Women entrepreneurs in Ethiopia are disadvantaged from the start. They have less access to the finance, networks, and education which help their male counterparts advance. They face regular discrimination and harassment from society--sometimes even from their own families and communities. The challenges a woman entrepreneur in Ethiopia faces in growing her business are overwhelming.

The Women’s Entrepreneurship Development Project (WEDP) is a $50 mill IDA investment lending operation designed to increase earnings and employment for women who own businesses in Ethiopia. It created the first ever women-entrepreneur focused line of credit in Ethiopia in 2013, and the demand has been staggering. Additionally, the project includes a cutting-edge entrepreneurship training program that equips Ethiopian women with business skills, as well as the ability to ‘think like an entrepreneur’.

As team leader of the WEDP I have seen firsthand how the program is addressing these challenges and boosting the business environment for women in Ethiopia. My team and I are also learning a lot about the support and structures needed to run a program such as WEDP.

Top Five results of WEDP so far:

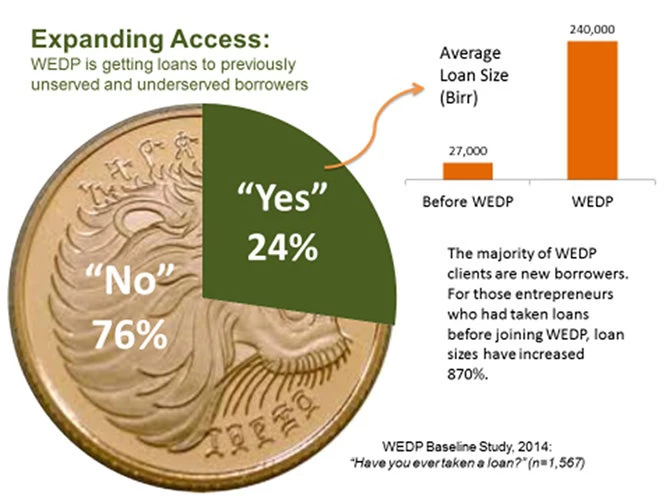

- Reaching the un-reached: New women borrowers are being reached - 76% of WEDP clients have never taken a loan before.

- Catalyzing growth: The average WEDP loan has resulted in an increase of 24% in annual profits and 17% in net employment for Ethiopian women entrepreneurs, one year after taking the loan. These female-owned businesses are continuing to grow, as the impacts of capital investments play out. Repayment of loans stand at over 99%.

- Unlocking needed capital: One of WEDP’s objectives was to increase loan sizes, since most Ethiopian women-owned enterprises were stuck in a ‘missing middle’ trap where loans offered by microfinance were too small to meet their needs. For repeat borrowers, loan sizes increased on average by 870%.

- Improving capacity of lenders: Through a dedicated technical assistance component, WEDP is building the capacity of Ethiopia’s leading microfinance institutions (MFIs) to deliver loans to women entrepreneurs. The MFI’s improved ability to appraise, resulted in their capacity to reduce the collateral requirements from an average of 200% of the value of the loan to 125%. This is all the more relevant in a country where there is not a collateral registry yet. Loans are now more accessible to all.

- Underwriting innovations in the sector: Through partnership between the World Bank’s Finance & Markets Global Practice and the Gender Innovation Lab, WEDP is introducing innovative credit technologies to lenders, such as psychometric tests which can predict the ability of a borrower to repay a loan and reduce the need for collateral.

Top Three Things we’ve learned:

- Lenders need help too. Helping lenders move away from traditional collateral-based lending and adopt innovative (and likely more effective) forms of appraisal is a powerful way of expanding access to women entrepreneurs. Improved appraisal can be easier and more profitable for lenders, but changing the way a bank makes loans takes time, and most lenders are cautious when reforming these fundamentals.

- Engaging men is critical. When women entrepreneurs grow their businesses, dynamics in the household and the family can change. Engaging husbands, partners, and male family members to ensure their buy-in and support is critical. Linking women entrepreneurs with trusted male mentors and role models in other sectors can help them transition into more profitable businesses.

- Training is hard. While most women entrepreneurs say that they want to enhance their skills, many don’t register for training programs. Entrepreneurship training needs to be of high quality, in accessible locations, and at convenient hours, in order to attract busy women entrepreneurs. Mentorship and follow-up are just as important.

Join the Conversation