[1] However, deeper integration may also impose costs and losses to these economies, especially in the short and medium run. The exposure to increased competition from Chinese products could challenge local industries. On the other hand, improved access to China’s vast market could benefit the export sector in B&R economies.

In recent research, I used detailed bilateral trade data for the period 1995-2015 to assess the degree of exposure of B&R economies to Chinese trade shocks (see Bastos, 2018). The paper builds on a growing literature seeking to assess the implications of China’s transformation and deeper integration in the world economy for economic outcomes in other countries[2].

The paper examines econometrically the heterogeneous impacts of competition and demand shocks associated with China’s trade dynamics for the exports of B&R economies[3].

The results reveal that the exports of B&R economies were significantly impacted by China’s trade shocks. Between 1995 and 2015, demand shocks associated with China’s trade growth were more important than competition shocks, implying that China trade shocks contributed to boost the exports of B&R economies during this period. However, in the period 2005-2015 competition shocks had a stronger negative impact on the exports of B&R economies. These effects are highly heterogeneous across B&R economies and industries.

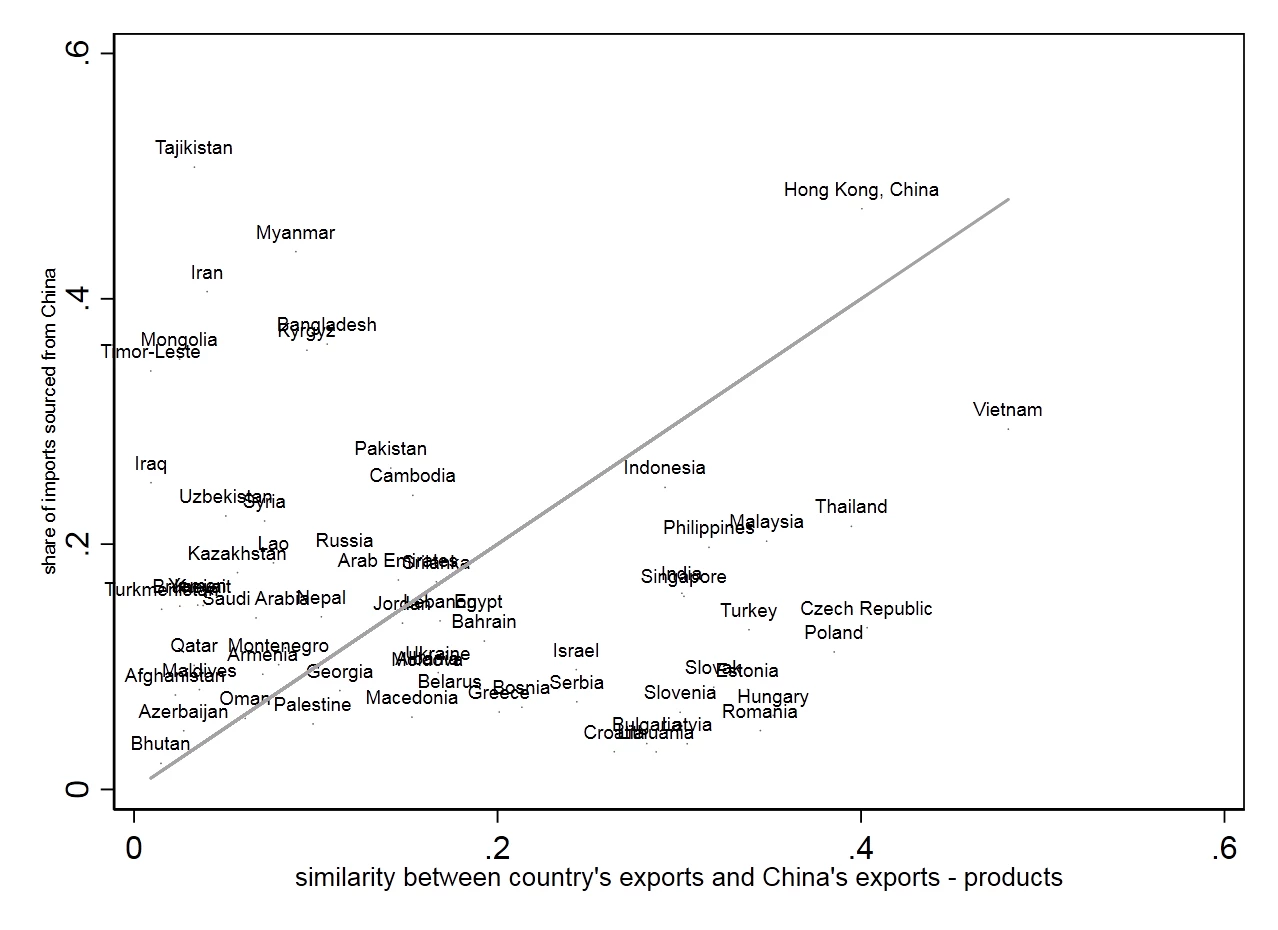

Building on these empirical findings, the paper documents the current degree of exposure of each B&R economy to competition and demand shocks associated with deeper integration with China. Although one must be cautious in extrapolating from historical data, the econometric results suggest that the trade similarity indexes contain useful information for capturing the current degree of exposure to China trade shocks. Exposure to competition shocks from China is higher in Hong Kong, Vietnam, Malaysia, Philippines, Thailand and Indonesia. These economies source a relatively large share of imports from China and have an export structure that is similar to that of China (Figure 1). To the extent that differences in export structure reflect underlying differences in production structures, these economies are likely to be more exposed to import competition from China in their own markets in several industries.[4]

Further integration with China would likely involve stronger competitive pressures in final goods markets, which may also have important implications for factor market adjustment (notably labor markets). There are nevertheless various important sources of mutual gains from further integration: consumers would gain access to a wider range of product varieties; firms and countries would obtain efficiency gains due to further specialization in different varieties or stages of production, leading to lower prices.

Figure 1: Exposure to competition shocks from China, 2015

Several other B&R economies are only weakly exposed to competition shocks associated with further integration with China. Tajikistan, Myanmar, Iran, Kyrgyzstan, Bangladesh, Mongolia and Timor-Leste source a sizable share of imports from China, but have an export structure that differs considerably from that of China. To the extent that differences in export structure reflect differences in production structures, these economies are only weakly exposed to Chinese import competition in their own markets, even though they source a large share of imports from China. Mutual gains from further integration with China are likely to derive mainly from further specialization according to comparative advantage.

Several other B&R economies are only weakly exposed to competition shocks associated with further integration with China. Tajikistan, Myanmar, Iran, Kyrgyzstan, Bangladesh, Mongolia and Timor-Leste source a sizable share of imports from China, but have an export structure that differs considerably from that of China. To the extent that differences in export structure reflect differences in production structures, these economies are only weakly exposed to Chinese import competition in their own markets, even though they source a large share of imports from China. Mutual gains from further integration with China are likely to derive mainly from further specialization according to comparative advantage.

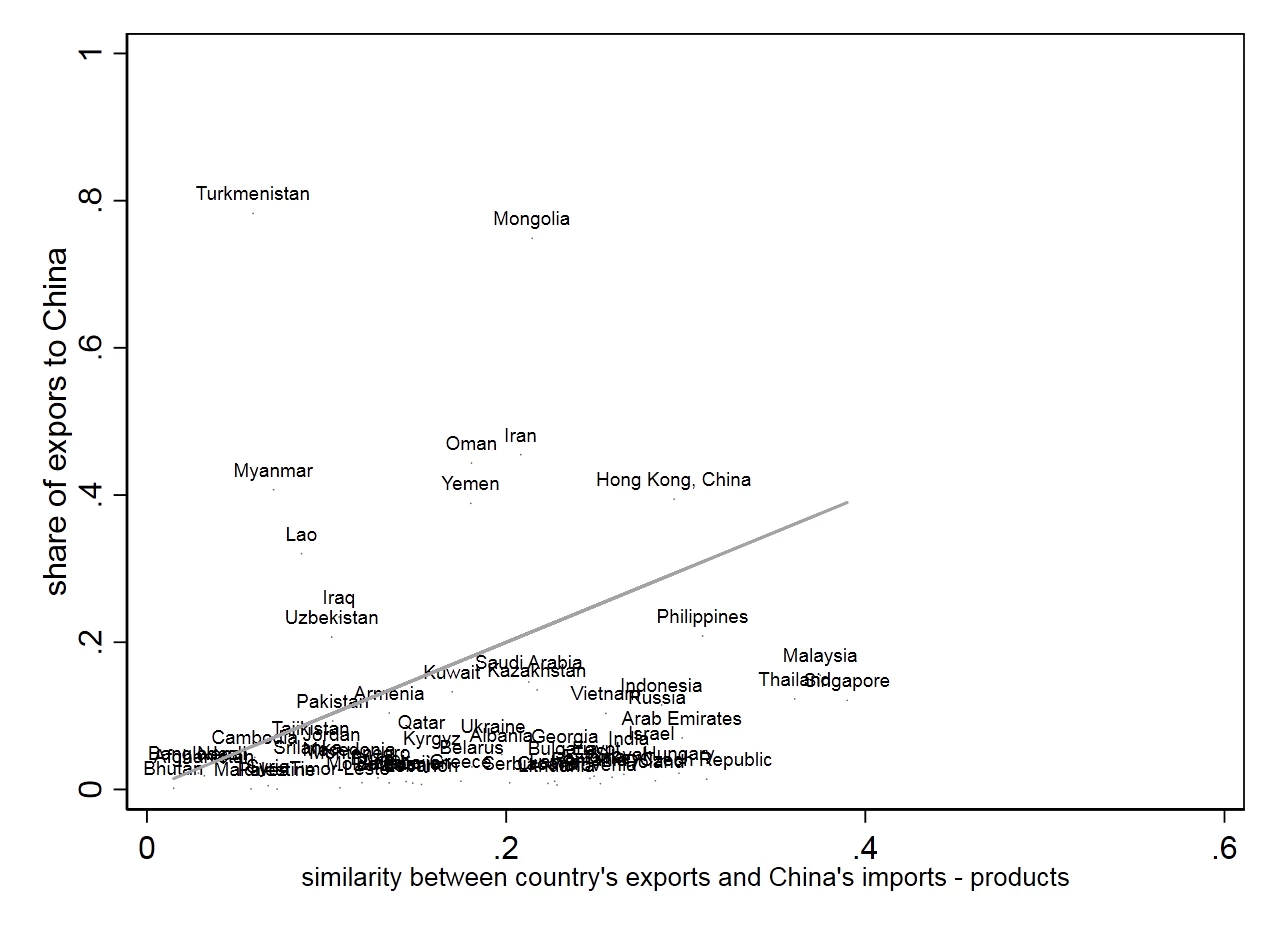

Exposure to demand shocks from China is the highest in Mongolia, Hong Kong, Iran, Oman, Turkmenistan and Yemen. The Chinese market accounts for a large share of exports of these economies, and their export structure displays a relatively high degree of similarity with China’s overall import demand (Figure 2). China is also an important destination market for Lao, Uzbekistan, Myanmar and Iraq, although the export structure of these economies differs significantly from the structure of China’s overall import demand. Finally, Malaysia, Philippines and Singapore export a sizable share of exports to China and have an export structure that is relatively close to the structure of Chinese multilateral imports, suggesting that these economies are also strongly exposed to China’s demand shocks.

Figure 2: Exposure to demand shocks from China, 2015

Those B&R economies that are more exposed to competition shocks should consider if their inclusive policies are appropriate to deal with the adjustment costs imposed by trade shocks. These costs are associated with reallocations of workers across sectors, regions and occupations triggered by sector-specific competition and demand trade shocks. Countries more exposed to competition shocks from China are likely to have more displaced workers and therefore face stronger adjustment costs. There is no one-size-fits-all strategy for dealing with trade-induced adjustment costs (IMF, World Bank and WTO, 2017). The optimal policy design depends on the nature of the shock, as well as on country attributes and initial conditions. For example, facilitating geographic mobility may be especially important in larger economies, or when such mobility has been historically lower. The set of policy options to offset these impacts includes general inclusive policies, notably social security and labor policies (including education and training). Well-designed credit, housing and place-based polices may also facilitate adjustment. Trade-specific adjustment programs may play a complementary role.

References

Autor, David, David Dorn, and Gordon Hanson (2013), “ The China Syndrome: Local Labor Market Effects of Import Competition in the United States”, American Economic Review, 103(6): 2121-2168.Bastos, Paulo (2018). “Exposure of Belt and Road Economies to China Trade Shocks,” World Bank, Washington DC.

Finger, Joseph and Mordechai Elihau Kreinin (1979). “A measure of export similarity and its possible uses.” Economic Journal, 89(356), 905-912.

International Monetary Fund, World Bank and World Trade Organization (2017). “Making Trade and Engine of Growth for All: The Case for Trade and for Policies to Facilitate Adjustment.” Washington DC.

Notes

Join the Conversation