Over more than a decade, the Global Findex has tracked financial inclusion rates in Sub-Saharan Africa. To highlight ten years of progress and how account ownership and usage has grown as well as changed, the Global Findex team has prepared a series of notes. The first three highlight:

- The state of financial inclusion in Sub-Saharan Africa

- The impact of mobile money on financial inclusion in Sub-Saharan Africa

- Financial wellbeing in Sub-Saharan Africa

With this blog, we share highlights from these first notes in the series—and encourage you to visit the Global Findex Africa page to read or download the full versions.

Account ownership has more than doubled since 2011

As of 2022, 49 percent of adults in Sub-Saharan Africa owned an account, a rate that has more than doubled since 2011. There is a great deal of variation country-by-country, however, ranging from 6 percent account ownership in South Sudan to 80 percent in Kenya. In 16 of the 36 economies surveyed in 2021-22, well over 50 percent of adults have an account.

Mobile money continues to significantly affect account ownership rates. Between 2017 and 2022, 9 out of 36 surveyed economies experienced double digit account ownership growth driven in most of them by mobile money adoption. Across the continent, an average of 28 percent of adults have a mobile money account—more than twice the developing economy average.

Yet mobile money is not the sole driver of increased inclusion in every country. On the contrary, in some economies mobile money adoption is happening in parallel with growth in bank account ownership. Others are investing in their banking sector to drive inclusion (Figure 1).

Equity gaps remain in Sub-Saharan Africa

Significant gaps remain in access to accounts for women. The account ownership gender gap for the region is twice the developing economy average, at 12 percentage points. Individual economies have made great strides to drive equitable gender access, however. Mali, for example, has dramatically reduced its gender gap from 20 percentage points in 2017 to just 5 percentage points as of 2021. Mobile money accounts also seem to help drive greater gender equity in account ownership: in seven of the 15 economies where more than 20 percent of adults have a mobile money account, women have equal or higher mobile money account ownership than men. Our notes explore additional gaps by income, rural residence, and age.

Lack of money, lack of documentation, and distance act as barriers to account ownership

The most common reasons why unbanked adults do not have a bank account, in order, are that they do not have enough money for it, they lack documentation required to open an account, the distance to a brick-and-mortar branch is too far, the expense of financial services is too high, and/or that a family member has one so they do not need their own. (Respondents could give more than one answer, and most do).

The reasons for not having a mobile money account are similar, though not having a mobile phone is the second most common after not having enough money, and the issue of distance applies to an agent, not to a bank branch.

Adults in Sub-Saharan Africa increasingly use accounts for a wide range of services

Adults in the region with bank or mobile money accounts are using a broader variety of financial services, though payments remain the most popular. Digital payment usage rates are as high as 95 to 98 percent of account owners in economies such as Kenya and South Africa. Some of the most popular payment types are government payments, private sector wage payments, and domestic remittances. Most government payments are made directly into account—for example, over 60 percent of government payment recipients in Mali and Senegal receive them directly. In every country in Sub-Saharan Africa save four, a larger share of domestic remittance senders and recipients made digital transfers from or into an account than paid cash or used other methods (Figure 2).

Beyond receiving payments, adults in Sub-Saharan Africa make digital payments to merchants and utilities—both saw a significant increase in adoption due to the COVID-19 pandemic.

As for saving, 52 percent of adults in Sub-Saharan Africa save in some way—a higher share than the developing economy average of 42 percent. On average, 44 percent of savers in the region used an account to do so, the first time that formal saving exceeded other methods in popularity. Mobile money savings played a significant role in that increase. Similarly, mobile money is motivating more access to formal credit for borrowers (Figure 3).

Adults in Sub-Saharan Africa have difficulty coming up with extra money in an emergency

One of the goals of financial inclusion is to improve the ability of households to deal with events that have financial costs—such as a sudden loss of income, an illness, or an accident. The ability to come up with extra money equal to 5 percent of gross national income per capita is one measure of financial resilience. In Sub-Saharan Africa, only 41 percent of adults are financially resilient. South Asia is the only developing world region with a lower resilience rate.

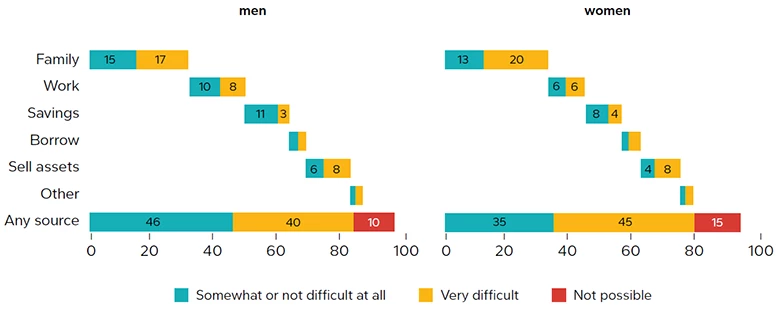

One factor that influences financial resilience is the source of funds. In Sub-Saharan Africa, 32 percent of adults would turn to family and friends for extra money, a larger share than would rely on any other source. The challenge is that family and friends are unreliable sources of extra money—more than half of adults in the region who would turn to them for help say the money would be difficult to get (Figure 4).

FIGURE 4. Women are less likely to be resilient than men, and are more likely to rely on social sources for extra money

Adults idenfitying the source of, and assessing how difficult it would be to access, emergency money (%), 2021

Source: Global Findex 2021

Note: The length of the bar in each row is the share of adults that reported using the specified source of money.

A small share of adults did not know or refused to disclose their main source of emergency money.

While the landscape of financial inclusion in Sub-Saharan Africa has evolved significantly, the journey is far from over. Countries and organizations are actively addressing the barriers that still exist through innovative solutions. Mobile agent networks extend services to remote areas, governments are streamlining documentation processes, and strengthening consumer protection frameworks, and financial literacy programs are equipping individuals with essential financial management skills. These efforts are crucial in moving towards a financially inclusive region. By providing comprehensive data on financial behaviors, the Findex database identifies areas in need of intervention. The World Bank leverages this data to promote financial products and services that cater to the unbanked and underbanked. Collaborating with governments and the private sector, we can scale up successful financial inclusion strategies, such as mobile money platforms, to reach a wider audience. These initiatives are essential in bridging the financial access gap and fostering an inclusive financial ecosystem that supports sustainable economic growth and poverty reduction.

For more on financial inclusion in Sub-Saharan Africa, visit the Global Findex Africa page.

Join the Conversation