View of Ourika Valley in Morocco. (Shutterstock.com)

View of Ourika Valley in Morocco. (Shutterstock.com)

Morocco is grappling with substantial climate change challenges. As one of the world's most water-stressed countries, it faces increasing drought pressures that severely impact its agricultural sector in particular. Additionally, the threat of intensified and more frequent floods looms over its major urban centers. These climate shocks pose risks not only to the population, infrastructure, and overall economy but also to the stability and soundness of Morocco's banking sector — a key driver of economic growth with assets totaling 138% of GDP.

In a pioneering collaboration, the World Bank (WB) and Bank Al Maghrib (BAM), the Moroccan Central Bank, supported by Agence Française de Développement (AFD), have explored the impact of climate risks on Morocco's banking sector. This endeavor represents the first comprehensive analysis of both physical and transition climate-related financial risks in Africa and among the few conducted in emerging markets globally. Utilizing a variety of climate and macro-financial models, a climate risk stress test was carried out to quantify the effects of climate-induced droughts and floods on Morocco's economy and banking sector, and assesses the impact of an energy transition on credit exposures. Notably, it is among the first analyses to analyze the financial sector's exposure to climate change-induced drought risks.

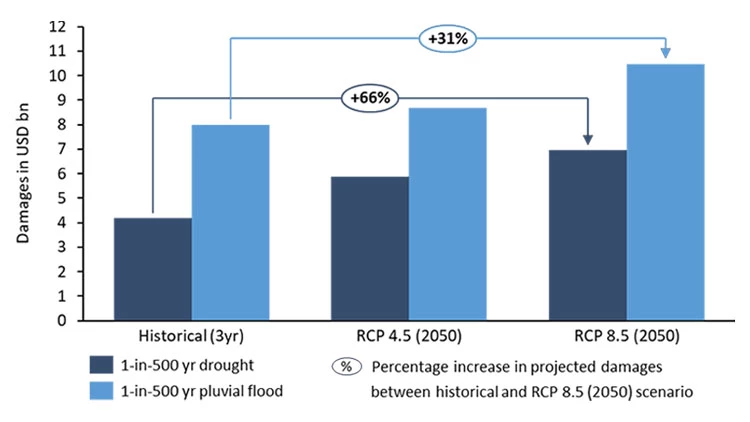

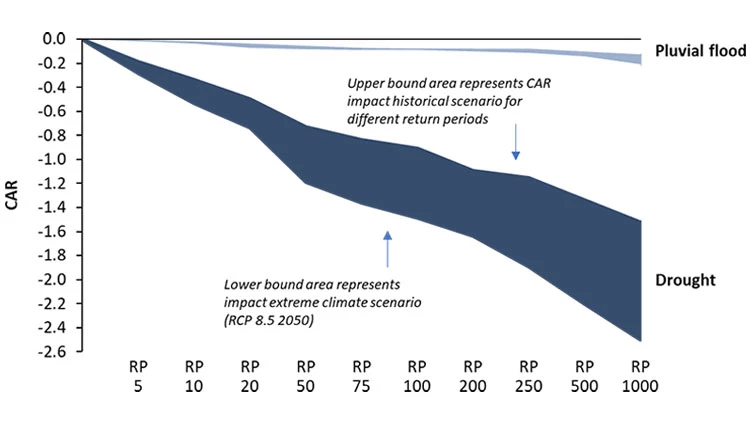

The report highlights that climate change could significantly escalate financial damage from droughts and floods in Morocco, with notable impacts on bank losses in the case of droughts. Over a third of bank loan portfolios are particularly exposed to climate physical risks (see also World Bank Morocco Country Climate and Development Report, 2022), mainly due to lending in the agricultural, food processing, and tourism sectors, and to households in vulnerable areas. The economic impacts in a variety of drought scenarios range between $4.2 billion (historical 1-in-500 year drought) and $7 billion (1-in-500 year drought in a severe climate change scenario, RCP 8.5, in 2050), decreasing Gross Domestic Product (GDP) by 1.8 to 3.5 percentage points, while reducing the Capital Adequacy Ratio (CAR) of banks by 1.3 to 2.2%. The analysis highlights the significant amplification effects of climate change across all scenarios. Floods could even cause damages between $8 billion (historical 1-in-500 year pluvial flood) and $10.5 billion (RCP 8.5, 2050), reducing GDP by 1.6 to 2.2%. However, unlike the prolonged nature of droughts, floods are short-lived, resulting in small impacts on loan losses and bank capital (see figure).

Climate change could significantly increase financial damages from droughts and floods

Projected damages in Morocco under historical and climate scenarios (in USD bn) under 1-in-500 return periods for considered perils

Source: Adapted from World Bank, BAM (2024).

Note: RCPs (Representative Concentration Pathways) are scenarios describing GHG-trajectories and their climate impacts. RCP4.5 is an intermediate scenario with emissions peaking by 2040, while RCP8.5 is a high-emission scenario with rising emissions, leading to significant global warming.

Banking sector capital may also be adversely affected — in particular by droughts

Banking sector capital adequacy ratio (CAR) impacts of floods and droughts under historical and climate scenarios for variety of return periods (RP) (in percentage points)

Source: Adapted from World Bank, BAM (2024).

Note: CAR impacts are based on a macro-modeling exercise to simulate the impact of the simulated catastrophic scenarios on a variety of macro-economic variables. The results presented here are a subset of the scenarios that were simulated. Other scenarios include severe impact scenarios for 2030 (RCP 8.5), and medium impact scenarios for 2030 and 2050 (RCP 4.5). Assessed impacts of the other scenarios all fall within the upper and lower bound projections in the graph. The annual return period (RP) is a statistical concept used to estimate the likelihood of a catastrophic event, such as drought or flood. E.g., if a drought has a return period of 100 years (RP 100), it means that there is a 1 percent chance (1 in 100) of that drought occurring in any given year.

The Moroccan banking sector could also face transition risks from policy shifts and rising GHG emissions, despite Morocco's small global GHG emission share (0.16%). Emissions in Morocco are rising, potentially increasing transition risks for carbon intensive sectors like electricity generation, transport, mining, agriculture, manufacturing, and utilities. The EU's Carbon Border Adjustment Mechanism (CBAM), which imposes trade tariffs on some carbon-intensive goods, also poses additional risks for industries like cement and aluminum, given Morocco's significant trade with the EU. The report finds that 24.3% of total loans and 43.6% of loans to nonfinancial corporates are exposed to transition-sensitive industries, a relatively high proportion compared to other countries. A vulnerability assessment shows that a $75/tCO2 carbon tax could increase credit risk for 8.4% of corporate loans, equivalent to 3.1% of banking sector assets.

The results of the climate risk analysis should be viewed cautiously due to estimation uncertainties and methodological limitations. The impact of climate change on the banking sector may be underestimated due to challenges in modeling climate tipping points and the interplay between macroeconomic, financial, and climate impacts. Data limitations and diverse modeling approaches could affect the assessment's accuracy, making it exploratory and subject to updates as understanding of climate risks improves.

The report emphasizes that while aggregate climate impacts on the banking sector are manageable, the financial impact varies across banks, requiring further attention by financial institutions and BAM. The impacts of physical and transition risks differ widely across institutions, with very low and high outliers, depending on geographic and sectoral concentration of loan portfolios. The report stresses the need for Moroccan banks to integrate climate risks into their risk management and governance arrangements. Meanwhile, BAM is responding by developing more detailed supervisory guidance for banks, particularly for stress testing and reporting. It seeks to incorporate climate risks into supervisory practices, aiming for alignment with global standards such as the Basel Committee’s climate risk management principles and IFRS sustainability-related disclosure requirements.

The World Bank will continue to collaborate with BAM, other national regulators, and international partners like the Financial Stability Board and Network for Greening the Financial System to enhance assessment methodologies and integrate climate risks into supervisory approaches to improve resilience of financial sectors against climate shocks. This support is part of the World Bank's global technical assistance to over 60 countries in managing climate-related financial risks and enabling climate finance.

Join the Conversation