The Brookings’ Metropolitan Policy Program recently released their

Global Metromonitor for 2013-2014. This fourth edition of the report analyzes the performance of the world’s 300 largest metropolitan areas on their annualized Gross Domestic Product (GDP) growth rates per capita and employment. These two indicators are merged into an economic performance index to rank metropolitan areas - by comparing them to each other, to their own countries and their previous performance. This is not a measure of which metro areas are most competitive, wealthy, or livable – the goal is to see how metro areas respond to the world economy and factors underlying their performance.

The Brookings’ Metropolitan Policy Program recently released their

Global Metromonitor for 2013-2014. This fourth edition of the report analyzes the performance of the world’s 300 largest metropolitan areas on their annualized Gross Domestic Product (GDP) growth rates per capita and employment. These two indicators are merged into an economic performance index to rank metropolitan areas - by comparing them to each other, to their own countries and their previous performance. This is not a measure of which metro areas are most competitive, wealthy, or livable – the goal is to see how metro areas respond to the world economy and factors underlying their performance.

Before looking at how the Arab world fared in this ranking here are a few key takeaways from the report:

- The 300 largest metropolitan economies are home to 20% of global population and employment yet account for nearly 50% of global GDP.

- Metropolitan areas power national economic growth, most have faster GDP per capita and/or employment growth than their countries.

- GDP per capita in the top 300 metro areas grew by 1.3 percent in 2014, versus 1.6% in 2013. Employment grew 1.5% in 2014, as it did in 2013.

- Employment in developing metro areas grew by 1.7% in 2014, slightly higher than the developed cities’ 1.3%. GDP per capita growth expanded by 4.0% in developing metro areas, versus 0.8% percent in developed ones.

- Most metropolitan areas (60%) are back to pre-recession (2007) levels of employment and GDP per capita.

- Metropolitan areas specializing in commodities registered the highest rates of GDP per capita and employment growth in 2014. Utilities, trade and tourism, and manufacturing specializations also led to higher growth. Metro areas with high concentrations of business, financial, and professional services grew slower.

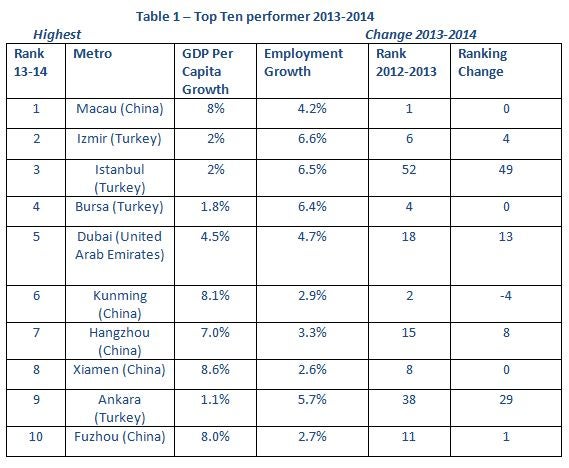

Overall, Macau (China) was the best performer, followed by Izmir, Istanbul, Bursa (Turkey) and - rounding the top 5 – Dubai (UAE). China and indeed the Asia-Pacific region led in terms of fastest growing cities. Turkish cities had a very good year with 3 in the top 5 and 4 in the top 10. Those numbers were respectively 1 and 2 in the 2012-13 rankings. While all 4 of the Turkish metropolitan areas in the top 10 are strong in manufacturing, their 2014 showing was led by strong expansions in business and financial services.

The Arab Cities in the Rankings

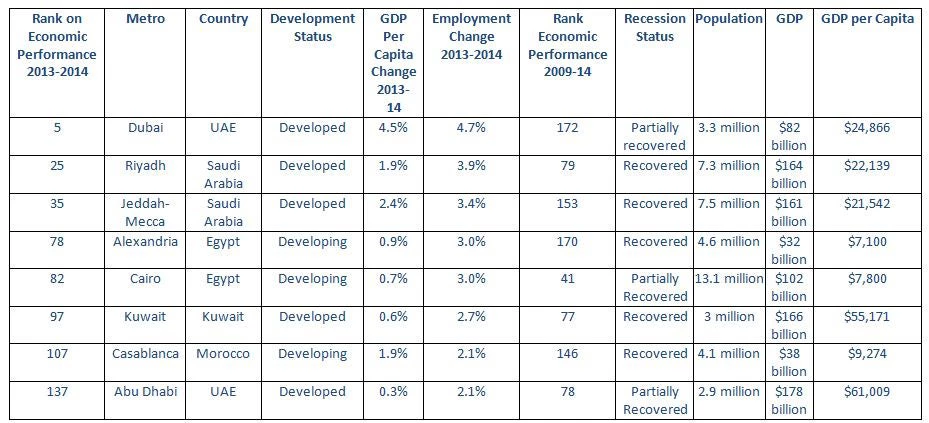

Arab cities stood out in a couple of areas. For example, no metropolitan area grew faster relative to its national economy than Dubai. The city’s business and financial services sector powered a 4.5% growth in GDP per capita, versus UAE’s 1.6%. In employment growth, MENA came in second highest at 2.7%, just behind Eastern Europe and Central Asia’s 2.9%. The listing of Arab cities has not changed much over the past four years, though in 2012-2013 Casablanca dropped off the list (see Table 2 below).

Table 2: Ranking of Arab Cities in Global Metromonitor for 2013-2014

Most Arab cities in the rankings have recovered from the 2008 crisis, except for Dubai and Abu Dhabi. This is in line with the overall findings that developing metropolitan areas recover faster than developed cities. Here, Riyadh and Jeddah and Kuwait are outliers but this may have something to do with the massive stimulus spending engaged in by the government following the Arab Spring. Cairo too is an outlier, as a developing country metropolitan area it has yet to recover but political turmoil might be to blame.

Challenges Looking Forward

This is a relative ranking with many variables but a number of factors will impact on future rankings, here are some:

- The dropping price of oil is going to be important to watch, though less so in the short run for the region’s developed major oil exporters (the GCC) who have enough reserves to maintain expenditures for some time. However, there will be an impact if low prices persist for a length of time as they curb expenditures and reduce investments elsewhere in the region. Things are tougher for developing oil producers like Iran, Iraq and others. Oil importers, including Egypt, expect modest gains. More on this can be had from the World Bank’s January 2014 “MENA Quarterly Economic Brief: Plunging Oil Prices”.

- Conflict in the region will play an important role. The war against ISIS and the broader conflicts within Syria and Iraq, pose a risk to Lebanon, Jordan and Saudi Arabia. For now, the conflict in the Mashreq appears less likely to impact on Jeddah or Riyadh and the rest of the GCC. As long as Libya remains relatively contained and does not spread into Egypt or Tunisia and the rest of the Maghreb, its impact should remain relatively muted. Still, as events in France have shown, terrorism remains a risk. The importance of tourism for Dubai, Egypt and Morocco underscores this threat – ditto for Turkey.

- Internal Political stability will heavily impact on all but, more directly in the current context, on the fortunes of Egypt. If President Sisi and his government further stabilize politics and parliamentary elections are carried off without a hitch, this will improve prospects for Alexandria and Cairo.

- Europe’s economy will also have an important impact on the region and its cities. Improved European economic prospects in 2015 can benefit not only Casablanca, Cairo, and Alexandria but the region as a whole.

Join the Conversation