wb

wb

Digital technologies (DTs) have proven to be critical to the development of modern economies. They have changed the ways people communicate, reduced information frictions in markets, improved inclusion (especially in finance), and led to efficient delivery of services. The importance of DTs became even more obvious during the COVID-19 pandemic via their role in the transition to home-based work, e-commerce, and telecommuting, inter alia. Access to DTs features prominently among the development priorities at the continental level. For example, the African Union’s Digital Transformation Agenda aims to achieve universal access to the internet in Africa by 2030.

Yet, in many African countries, access to DTs has been historically low and there remains a huge gap between availability and use as examined extensively in a recent World Bank report, Digital Africa: Technological Transformation for Jobs.

In this blog post, we use newly available census data from Ghana and offer 10 facts on the uptake of internet and fintech between 2010 and 2021, and evidence on factors that drive adoption in the country.

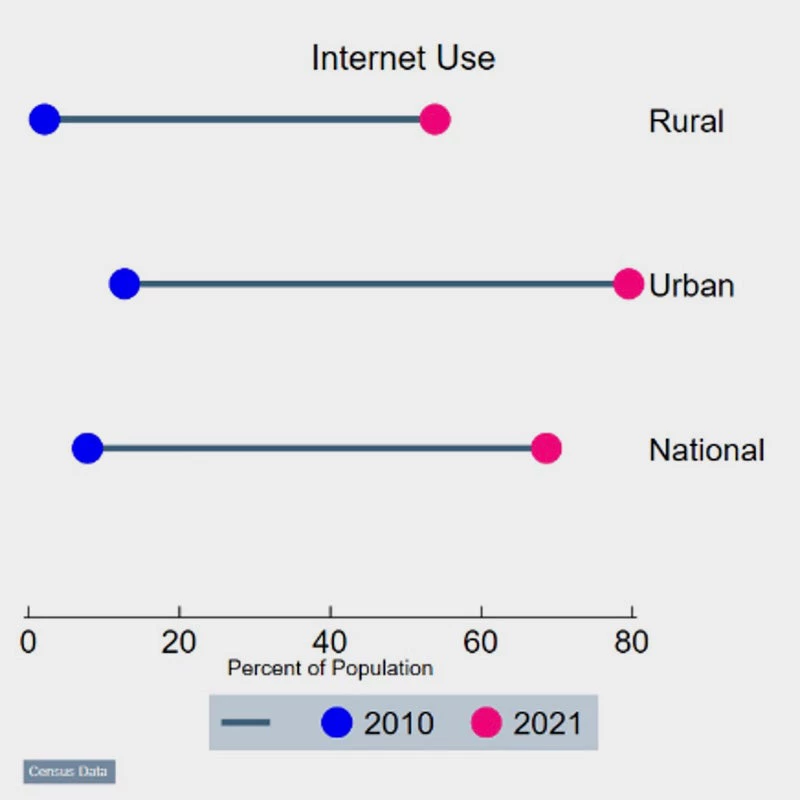

| Fact 1: Internet uptake in Ghana increased by nearly 9-fold over the past decade The share of the population with an online presence increased from 8% in 2010 to 69% in 2021. However, rural-urban uptake gaps persist and are widening. In urban areas, internet uptake rates increased from about 13% to 80% compared to 2% to 54% in rural areas. Nonetheless, the access rate in rural Ghana compares favorably with other Sub-Saharan African countries. |

|

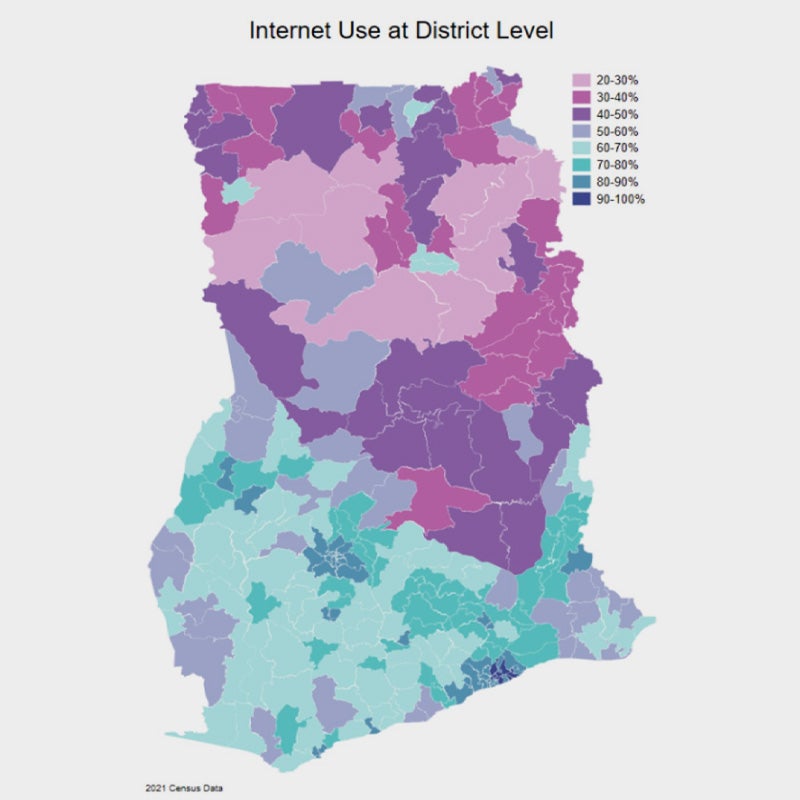

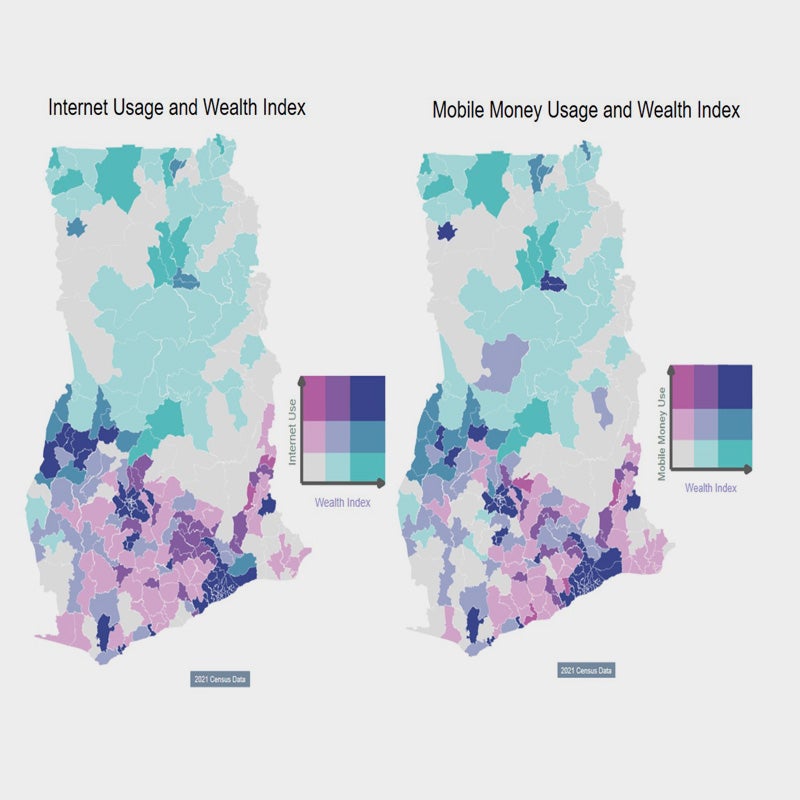

| Fact 2: There is a north-south gradient in adoption Internet usage rates at the district (subnational) level ranges from 24% in Mion, North East Gonja, and Karaga districts to 92% in Tema West, Ayawaso West, and La Dade-Kotopon municipalities. Overall, in much of the northern belt of the country, internet use rates are below 50% compared to the middle belt and coastal regions where usage rates range between 50%-92%. The north-south divide in internet connectivity mimics the north-south divide in income in the country. |

|

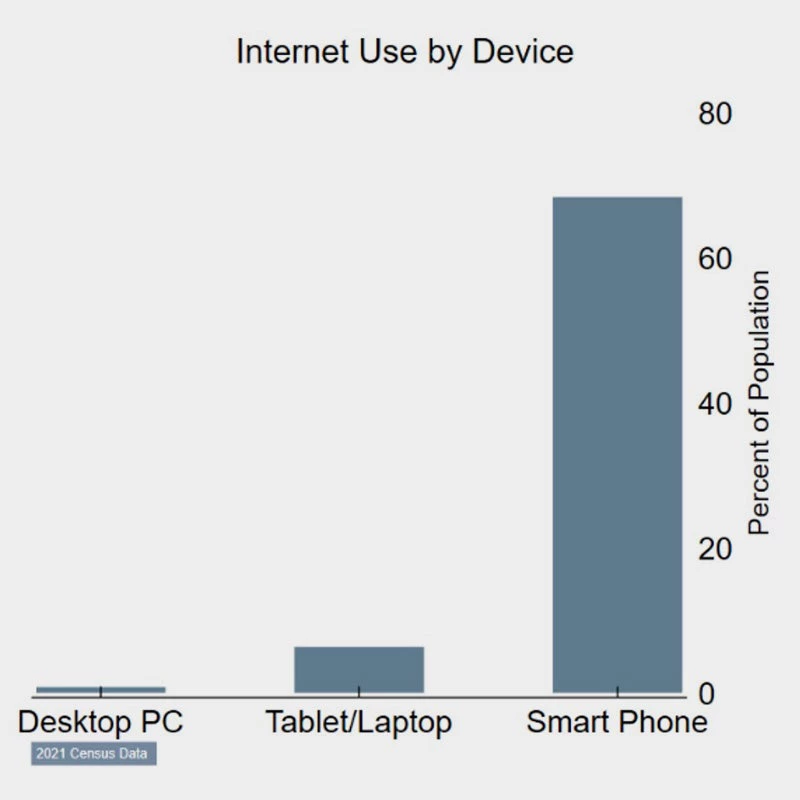

| Fact 3: Expansion in mobile broadband internet explains much of the uptake Internet connectivity is strongly correlated with the expansion of 3G and 4G mobile networks. About 68% of the population access internet via smartphones, compared to 6.3% and 0.7% via laptop/tablets and desktop computers respectively. The ease of connection via smart phones and the low cost of mobile broadband network expansion, relative to fiber broadband networks, are potential reasons for the dominance of mobile broadband. Similar trends are observed in other African countries. |

|

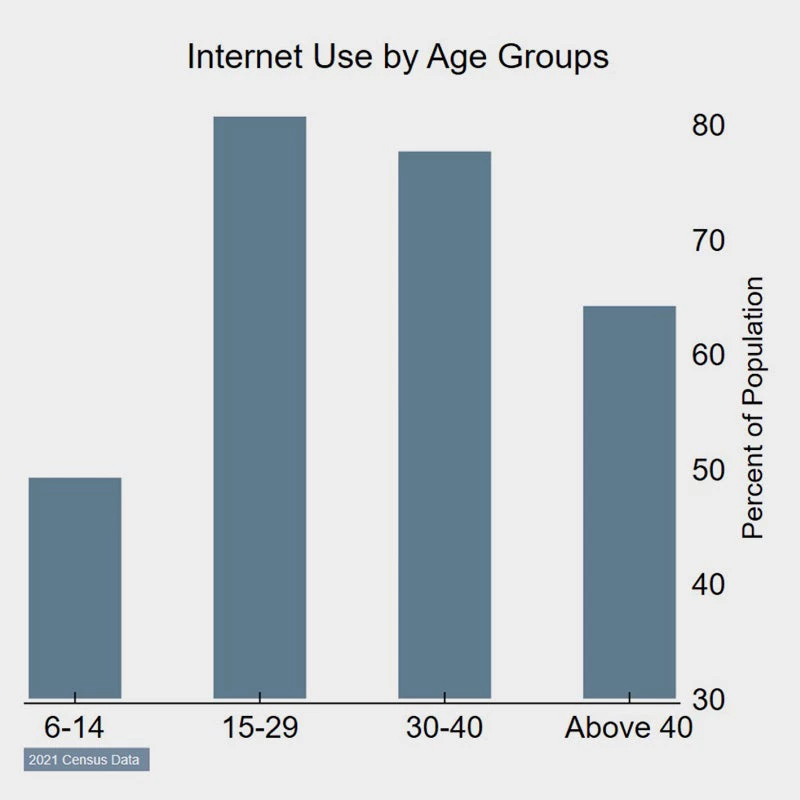

| Fact 4: Internet use is very high among youth While internet use is prevalent across all age groups, usage rate is particularly high (80%) among youth (ages 15-29), followed closely by the 30-40 age cohort with a usage rate of 78%. The usage rates among children (ages 6-14) and the older cohorts (ages 41 and above) are 49% and 64% respectively. This pattern is similar to what is observed in developed economies like the US, where internet use among young adults is nearly ubiquitous. Increasing use of internet by children (6-14 years old) is encouraging as it can be beneficial to their education, although excessive use of social media can have unintended consequences on mental health of children. |

|

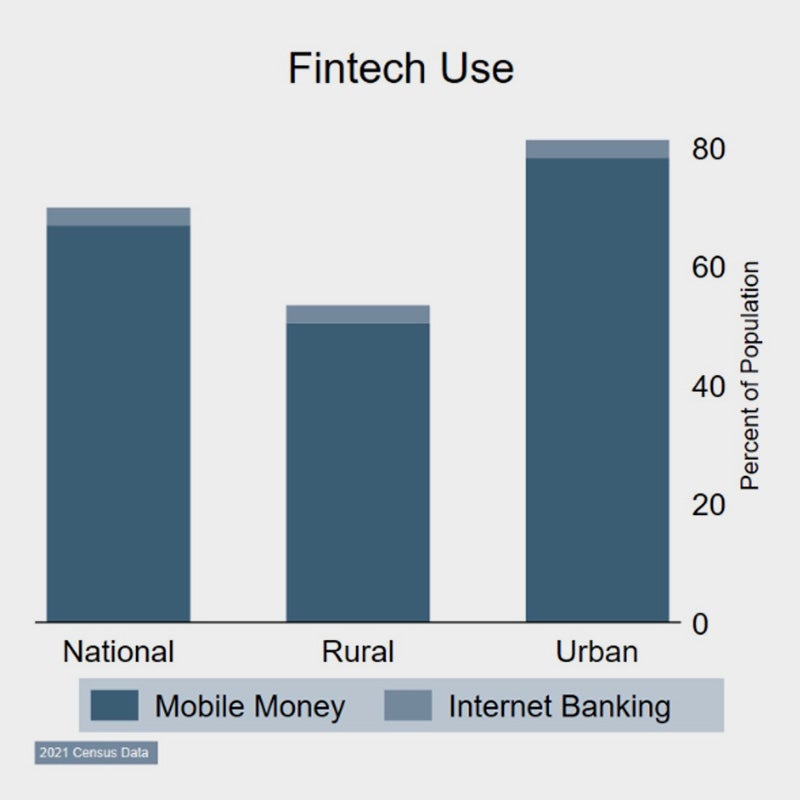

| Fact 5: Fintech use is on the rise, but largely dominated by mobile money Adoption of financial technologies (fintech) has been impressive. In 2021, 67% of Ghanaians used some form of fintech applications–mobile money and/or internet banking–of which 62% used mobile money and 5.2% used internet banking. Launched in 2009, the uptake of mobile money in the country was initially very slow. For instance, in 2012– three years after its introduction into the Ghanaian market–the number of active mobile money accounts in the country stood at only 350,000. By 2020, the number of active mobile money accounts had reached 17.1 million. Regulatory changes such as the central bank’s provision to allow non-bank institutions (e.g., Telcos) to own and run mobile money network operations in 2015, and the introduction of mobile money interoperability in 2018 spurred uptake. |

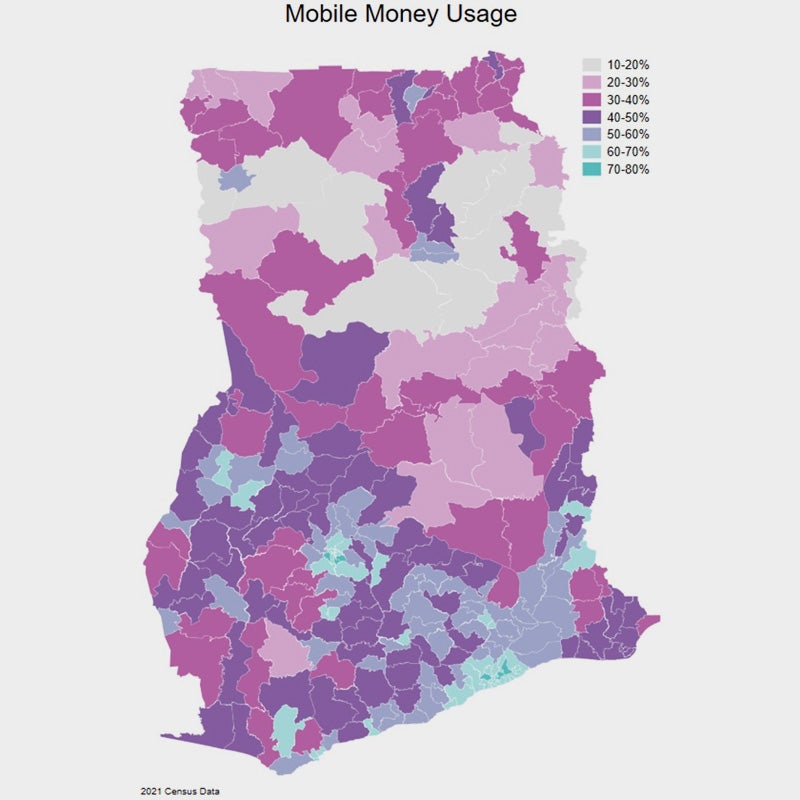

| Fact 6: Mobile money adoption rates exhibit significant spatial disparities Despite increased uptake, a significant rural-urban gap in mobile money usage exists: 72% in urban vs 47% in rural areas. Usage rates are also very high (80%) in districts within the Greater Accra and Greater Kumasi Metropolitan Areas. Examples of such districts include Asokwa, Kwadaso, Adentan, and Ayawaso West. Conversely, districts with the least mobile money usage rate (25%) include Gushegu Municipal, Karaga, and North East Gonja districts. Unlike internet use, there is not a clear north-south divide in mobile money usage, plausibly an indication of a less apparent income gradient in mobile money adoption in Ghana. |

|

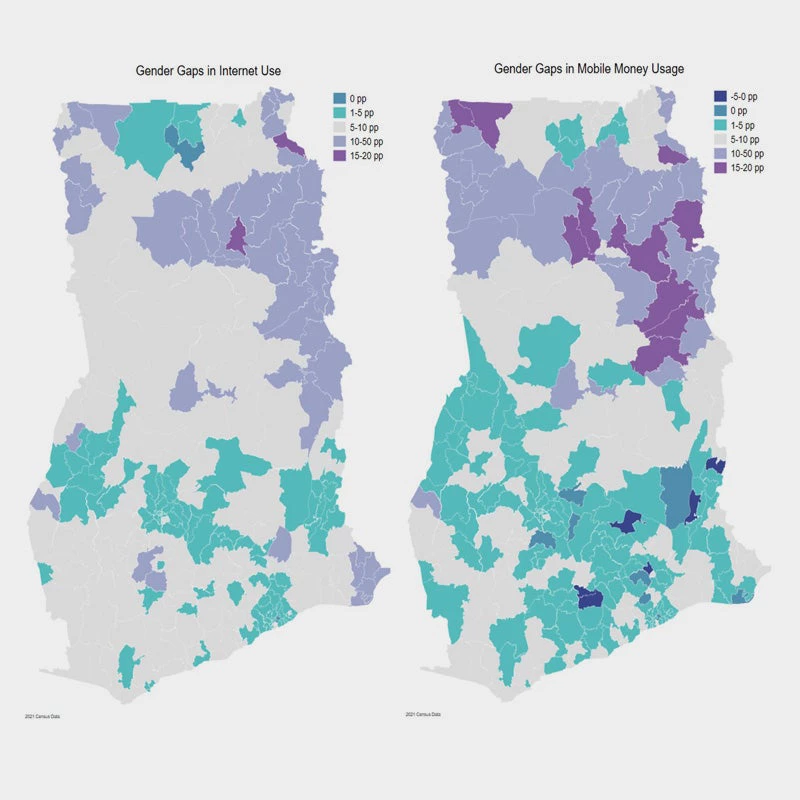

| Fact 7: Gender gaps remain While internet usage among men and women has increased significantly over the last decade, it remains higher among men than women. Men are 7 percentage points more likely to use internet (72% v. 65%) in 2021 compared to a 5 percentage points difference in 2010 (10% vs 5%). Although in absolute terms, the gap appears relatively stable, in relative terms, the growth in internet usage among women has been impressive, increasing by nearly 11-fold relative to a 7-fold increase for men. In relation to digital finance, men are 6 percentage points more likely to use mobile money (65% v. 59%) than women in 2021. The male-female usage gaps are wider at the subnational level: in some districts, the usage gap can be as high as 16 and 20 percentage point for internet and mobile money respectively. Interestingly, for six districts, the mobile money usage gap is in favor of women by between 1-3 percentage points. These districts include Achiase, Birim South, Guan, Kwahu South Municipal, North Dayi, and New Juaben North Municipal. |

|

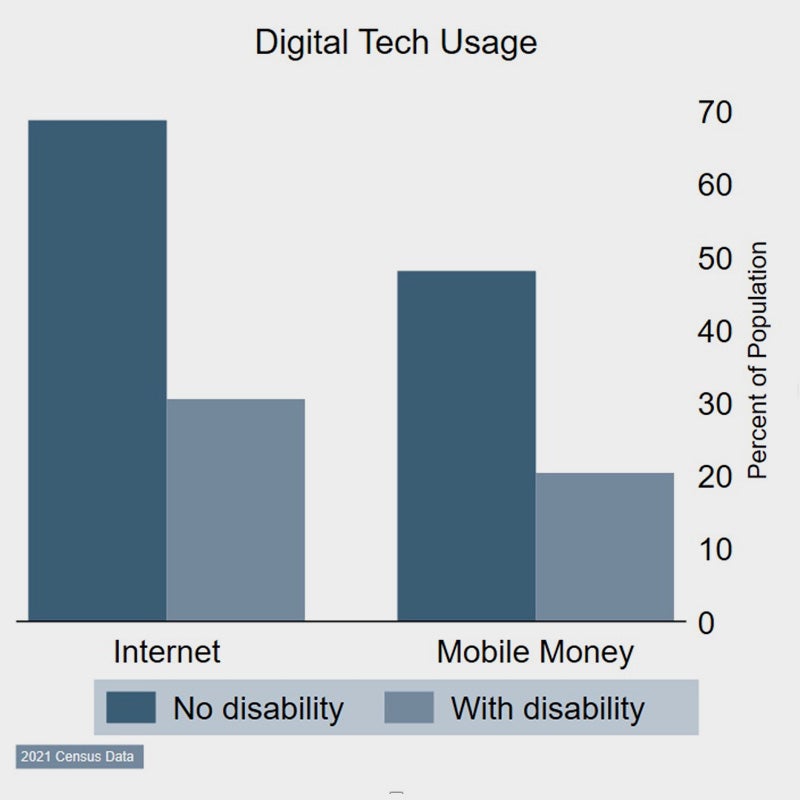

| Fact 8: Internet and mobile money usage gaps are much larger for persons with disabilities Usage of internet and mobile money are substantially lower for persons with (reported) disability (e.g., sight, speech, physical, self-care) (30% and 20%) compared with those who do not report any disabilities (69% and 48%) in 2021. Addressing this digital divide may require the provision of digital devices that are more accessible to persons with disabilities. |

|

| Fact 9: Income is an important correlate of digital technology adoption Like most technologies, adoption of internet and fintech is highly correlated with income, due to the relatively high upfront cost with device purchases (mobile phones, tablets, computers), as well as usage cost. The bivariate plot below shows a positive association between household wealth and usage rates of internet and mobile money. Access to these technologies tend to be high in wealthy subnational districts in the southern and middle belt, while districts in the northern part of Ghana, which also happen to be among the poorest, have low usage rates. |

|

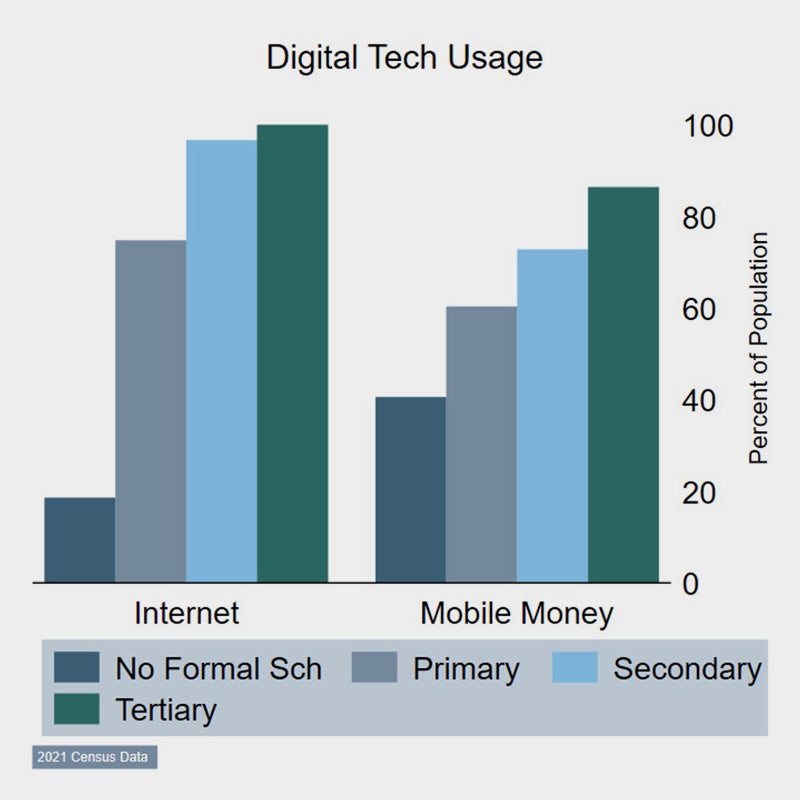

| Fact 10: Digital Technology adoption is also correlated with education Internet usage is near universal among people with tertiary and secondary education, but only 18% and 74% among those with no formal education, and primary schooling respectively. However, the education gradient is not very steep with regards to mobile money usage. The usage rates among people with tertiary and secondary school education are 86% and 73% respectively, compared to 40% and 60% respectively among those with no formal education, and primary schooling. Perhaps the availability of mobile money merchants, as intermediaries, account for the relatively high usage rates among people with low education levels. Unlike internet, one can access mobile money services without having to operate the service themselves. Overall, these ten facts show significant adoption of digital technologies in Ghana. Next, it will be important to understand the policies that encourage productive use of these technologies and their development impact. |

Join the Conversation