Sustainability is the holy grail of development. There are many interventions that yield positive results in the short term but somehow fail to be sustained over time. This is why the experience in Guatemala that we are about to describe is worth paying attention to. In short, it shows that behavioral insights can lead to lasting change.

It all began in 2012 in the United Kingdom, with simple changes in the reminder letters sent to taxpayers that were late in their income tax payment. The changes were very successful, inducing payments of 4.9 million pounds (around $6.5 million) in a sample of almost 120,000 delinquent taxpayers, which would not have been raised without the intervention. The then-nascent institution called the "Behavioral Insights Team" (BIT) became known around the world with this effective and very low-cost intervention that was based on modifying the messages of the letters sent to delinquent taxpayers. The message that was most effective said: "Nine out of ten people in the U.K. pay their taxes on time. You are currently in the very small minority of people who have not paid us yet." Behavioral science experts have been able to show that telling people what most people do, especially when it comes to positive behavior, is a good technique to change behavior.

Inspired by this intervention, the Superintendence of the Tax Administration (SAT) of Guatemala, in collaboration with the World Bank and BIT, wondered if it would work in a context as different as Guatemala, where tax collection is a challenge and where the tax compliance is not 90 percent, as in the United Kingdom, but closer to 65 percent. In Guatemala, tax collection is so low that between 2011 and 2015 it was only 12 percent of GDP, less than half the average in Latin American countries. There was only one way to see if this would work in Guatemala, where there was little to lose - the cost was very low — and instead, if it went well, much to gain.

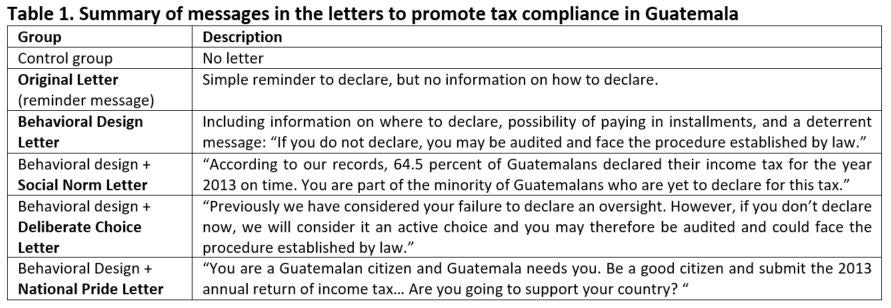

Thus, in 2015, they decided to design a simple nationwide intervention in Guatemala to measure the impact of specific messages included in the letters that the SAT sent to taxpayers who were delinquent in the payment of income tax. The messages referred to social norms, deliberate choices or even national pride, among others. The objective of this experiment was not only to increase the number of taxpayers filing their taxes and the total collection of income tax, but also to learn, through impact evaluation methods, what the most effective message in the Guatemalan context was.

Did it work? Indeed. Not only did more Guatemalans filed their taxes, but those who did paid higher values. Those who received the letter with the social norm message — where it was highlighted that they were part of a minority that had not yet filed their taxes — and the message that referred to the non-filing as an intentional choice — where they were warned of a potential audit — paid four times more in taxes relative to those that received the original letter (see Table 1).

It has been almost four years since they collected the results of that first experiment, and it is very good news to see that the process continues to date. In all subsequent years, the SAT repeated the experiment using different transmission mechanisms. In addition to sending physical letters, they used emails and text messages. With each experiment, the total income tax collection not only continued to increase, but the effects were sustained over time, up to 12 months after sending the initial messages and without the need to send a reminder.

The SAT team has been able to observe firsthand the effects of the application of behavioral techniques on income tax collection, and they are currently exploring how to scale up this intervention and apply it to other business areas. Today, they are working on ideas to increase the collection of other taxes, such as VAT, and options to increase collection of the vehicle circulation tax.

This experience of using behavioral techniques began with timely support from the World Bank and BIT and is now ingrained in day-to-day operations at the fiscal authority of Guatemala. It serves as an example for other countries with similar challenges created by relatively low tax compliance rates. Traditional measures to increase tax collection are costly, require changes in legislation, and do not always yield positive results. In Guatemala, we have a very powerful, simple, and inexpensive example of the effectiveness and sustainability of behavioral science.

Join the Conversation