One of the key features of the African digital renaissance is that it is increasingly home grown. In other sectors of the African economy, such as mining or agribusiness, much of the know-how is imported and the wealth extracted. But Africa’s 700 million or so mobile subscribers use services that are provided locally, and they are also downloading more applications that are developed locally.

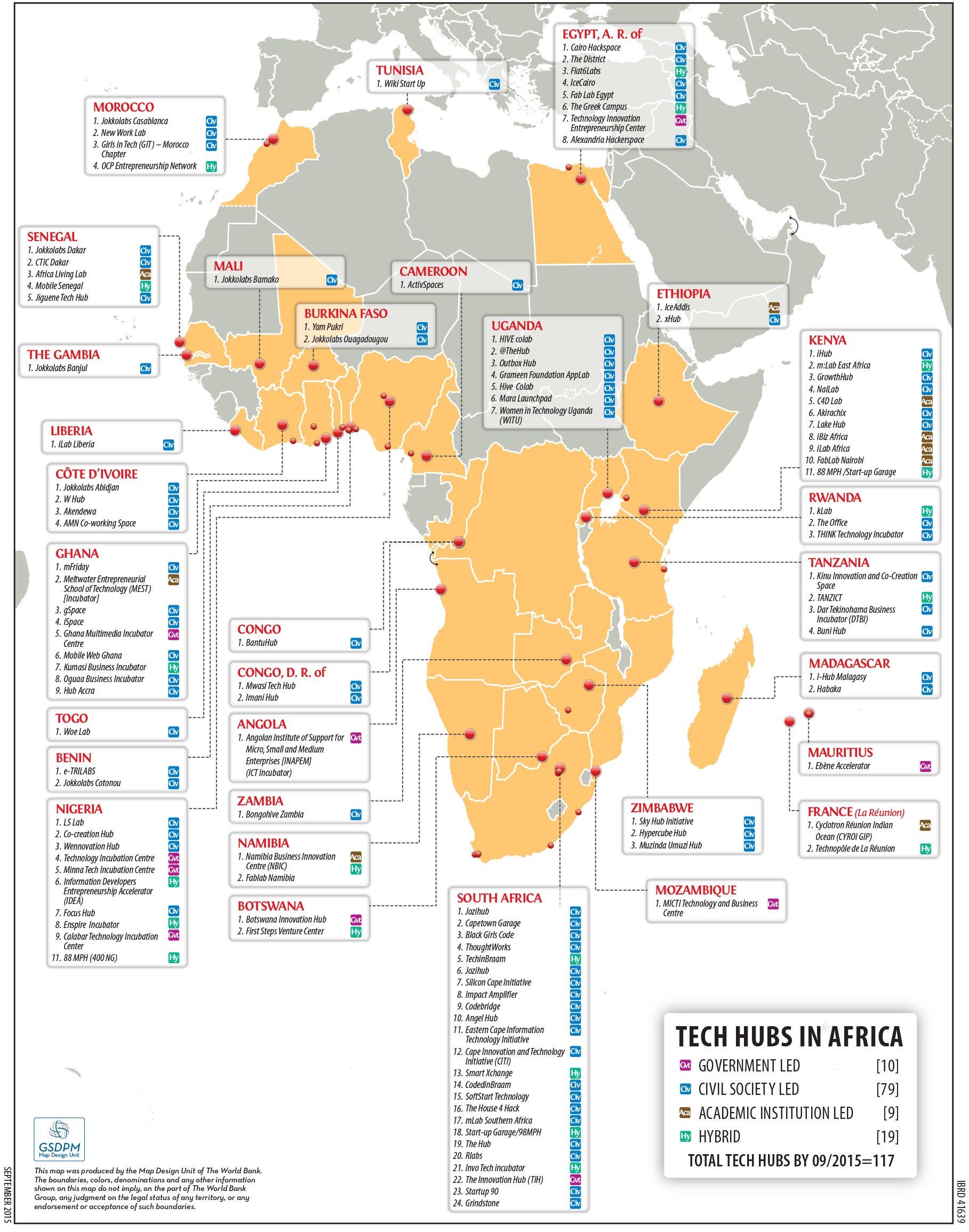

One of the main sources of locally developed applications is the technology hubs that are springing up across Africa. In a recent project carried out for the Botswana Innovation Hub, we worked with two of the longer established labs, the research arm of *iHub_in Kenya and BongoHive in Zambia, to create a map of tech hubs. To our surprise, there are now around 90 tech hubs across the continent, and more than half of Africa economies have at least one. South Africa was the first to make it into double figures but other countries are not far behind. Indeed, hubs such as MEST in Ghana, the Co-creation hub in Nigeria or *iHub_ in Kenya are widely regarded as models, and the latter was recently named by Fast Company magazine as one of the most innovative companies. It has impressed the Kenyan government enough for it to commit to establishing a tech hub in each of its 47 counties.

As might be expected, tech hubs vary a lot in their scale, objectives and business models. Some, like Smart Xchange in South Africa, aspire to be fully-fledged ICT business incubators, offering office space for start-ups to grow. Most, like Hive CoLab in Uganda, might be better described as pre-incubators, or co-working spaces, where entrepreneurs come together to shape and refine business ideas. Some, like Rlabs or Jokkolabs, seek to grow through a franchise model, while others look to external seed funding from commercial partners, such as the Nokia Greenhouse Nairobi or from non-for-profits, such as infoDev’s mobile applications labs (mLabs) in Nairobi and Pretoria. Other tech hubs begin life in universities, like the iLab at Strathmore, one of Kenya’s premier private universities. Increasingly, governments are seeking to get directly involved in funding tech hubs, attracted in part by the jobs that can be created, particularly for young people, or the chance to create a new MPesa, Kenya’s mobile money service. Botswana Innovation Hub is an example of a government-driven initiative, now transitioning to a more sustainable model, with assistance from the World Bank under a reimbursable advisory services contract aimed at promoting economic diversity and competitiveness in Botswana’s economy.

The list of hubs is growing on an almost weekly basis, and BongoHive maintains a current list based on a crowdsourcing model. But tech hubs also disappear, particularly those that are based on informal gatherings of developers, or hackerspaces. A high failure rate is an inevitable consequence of innovation, and the testing of ideas. A recent World Bank Group report, on the business models of tech hubs, provides some lessons on how to improve sustainability. *iHub_, in Kenya, lists more than 150 companies that can trace their origins to ideas incubated there, among its 13’000+ members. In the longer term, it is the companies that tech hubs give birth to that will be the lasting legacy. So which will be the legacy-makers among today’s generation of African Tech Hubs? Send us your thoughts and join the conversation.

Join the Conversation