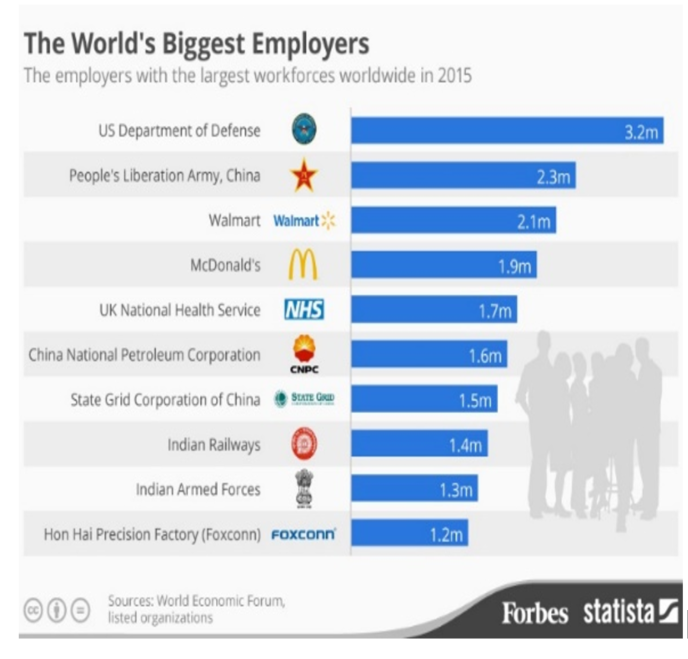

- Hon Hai, the holding company of Foxconn – a Taiwanese multinational corporation known for manufacturing many Apple products in China - is among the top 50 companies to receive the largest number of US patents in 2016, thus driving innovation in East Asia.

- InterContinental Hotel Group (IHG)’s management contracts with locally-owned hotels aim to raise the quality and service of hotels around the world. It does this by bringing global hotel management and operation standards to host countries, transferring technology to local construction companies around how to design and build global standard hotels, and providing skills and training in hospitality through the IHG Academy. During 2016, 2,145 IHG Academy programs in 75 countries benefitted nearly 12,000 participants.

What do these two examples have in common? Both Hon Hai and IHG are companies that use contract-based models of doing business overseas, involving little or no equity investment from the parent company. And both seem to generate significant development benefits for host countries. For developing countries, investments in a form other than “equity”, often referred to as non-equity modes of investment (NEMS), provide a huge, but often overlooked opportunity to connect with multinational corporations (MNCs) and integrate into global value chains.

As businesses become more international, multinational companies have been looking for new ways to gain efficiencies of production or to access foreign markets. Commercial contractual arrangements between a foreign multinational company and a local enterprise are becoming a common way multinational companies invest across borders. In this case, the foreign company’s “investment” consists of making available its brand name, intellectual property, know-how, technology, skills and/or business processes. The local enterprise provides financing, local production capabilities, physical assets, or other locational advantages. The level of direct involvement of the foreign company in daily economic activity varies. Examples include:

- A locally-owned hotel in Nepal using Hyatt’s brand and business model through a franchise arrangement, where Hyatt also manages operations through a management contract;

- Intel outsourcing development of specific software or IT services to Wipro India;

- Lenovo contracting out production of specific components of laptops to Flextronics in Singapore through a contract manufacturing arrangement.

Non-equity modes of investment are often a gateway to future investments. MNCs enter a host country using non-equity modes, but may over time decide to invest directly through equity ownership, creating foreign subsidiaries or joint ventures. Particularly in higher risk environments – such as countries afflicted by conflict, fragility and high levels of political risk- foreign companies may prefer to explore an investment opportunity through a contractual arrangement as opposed to capital investment. Decisions by MNCs to choose non-equity modes thus depend on availability of capital, degree of ownership and control required, risk appetite and availability of local suppliers.

Job creation, value addition, technology transfer, exposure to higher standards, sales generation from NEMs can be significant, depending on the type and sector of the NEM. The Indian Information Technology – Business Process Outsourcing sector had revenues of $143 billion in 2016, exports reaching $108 billion and growing at 10.3%. UNCTAD estimates that 18-21 million workers are directly employed in firms operating under NEMs arrangements across various sectors. Most of the jobs created are in contract management, outsourcing and franchising activities. Around 80% of these jobs created are in developing or transition economies.

NEMs tend to be an important vehicle for technology transfer and for exposure to new and higher standards. In licensing for example, the licensee gains access to technology related intellectual property and financially compensates the licensor for it while in franchising, franchisors transfer a business model to local partners, typically entailing extensive training to setup operations, and technology transfer.

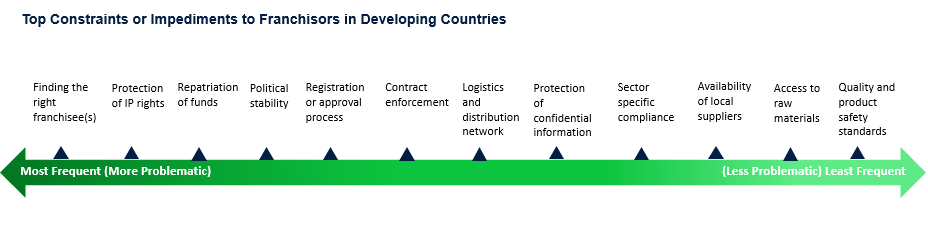

The findings of a survey of international franchisors conducted by the World Bank Group and the International Franchise Association presents further insights. It shows that 100% of respondents provided training to their new franchisees, including both industry-specific professional skills and more general management capabilities while 63% transferred technology in the form of equipment or software that were new to the local market. The survey also examined the main constraints for expansion and high potential markets for international franchisors.

Despite these benefits to host countries, NEMs also present inherent risks. MNCs may find it relatively easier to promptly relocate production or manufacturing base to a more cost-effective location when they find one, resulting in loss of jobs and business opportunities to local suppliers. Host country NEM partners may remain at the low end of the value-added scale for several years. But these potential downsides are not unique to NEMs; they are often associated with the traditional equity-based FDI as well.

Despite these benefits to host countries, NEMs also present inherent risks. MNCs may find it relatively easier to promptly relocate production or manufacturing base to a more cost-effective location when they find one, resulting in loss of jobs and business opportunities to local suppliers. Host country NEM partners may remain at the low end of the value-added scale for several years. But these potential downsides are not unique to NEMs; they are often associated with the traditional equity-based FDI as well.

On balance, NEMs can bring about significant development benefits to host economies and boost opportunities for their private sector. In addition to commercial viability , research and investor surveys show that policy and regulatory frameworks (such as registration/approval processes, repatriation rules, contract enforcement) of countries also impact MNC decisions. Developing countries should consider systematically exploring the value proposition of non-equity modes of investment, steps towards facilitating their growth, alongside ensuring upgrading, diversification and their sustained contribution to development.

Join the Conversation