely due to peer benchmarking, we study trading behavior by Colombian pension fund managers in the presence of a peer-based underperformance penalty known as the Minimum Return Guarantee (MRG). The use of the MRG to monitor performance is common in many Latin American and Eastern European countries with mandatory defined contribution pension systems. In June 2007, the Colombian government changed the MRG formula, increasing the maximum allowed shortfall and thereby loosening the underperformance penalty. This policy change affects the propensity of pension funds to track the portfolio of their peers and is exogenous to stock fundamentals, and thus provides an ideal set up to differentiate trades motivated from peer-group effects from informational motivated trades.

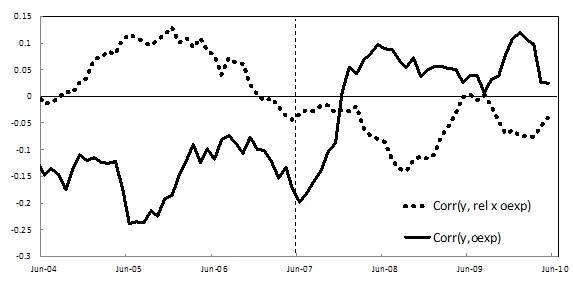

The Figure above illustrates the differences in trading behavior by pension fund managers before and after the change in the MRG. Before June 2007, with a tighter MRG, fund managers were more likely to trade in the direction of the peer group, buying stocks with lower participation relative to other funds (solid line). This behavior was more pronounced for managers with poor relative performance (dotted line).

Exploiting this change in behavior pre and post the MRG change, we are able to identify the component of demand for a stock, which is driven purely by peer benchmarking considerations. We find that peer benchmarking generate contemporaneous abnormal returns on the average stock. These excess returns are fully reversed after six months, indicating that peer-effects among pension funds tend to generate excess volatility in stock prices. We also find that when the funds are buying a stock to track their peers’ performance, the stock price starts moving more with the prices of other stocks in the peer portfolio. This increase in co-movement is persistent over the next six months following the trades of the PFAs and is not explained by economic fundamentals. Overall, the findings suggest that peer effects and relative performance concerns among institutional traders reduce market efficiency.

This blog highlighted how financial regulation can end up having unintended consequences. The MRG is intended to protect the interests of the working population by limiting unnecessary risk taking by pension fund managers. However, by relying on a benchmark based on peer returns, the regulation effectively incentivizes herding. Consequently, asset prices in the domestic market move in the short and medium run due to forces independent of fundamentals. Furthermore, these short-term considerations make these long-horizon traders also behave pro-cyclically, adding to systemic risk rather than stabilizing the system as was previously thought. Whether the welfare loss from this increased financial market inefficiency is clouded by the reduction in other forms of risk taking is still an open question and requires further investigation.

[1] See for example Shin (2013): The Second Phase of Global Liquidity and Its Impact on Emerging Economies.

[2] See Hirshleifer and Teoh (2003): Herd Behaviour and Cascading in Capital Markets: a Review and Synthesis, for a review of findings.

Join the Conversation