To a United States citizen, the Internal Revenue Services (IRS) might seem like the La Llorona -the Spanish-speaker’s response to the Boogeyman -of public administration. They come after those of us dilly dallying with our accounts and are much better at seeking than we are at hiding. But should paying taxes really feel like La Llorona is coming after you? Evidence from three experimental tax trials in Kosovo would seem to suggest that behaviorally informed tools can increase voluntary tax compliance and especially improve the workings of a tax administration without resorting to fear. So how does behavioral science inform tax compliance?

Even when deterrence measures are numerous and effective, as in the United States, our behavior as taxpayers is not entirely rational. For example, we don’t pay taxes because of our natural inclination toward loss aversion – the idea that we avoid losses far more than we seek out gains. Or, because we think others are evaders like us and are doing everything possible to avoid giving up even one more cent to a “greedy piglet,” spending our money on services we don’t appreciate or incorrectly appraise. When the reach of deterrence is limited and resources are heavily constrained, as is the case in most middle- and low-income countries, we should pay more attention to reputation and communication strategies, as behavioral insights emphasize. Kosovo is a case in point. Collecting tax revenues in the face of substantial budget constraints is a challenge, and resources could more effectively be used to help youth find (and keep) work or finance social programs than strengthen deterrence measures of the tax administration.

In this context, the Tax Administration of Kosovo’s (TAK) longstanding “Taxpayer as Client” approach to voluntary tax compliance -where education and information are favored over threats -provides further impetus to use behavioral science to encourage compliance. And evidence has shown that these nudges endure (as in the case of Guatemala, where tax authorities are still integrating lessons learned from earlier behavioral science trials), further justifying their use in low-resource settings.

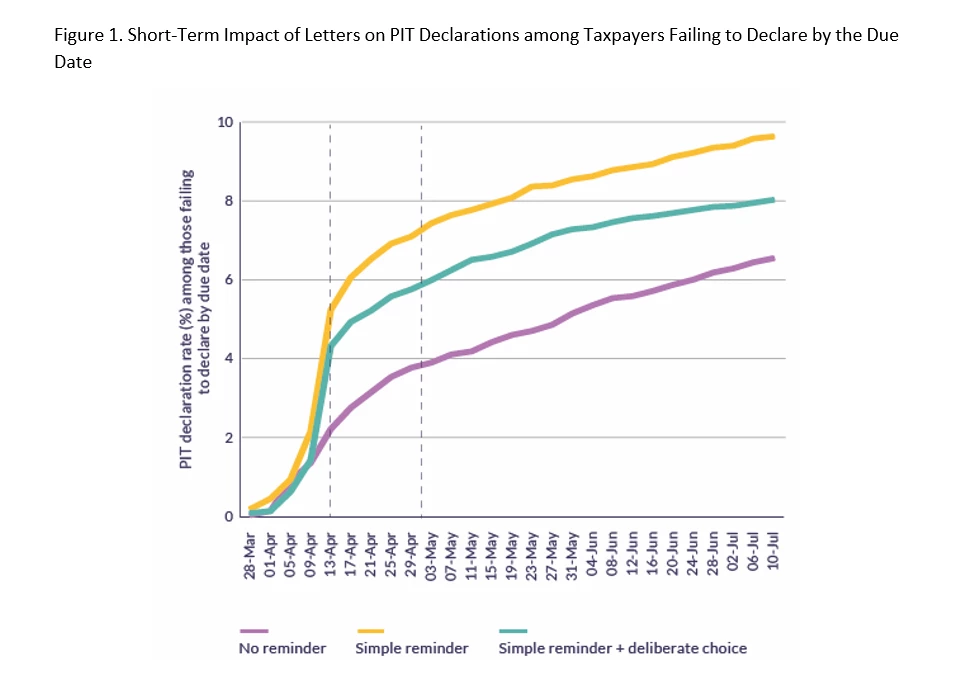

Between March and October 2018, the Bank’s Mind, Behavior, and Development (eMBeD) Unit — in collaboration with the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) — designed, implemented, and evaluated three experimental trials among taxpayers in Kosovo meant to increase voluntary tax compliance, building off the “Taxpayer as Client” model. What did we find? Behaviorally informed reminders sent randomly to select taxpayers induced small, but statistically significant and immediate, improvements in tax declarations (in one trial, increasing the yearly personal income tax (PIT) declaration rate by 2 to 4 percentage points, or by around 200 extra declarations), even among the stickiest taxpayers (See Figure 1).

These experimental results are only part of the story: A lot more can be learned from the experience in Kosovo if we focus on the implementation. Behaviorally informed interventions — specifically those intending to improve tax compliance — are not just about power calculations and assuring that treatment and control groups are indistinguishable in the absence of treatment (both of which were very carefully considered!). They require a fundamentally holistic approach to impact evaluation that considers all potential obstacles and ensures close collaboration with the tax administration to assure a smooth process and impactful results. And this holistic approach can change not only taxpayer behavior, but policymaker and tax administration staff behavior (and mindsets) as well. Why do these things matter?

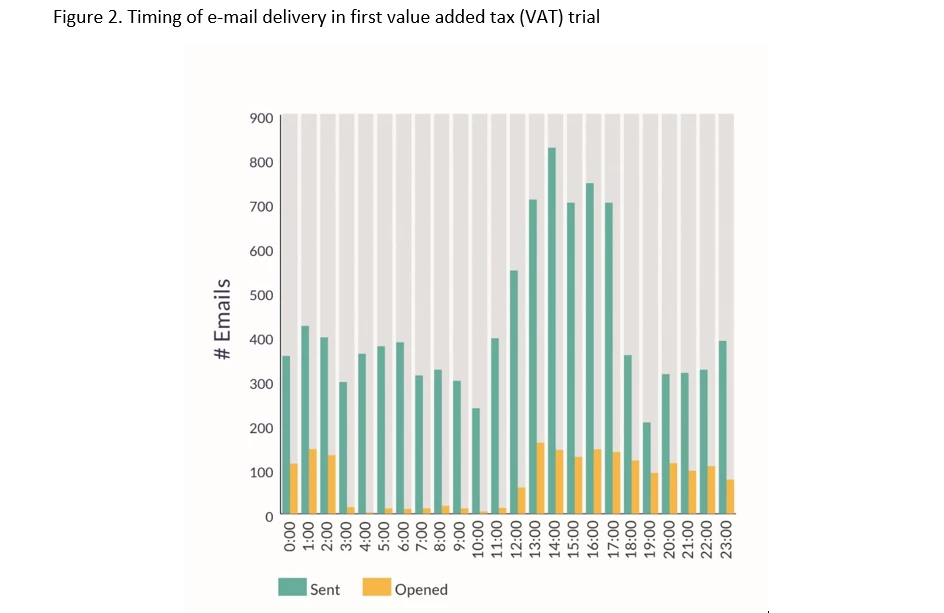

For one, many of the intended recipients never got the message. This particular flaw underscores how process (and, of course, practice) makes perfect. Only 48 percent of letters sent to taxpayers not submitting their PIT declaration on time made it to their intended recipients and less than one of four e-mails sent to firms subject to the VAT was actually opened. Moreover, the messages themselves were not always interpreted the way we intended: the augmented behavioral reminders did no better (and in fact, were less successful) than the simple behavioral reminders across trials. These implementation challenges arose as a result of outdated (or incomplete) contact information, highlighting the need to establish processes that help to integrate tax collection functions and data systems; an unbalanced timing of message delivery (Figure 2), highlighting the sensitivity of communication strategies in tax trials; and an imperfect interpretation of messages, highlighting the need to carefully evaluate language in communications. It was no surprise that the focus of attention turned towards the process at the completion of the trials.

Our colleague Oscar Calvo-González mentioned in a recent blog post about the case of Guatemala, “[Tax Administration] officials were convinced by the impact of the experiment and internalized and adapted behavioral science methods to their day-to-day operations and communication with taxpayers.” Tax administration officials in Kosovo were no different: They were sold on the process as much as the results, and understood the value of spending more time on parameters of tax compliance they can easily control. Combined with enduring impacts of messages, this type of intervention — with the adequate consideration of process — can be worth its weight in gold (or revenues, whatever the preference).

Read the full working paper here.

Join the Conversation