Although it’s Africa's largest economy, Nigeria is missing out on the region’s most exciting financial innovation: mobile money.

Twenty-one percent of adults in Sub-Saharan Africa have a mobile money account, nearly double the share from 2014, according to the latest Global Findex report.

By contrast, Nigeria lags behind: just 6% of adults have a mobile money account, a number virtually unchanged from 2014.

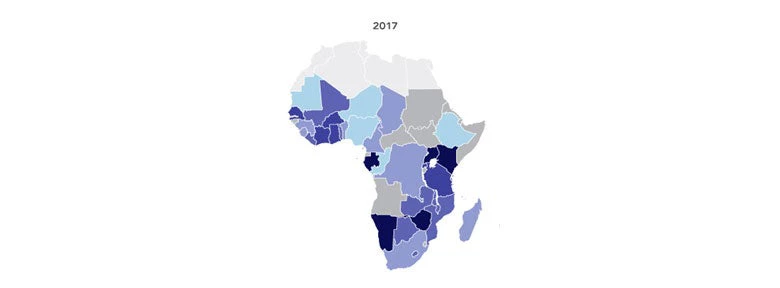

Mobile money accounts have spread more widely in Sub-Saharan Africa since 2014

Adults with a mobile money account (%)

Source: Global Findex Database

Note: Data are displayed only for economies in Sub-Saharan Africa

In the last three years mobile money has spread from East to West Africa. In Senegal, mobile money ownership jumped from 6% to 32%, with similar gains reported in Burkina Faso. In Ghana, 39% of adults now have a mobile money account, up from 13%, on par with Tanzania. In Kenya, more than 70% of adults use a mobile money account; in addition, over 30% of adults use mobile phones to make payments from a traditional bank account. The rise of mobile money has led to an increase in bank accounts; overall, account ownership now exceeds 50% in seven sub-Saharan African countries, and 80% in three regional economies.

Mobile money can expand financial inclusion, which can help reduce poverty. For example, mobile money helped 194,000 Kenyan households climb out of poverty, enabled women to move from farming into business and retail, and helped families build up savings.

Its low uptake in Nigeria means that people may be missing opportunities to participate in the economy and improve prosperity. Nigeria’s financial inclusion rates have also stagnated since 2014; only 40% of adults have a formal account.

The good news is that mobile money has plenty of potential to take off in Nigeria, as Global Findex data reveals. Roughly seven in 10 adults have a mobile phone, including 35 million unbanked adults, among them 20 million women. This offers a tremendous opportunity to expand mobile money if the necessary infrastructure, including the number of agents, is put in place.

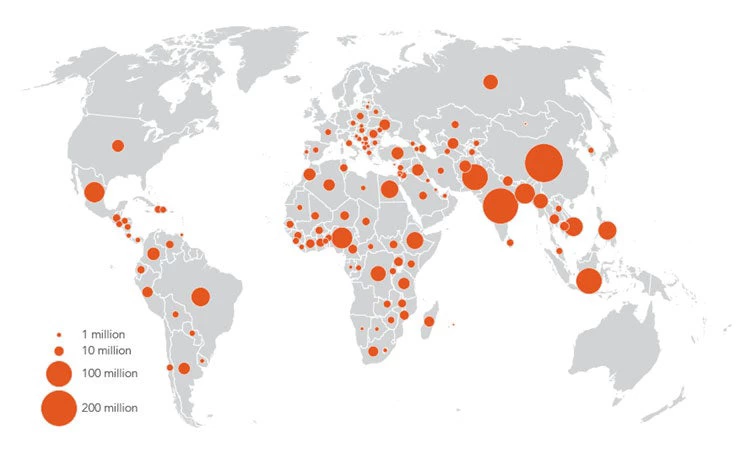

Globally, 1.7 billion adults lack an account

Adults without an account, 2017

Source: Global Findex Database

Note: Data are not displayed for economies where the share of adults without an account is 5 percent or less.

Where are the opportunities?

1. Reform the regulatory framework to allow subsidiaries of mobile network operators (MNOs) to apply for mobile money operators’ license:

Countries with strong mobile money growth have benefitted from engaged MNOs. By contrast, Nigeria's mobile money market is dominated by banks and technology companies. While they play an important role, they alone are not enough to unlock Nigeria’s massive potential. Allowing MNO subsidiaries to operate mobile money services could invite private investment and help Nigeria tailor and apply the models that have succeeded elsewhere.

Ghana is a good example. It initially opted for the bank-led model, resulting in limited mobile money use. The country changed its policy in 2015, and allowed telecommunication companies to apply directly for a license from the central bank, rather than through their partner banks. The regulatory changes yielded exceptional growth in use of mobile money, contributing significantly to financial inclusion and the rise in electronic payments, as illustrated below:

Table 1: Number of active mobile money customers and active agents in Ghana: 2012—2016

| 2012 | 2013 | 2014 | 2015 | 2016 | |

| Active customers | 345,434 | 991,780 | 2,526,588 | 4,868,569 | 8,313,283 |

| Active agents | 5,000 | 10,404 | 20,722 | 56,270 | 107,415 |

Agents are small shops that offer basic services to mobile money users, like deposits, withdrawals and transfers. For mobile money to reach a critical mass, Nigeria needs a dense network of mobile agents. Allowing MNOs to issue mobile money could help expand mobile networks in parts of the country typically ignored by financial services providers. However, MNOs need incentives to do this; the Ghana data show how things take off when a clear regulatory framework is in place and providers have an impetus to invest. Good infrastructure - such as reliable mobile network coverage – is also vital.

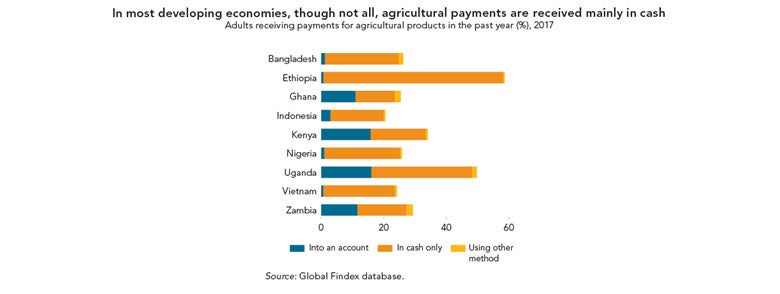

3. Digitize routine cash payments:

Many unbanked Nigerians are paid in cash. Moving them into accounts could drive up both mobile money adoption and financial inclusion. Nearly one in 10 unbanked adults in Nigeria work in the private sector and receive wages in cash, including roughly four million who have a mobile phone. Also, 15 million unbanked adults are paid in cash for the sale of agricultural goods, including some 10 million mobile phone owners. By contrast, in Kenya and Uganda - where MNOs are mobile money providers - almost one in six adults are farmers whose agricultural sales are paid directly into an account.

The government could also digitize all transfer, wage and pension payments. Digitizing these payments can deepen financial inclusion, increase security and efficiency, and reduce leakage and potential corruption. For instance, the South African Social Security Agency cut fess by 54% after migrating social grant recipients to e-payments.

People won't use mobile money if they're worried about fraud and deception. That's why it's important to enforce strong consumer protection regulations for issues such as safeguarding client funds, mistaken and unauthorized payments, fee disclosure and transparency, data protection, fair treatment and dispute resolution.

Financial inclusion helps tackle gender inequality. Evidence from Findex suggests that mobile money accounts might be helping to narrow gender gaps in some Sub-Saharan African economies. But in Nigeria, while 51% of men have a financial or a mobile money account, only 27% of women do. That 24-percentage point difference is twice as large as the region’s average and almost three times as large as the average gender gap in the developing world.

Expanding financial services to all Nigerians is critical to ensure that Africa's largest economy benefits everyone. Sub-Saharan African countries that have successfully leveraged MNOs and agent networks to deliver financial services have been most successful in meeting their financial inclusion goals.

These countries offer lessons for Nigeria to identify opportunities, address potential risks and develop an appropriate regulatory and supervisory framework to leverage MNOs to expand mobile money and tackle the stagnating financial inclusion rate.

These recommendations align with the World Bank Group's Universal Financial Access (UFA) goal to ensure that adults worldwide have access to an account by 2020. Nigeria is among the 25 UFA focus countries.

Join the Conversation