Row of houses and a "For Sale" sign is visible in front.

Row of houses and a "For Sale" sign is visible in front.

When markets are illiquid, investors have incentives to sell assets urgently, while potential buyers are constrained themselves. As a result, asset liquidations trade at dislocated—or “fire sale"—prices (Williamson, 1988; Shleifer and Vishny, 1992; Mayer, 1995). The housing market during the global financial crisis was such a market. Back then, each additional foreclosed house lowered the price at which other houses in the same neighborhood could be sold (Campbell et al., 2011; Anenberg and Kung, 2014). In this paper, we empirically investigate whether lenders incorporate the risk of a future dislocated foreclosure in their decisions to grant a loan or not. That is, do creditors underinvest in collateral assets that at interim could be liquidated at fire sale prices?

Using comprehensive micro-level data, in a recent working paper we document that an expected disorderly foreclosure reduces lenders’ incentives to provide mortgage credit to begin with. The anticipation of fire sale risk leads to socially inefficient credit constraints. Yet, it reduces market exposure to fire sales going forward.

Empirical Strategy

This paper adopts the U.S. mortgage market as a research laboratory. We borrow from prior theoretical work two fire sale risk channels. First, lenders with a large fraction of local market share face relatively low fire sale losses upon borrower default because they have incentives to mitigate foreclosure spillovers (Favara and Giannetti, 2017). As a result, they can efficiently provide more liquidity ex ante. By contrast, in dispersed markets, atomistic lenders rationally anticipate others to be quick to liquidate, giving rise to “rushes to the exit” (Ohemke, 2014). Second, fire sales are more likely (and costly) when locally active lenders get into financial distress at the same time. A likely driver of correlated financial distress is common exposures in asset portfolios. Hence, collateral fire sale risk is higher and credit supply is expected to be lower in local markets served by lenders with similar portfolios (Wagner, 2011).

We exploit exogenous variation in legal frictions that makes markets less prone to foreclosures in the first place. Arguably, the fire sale risk should be weaker in states where foreclosure laws make the collateral repossession process more costly and lengthy to complete. Using a comprehensive borrower application-level dataset, our empirical strategy involves studying lender decision to accept mortgage applications controlling for borrower, neighborhood, and lender characteristics. We pick the global financial crisis of 2007–2010 as sample period for our baseline analysis. Because foreclosures were salient and relatively likely (Gupta, 2016; Mian et al., 2015), we expect a high signal-to-noise ratio in this period. Moreover, private securitization was largely impaired, which facilitates identification too.

Results

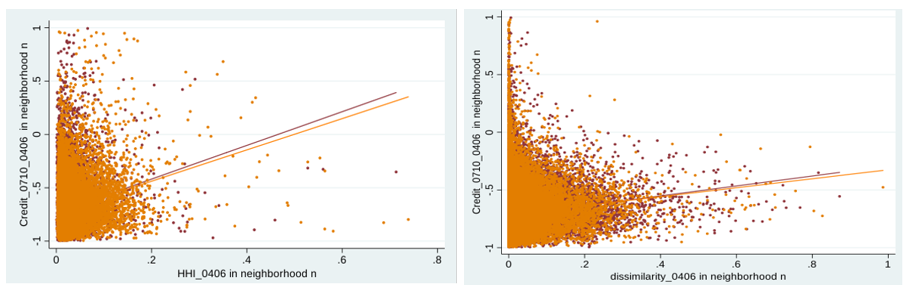

Our results suggest that lender propensity to approve mortgage applications increases in her incentives to renegotiate defaulting mortgages, when outstanding local debt is more concentrated and when lenders in the neighborhood hold more orthogonal portfolios. Importantly, we also find that all fire sale risk channels affect loan acceptance decisions to a less extent in states with higher foreclosure frictions. Figure 1 visually confirms the statistical results of the paper. The chart on the left shows that more concentrated neighborhoods (x-axis, HHI) exhibit a smaller credit decline (y-axis,

Figure 1: Relationship between average changes in neighborhood credit volumes between 2007–2010 and 2004–2006 (y-axis) and aggregate Fire Sale Risk (x-axis).

We test additional mechanisms and conduct several robustness tests. First, we fail to reject that lending decisions on applications for existing houses statistically differ from those on construction loan applications. Also, we exploit variation in borrower default risk and find that lenders' incentives to mitigate fire sales are amplified when riskier borrowers apply for a mortgage. Taken together, both exercises help us to address the possibility that our proxies do not capture the alternative explanation of propping-up local prices at the first sign of trouble (Giannetti and Saidi, 2018).

Then, we focus on mortgage applications in states with recourse clause to mitigate any confounding effects arising from borrower's strategic default (Demiroglu et al., 2014). In these circumstances, we find that loss severity effects do not differ from baseline results. Furthermore, we provide evidence that these anticipation effects are amplified for lenders with balance sheet pressures, such as binding equity constraints. This is consistent with the theory that investors with a shorter and more uncertain horizon do more likely consider the deleverage option through asset sales (Morris and Shin, 2004; Ramcharan, 2020). Finally, we investigate whether borrower counteract the terms of the mortgage contract: we find that borrowers are unlikely to reject any hypothetical unfavorable terms that lenders initially offer. As a related point, we examine how mortgage rates on accepted loan applications vary with the fire sale risk. To the extent that expected crowded liquidations decrease a foreclosure payoff, it is likely that lenders charge higher interest rates as compensation.

Policy implications

The anticipation of fire sale risk suggests that banks prevent illiquidity deadlocks by maximizing their expected loan payoff. Financial institutions rationally shift portfolio allocation over time from the most pronounced fire sale risk areas to the least ones. These endogenous dynamics make local mortgage markets more concentrated and more diverse, reducing fire sales going forward, and improving financial stability. These results have important policy implications. A regulatory intervention should if anything focus on strengthening lenders’ incentives to internalize fire sale risk (e.g., “skin-in-the-game” regulatory interventions), rather than on committing to solve ex post inefficiencies (e.g. creation of “bad banks”). In fact, beyond direct organizational costs, ex post measures may lead to unintended consequences, such as ex ante moral hazard (e.g., risk-shifting).

References

Anenberg, E. and Kung, E. (2014). Estimates of the size and source of price declines due to nearby foreclosures. American Economic Review, 104(8):2527–51.

Campbell, J. Y., Giglio, S., and Pathak, P. (2011). Forced sales and house prices. American Economic Review, 101(5):2108–31.

Demiroglu, C., Dudley, E., and James, C. M. (2014). State foreclosure laws and the incidence of mortgage default. The Journal of Law and Economics, 57(1):225–280.

Favara, G. and Giannetti, M. (2017). Forced asset sales and the concentration of outstanding debt: evidence from the mortgage market. The Journal of Finance, 72(3):1081–1118.

Giannetti, M. and Saidi, F. (2018). Shock propagation and banking structure. The Review of Financial Studies, 32(7):2499–2540.

Gupta, A. (2016). Foreclosure contagion and the neighborhood spillover effects of mortgage defaults. The Journal of Finance.

Mayer, C. J. (1995). A model of negotiated sales applied to real estate auctions. Journal of urban Economics, 38(1):1–22.

Morris, S. and Shin, H. S. (2004). Liquidity black holes. Review of Finance, 8(1):1–18.

Mian, A., Sufi, A., and Trebbi, F. (2015). Foreclosures, house prices, and the real economy. The Journal of Finance, 70(6):2587–2634.

Oehmke, M. (2014). Liquidating illiquid collateral. Journal of Economic Theory, 149:183– 210.

Ramcharan, R. (2020). Banks’ balance sheets and liquidation values: Evidence from real estate collateral. The Review of Financial Studies, 33(2):504–535.

Shleifer, A. and Vishny, R. W. (1992). Liquidation values and debt capacity: A market equilibrium approach. The Journal of Finance, 47(4):1343–1366.

Wagner, W. (2011). Systemic liquidation risk and the diversity–diversification trade-off. The Journal of Finance, 66(4):1141–1175.

Williamson, O. E. (1988). Corporate finance and corporate governance. The journal of finance, 43(3):567–591.

Join the Conversation