For the past few years, I have been fortunate enough to be the World Bank’s resident economist for Mauritius and Seychelles. With this now coming to an end, here are some especially striking impressions of these countries’ successes and challenges that I hope can provide food for thought more widely.

Small really can be beautiful…

Mauritius and Seychelles are small. Mauritius has a population of 1.3 million, making it the world’s 26th smallest sovereign state. Seychelles has a population of just 95,000, making it the 17th smallest sovereign state. They are also quite geographically isolated, with their nearest neighbors over 1,000km away from their centers.

Small, remote island states face well-recognized development challenges. Yet, these have not stopped Mauritius and Seychelles from making impressive progress. Both have more or less eliminated extreme poverty (at the $3.20/day international line). They have built economies generating average incomes in the upper-middle income category for Mauritius ($ 9,770 GNI per capita) and the high-income category for Seychelles ($15,410). What is more, this prosperity has so far been quite widely shared (Gini coefficients are 0.36 for Mauritius and 0.47 for Seychelles).

How have these countries achieved this considerable economic success? Clearly, many factors have contributed. However, two features are striking.

…if the economy is not an island

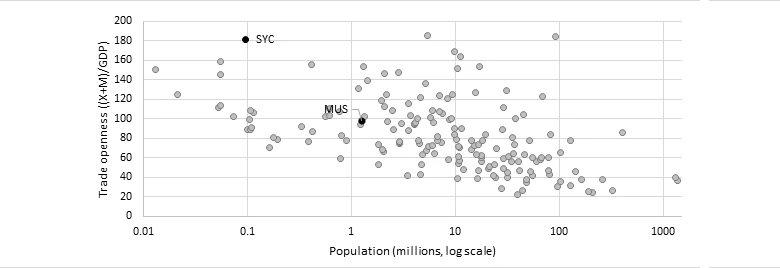

Figure 1: Mauritius and Seychelles have open economies, as measured by trade in goods and services relative to total output

Sources: World Development Indicators.

Both countries’ economies are very open to world trade and investment. Exports and imports make up 98% of Mauritius’ GDP, and 181% of Seychelles’ GDP (Figure 1). Without this, their small domestic markets could never provide sufficient demand to generate high quality jobs and income, or enough opportunities for the specialization critical for productivity and output growth. Access to key markets on preferential terms—the European Union for sugar and GATT MultiFibre Agreements for textiles— turbocharged the role of external trade for Mauritius’ development, in particular.

Economic openness is also likely key to the success of these small island economies in less quantifiable ways. Foreign direct investment brings critical know-how and international best-practice to Seychelles’ crucial tourism industry. Openness also widens horizons, raising the returns to the job-relevant skills needed by firms competing in global markets. This can filter through to student and worker motivation, and ultimately performance and earnings.

…and if state spending and the social contract are inclusive

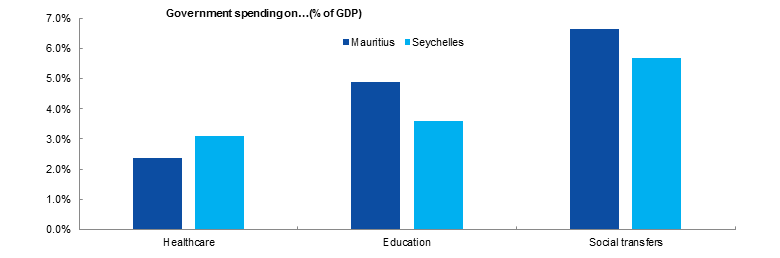

Figure 2: Strong focus on social spending

The other striking feature is that their governments (both operating in democratic, multi-party constitutional systems) have provided universal free access to education and also primary healthcare, and sustained high levels of social welfare spending. The governments are expected by voters to channel resources to the services that build human capital, and to ensure that there is a safety net, including for the elderly.

So, it is not just “sun, sand, and sea”

The sustainability of the economic openness and inclusive social contracts and their ability to generate shared prosperity are interlinked. These economies have generated wealth by being open; the state has shared this wealth by channeling resources into equipping people to lead productive lives; and an empowered citizenry has been vital to successfully growing exports. Natural resources, which include “sun, sand, and sea,” tuna (Seychelles), and sugarcane (Mauritius), cannot explain the degree of economic success achieved, as demonstrated by the development shortcomings of many other much more resource-rich countries.

What about the role of the offshore corporate and financial sectors?

While Seychelles has an offshore corporate sector, this has not been a major driver of its economic development.

The offshore sector in Mauritius is much larger: Mauritius’ structural transformation from a monocrop (sugar) economy into textiles and other manufacturing (in the 1980/90s), and increasingly services (tourism, finance, and ICT), is well-known.

The early years of this coincided with the start of Mauritius establishing itself as an attractive offshore location for Indian companies, following the implementation in 1983 of its Double Taxation Avoidance Agreement (DTAA) with India. This makes quantifying the impact of the sector difficult. However, there is no doubt that the India DTAA has benefited Mauritius, both by supplying jobs, and by loosening external financing constraints.

As everywhere, there are challenges

While Mauritius and Seychelles are economic development success stories, they continue to face many challenges, as assessed by the World Bank’s Systematic Country Diagnostics (SCDs) for Mauritius and Seychelles.

Ageing and migration

Population growth has slowed and will turn negative by the 2030s in both Mauritius and Seychelles, and dependency ratios are already beginning to increase. These demographic shifts have major implications, requiring adjustments to safeguard the sustainability of universal retirement schemes.

They also place a focus on the sensitive issue of migration policy. Both countries already import a lot of foreign labor, but may need to consider attracting even more whilst ensuring that foreign labor enhances job opportunities for locals, rather than displacing them. Understanding the extent to which “brain drain” is occurring, notably of skilled youth, and what policy levers could arrest this or indeed generate “brain gain,” is a related priority.

Climate change

Mauritius and Seychelles are negligible contributors to global climate change but must adapt to its effects. Beach erosion is occurring and there are looming risks from temperature-change affecting fish stocks, and shifting weather (including the more intense seasonality of rainfall, as noticed in Seychelles) and cyclone risks (Seychelles is not in the usual Indian Ocean cyclone zone, but Mauritius is).

The investment needs are commensurately large. This places the focus on strengthening public investment management to ensure that scarce public investment funding is prioritized, and for building more capacity to crowd in private and development partner financing. It also calls for more planning, including marine spatial planning, as Seychelles is pioneering, something that would also benefit Mauritius.

Transparency, regulatory quality, and offshore sector strategy

Global efforts to combat illicit financial flows and tax evasion, and the shift towards more source-based taxation, are driving change in jurisdictions, including in Mauritius and Seychelles. Business models based on secrecy and tax arbitrage are under pressure. The sectors and their regulators must adapt to prioritize the transparency and quality of regulatory frameworks in line with global trends and in the mutual interest of other developing countries.

Indian Ocean “Icelands”?

Mauritius and Seychelles prove that small can be beautiful for economic development, and not only because they have beautiful islands, which tourists flock to. Sustaining and expanding their economic development gains will require overcoming myriad challenges. Development partners, including the World Bank, can continue to help tackle these challenges and other countries can benefit from the knowledge generated by their progress, including placing the preservation of environmental assets at the heart of development strategy, as in Seychelles.

Where to from here? Well, with the right mix of policies and focus on implementation, how about aiming to converge with much richer Iceland (GNI per capita: $56,790)!

*With apologies to Bill Bryson.

Join the Conversation