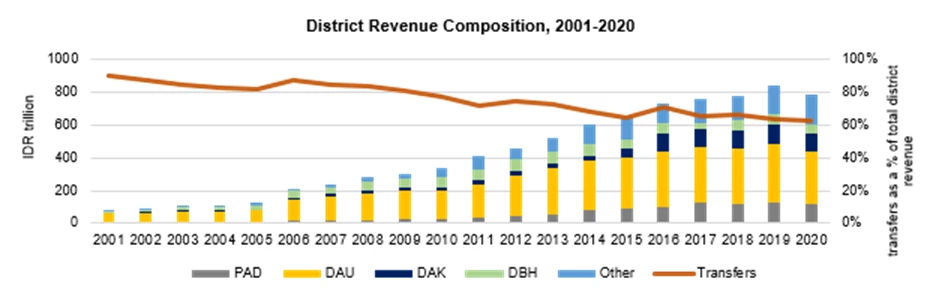

District Revenue Composition,2001-2020. Indonesia.

District Revenue Composition,2001-2020. Indonesia.

Indonesia’s subnational governments (SNGs) remain largely dependent on central government transfers to finance their spending. The general allocation fund (Dana Alokasi Umum or DAU) is a non-earmarked general-purpose block grant that aims to equalize SNGs’ fiscal needs and capacity. It is the most significant transfer, particularly for district governments (see Figure 1).

Figure 1. Districts primarily rely on central government transfers

The previous DAU formula regulated via Law 33/2004 has successfully financed SNGs but unfortunately disincentivized SNG revenue effort. This is because the DAU used actual SNG own source revenue as a proxy for fiscal capacity. As a result, districts that collected more revenues received less DAU allocation from the central government.

The government addressed this challenge via the introduction of Law 1/2022. The new law changed the measurement of fiscal capacity in the DAU formula from the previously used actual SNG own-source revenues to potential revenue estimates. The law left it up to the implementing regulations to define the method to estimate potential revenue which simultaneously represented a challenge and opportunity.

Our recent report provides a theoretically-grounded, and empirically-backed way to estimate potential revenues for the DAU formula in Indonesia. It does this by developing a comprehensive conceptual framework for revenue estimation and implements it using available data for Indonesia.

We consider three elements to identify the predictors of potential revenue of the main tax revenue sources at the district level:

1. Conceptual / theoretical link with revenue source: These indicators should, in theory, predict the relevant revenue stream.

2. Existence of empirical evidence: We check whether the indicators have been shown to empirically predict the revenue stream in other contexts.

3. Data Availability: We check whether selected indicators are available for Indonesia and test whether it predicts the revenue stream.

We apply this framework to four categories of district-level taxes in Indonesia, which collectively account for approximately 80 percent of districts' own-source revenue. For each category, we conducted separate tests using subnational fiscal data from 2010 to 2018, focusing on districts with available data. We then evaluated the predictive capability of several variables in estimating potential revenue.

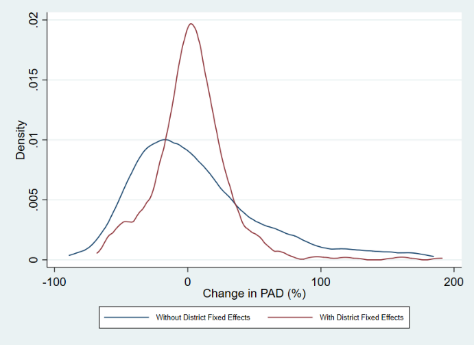

In testing the distributional implications of using different specifications, a particular concern was that certain parts of GRDP are not subject to district taxation. So GRDP for the mining sector was included as an additional control variable. This adjustment yielded positive results by increasing DAU allocations for numerous districts with high natural resources. However, relying solely on mining sector GRDP may not fully address the equity concerns. Thus, we used district fixed effects to capture time-invariant district-specific characteristics. Using district fixed effects led to fairer allocations.

Figure 3. District Fixed Effects help improve the fairness in DAU Allocation

With the latest enactment of Law 1/2022, Indonesia has taken the right step by moving from actual SNG revenues to potential revenues in the DAU formula to incentivize SNG tax effort. The report provides a viable way to estimate potential revenues given the existing data limitations. The reform will help reduce SNG reliance on transfers to finance their spending.

Join the Conversation