It was ten years ago, right before the global crisis when Lehman Brothers had not collapsed, and Fannie Mae and Freddie Mac had not been placed into conservatorship. For debt managers, the markets were less volatile and the future was less uncertain. In Turkey we were dealing with the implementation of the post-crisis reform agenda.

One day, I got an invitation from my son’s eighth-grade teacher to speak at the school’s “careers day” which aims educate children on different types of jobs. I accepted the invitation but I was a little worried because, as a debt manager I have a “different type of job” that was not necessarily an “exciting” one.

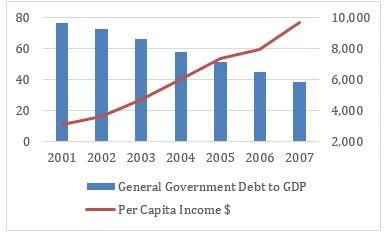

Those were the days of economic recovery. Turkey was writing a success story. During the crisis, the economy had contracted drastically, thousands lost their jobs, and the domestic debt to GDP ratio increased from 27% to 53% in only few months. However, almost five years after the deepest financial crisis Turkey ever experienced, the debt to GDP level was going down, both inflation and unemployment rates were declining too while income per capita was growing.

Yes, my job was not exciting, but at least I had a good story to tell.

The kids were listening silently but seemed quite interested. Finally, I told them how hard we worked during the days of the crisis to support the recovery of the economy, to help people to save their jobs (or at least to find new ones) and to make the lives of families better by initiating many economic reforms.

The story I told had a happy ending, thanks to the sound monetary and fiscal policies and teamwork. The declining public debt opened a fiscal space, which helped the government to invest in infrastructure, health, and education, to increase social transfers, and to create new jobs.

At home, my son was smiling with satisfaction. "Dad," he said, "My friends were very impressed, and they think that you and your friends are economic super-heroes."

As a seasoned debt manager, I learned that there is a negative correlation between the soundness of public debt management and the public interest on debt-related issues.

Let me explain: in the countries where public finances are strong, and debt levels are either low or at least sustainable, debt-related issues usually do not attract media's interest, and debt managers are not known publicly. On the contrary, if there is a sustainability problem or a roll-over risk in the short term, every single auction and redemption above some level will attract the media’s interest. However, even where the debt management is sound, it may become a hot public issue if the country suffers from fiscal slippages or if debt management is impacted by external factors.

Until the global financial crisis, the debt managers' main concern was funding the government's financing needs in relatively stable and liquid markets under their given mandate, which is to achieve the lowest possible cost with a prudent degree of risk. To this end, debt management was not the most exciting job in most countries.

However, with the crisis in the subprime mortgage market and the collapse of Lehman Brothers, the stormy days started. Several countries had to bail out banks/financial intermediaries, and some others were unable to refinance their government debt. Many countries introduced fiscal stimulus programs because of the global economic downturn.

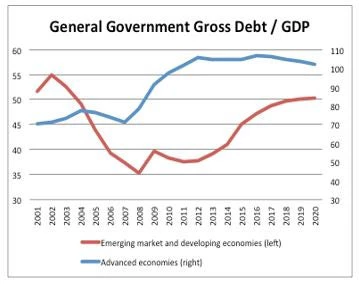

The stock of outstanding sovereign debt in the world has almost doubled since the beginning of the global crisis. From 2008 to 2012 general government gross debt to GDP increased to above 100% from around 70%, and then stayed steady in advanced economies. The World Economic Outlook of the IMF projects that general government gross debt to GDP ratio will stay on the same plateau until 2020. Nevertheless, in emerging markets, the declining trend in debt to GDP came first to a halt and then reversed, as debt began to increase starting from 2012. The IMF projects that the gross government debt of these economies will increase above 50% of GDP by 2020.

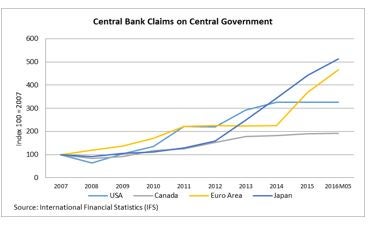

At the same time, Central Banks in advanced economies significantly expanded their balance sheets, and the claims on central government increased dramatically, as they purchased a substantial amount of government securities. Furthermore, due to the active monetary policy, aimed at stimulating economic activity, debt managers in Germany, Denmark, Switzerland and in some other countries issued bonds with negative yields. The monetary policies of central banks in advanced economies, have also had a significant impact on the debt markets of emerging and developing countries. Yield-seeking foreign investors invested extensively in emerging and developing country securities. This demand increased the liquidity and helped debt managers to borrow with relatively lower costs and longer maturities, as witnessed in many countries.

After decades of silence, thanks to growing debt stocks due to the global crisis, media interest in the public debt increased and debt related issues were in the headlines again. Since the beginning of the crisis, debt managers, with the help of the central banks, successfully rolled over the debt. Also, in order to finance fiscal stimulus and bailout programs, they borrowed more than their debt’s redemption. In some countries, while borrowing more, debt managers even reduced their cost without creating a refinancing risk and lengthened the average debt maturity. In that sense, in these turbulent times, debt managers “pulled the rabbit out of the hat”. I admit this may make debt management an exciting job - but only for a while.

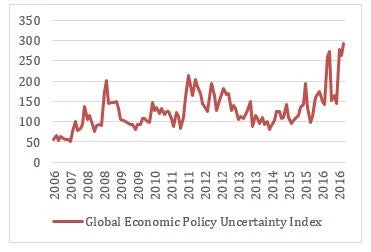

On the other hand, uncertainty is at the highest level and growing, as the global economic policy uncertainty index shows. Both the governments' and the central banks' balance sheets are now larger, more complicated and more connected to each other. This requires a higher level of coordination at the policy level and daily coordination at the technical level among the monetary, fiscal, and debt management policies. In such an environment, there is no doubt that debt managers by themselves cannot overcome the problems of the crisis but, with a revised mandate, can manage the residual risks of the sovereign balance sheet. This can reduce the vulnerability of economies to external shocks and increase resilience through effective and efficient coordination of debt management with monetary and fiscal policies.

Well, debt managers cannot save the world but we will still try to be “economic super-heroes.”

Join the Conversation