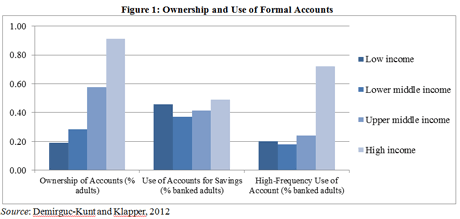

Who uses formal financial services? What policies are associated with greater use of accounts among the poor and rural residents? And why do certain segments of the population remain unbanked? Is it by choice or is it due to barriers such as high costs or large distances to the nearest bank branch? In a new paper we co-authored with Franklin Allen and Sole Martinez Peria, we explore these questions using an exciting new micro-dataset from the Global Financial Inclusion (Global Findex) database. This dataset, based on interviews with over 150,000 adults in 148 countries, lets us identify account ownership, the use of an account to save, and whether an account is used frequently, defined as three of more withdrawals per month. (For a detailed description of the data, see our earlier paper, Demirguc-Kunt and Klapper, 2012). Figure 1 shows summary statistics of our financial inclusion measures.

We find that the likelihood of owning an account is higher among richer, older, urban, educated, employed, married individuals, with greater trust in banks. For example, estimated marginal effects suggest that the likelihood of owning an account for a person in the lowest within-country income quintile is almost 16 percentage points lower than that of a person in the highest income quintile. We use selection models to estimate the likelihood of using an account to save and the likelihood of using an account frequently, conditional on having an account. Using an account to save is higher among richer, educated, married individuals, with greater trust in banks. In comparison, older, richer, educated, married men are more likely to use their account with higher frequency.

We find that policy makers may be able to boost the number of people using formal accounts with policies that help reduce the cost, documentation requirement and travel distance associated with accessing a bank account. But do country characteristics really matter? Yes. For example, Angola has approximately 1bank branch per 1,000 square kilometers, while Peru has slightly more than 9 branches per 1,000 square kilometers. Our results suggest that a one-standard deviation increase in branch penetration is associated with a 7 percentage point increase in the average predicted probability of having an account at a formal financial institution in Angola, and a 9 percentage point increase in Peru.

We also find that policies to promote the financial inclusion agenda are most effective among the groups that are most excluded: the poor and rural residents. For instance, we find a significant relationship between ownership and use of accounts and policies such as offering basic or low fee accounts, granting exceptions from onerous documentation requirements, allowing correspondent banking and using bank accounts to make government payments. For example, permitting correspondent banking is associated with a 2 percentage point increase in the average predicted probability of using an account to save among rural residents.

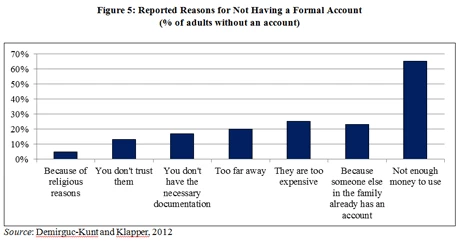

In a novel analysis, we also study the factors associated with perceived barriers to account use among those that are financially excluded (figure 2). For example, we find that the unbanked are less likely to report cost or distance as a barrier in countries with lower costs of operating an account. Interestingly, adults are less likely to report not having an account because of “lack of money” when they live in countries with government policies that promote inclusion. Although these unbanked are often thought of as “voluntarily excluded”, our results suggest that properly designed inclusion policies could potentially expand the pool of eligible account users.

To summarize, we find that a greater use of accounts is associated with a better enabling environment to access financial services such as lower banking costs, greater proximity to branches, and fewer documentation requirements to open an account. And furthermore, policies targeted to promote inclusion are especially effective among the poor and rural residents.

A growing body of research illustrates that financial inclusion brings significant welfare benefits for individuals and firms. With policymakers increasingly aware of such evidence, they have been increasingly promoting financial inclusion to achieve results. For instance, G20 leaders formally agreed to advance the financial inclusion agenda in Mexico early this year. With this research, we hope to drive more evidence-based policies to promote inclusion, allowing individuals to own accounts, save and borrow in a safe and effective manner.

The Global Findex data were collected by Gallup, Inc. using the Gallup World Poll Survey. The Research Group is building the database with a 10-year grant from the Bill and Melinda Gates Foundation.

References:

Asli Demirguc-Kunt and Leora Klapper, 2012, "Measuring Financial Inclusion: The Global Findex", World Bank Policy Research Working Paper 6025.

Allen, Franklin, Asli Demirguc-Kunt, Leora Klapper, and Maria Soledad Martinez Peria, 2012, "The Foundations of Financial Inclusion: Understanding Ownership and Use of Formal Accounts", World Bank Policy Research Working Paper 6290.

Join the Conversation