In a recent paper by myself and my colleague Megumi Kubota (forthcoming in the Journal of International Economics), we argue that the distinction between sudden stops caused by domestic versus foreign residents is crucial when we examine the effects of these types of episodes on economic performance and their policy implications. Identifying the relative importance of the shocks underlying these different types of sudden stops is essential. If sudden stops were, for instance, attributed to reduced inflows by foreigners, policymakers should minimize the country’s vulnerability to external shocks. The policy advice would be different, however, if net reversals in capital flows are explained by gross outflows of domestic residents looking for better risk-taking opportunities abroad.

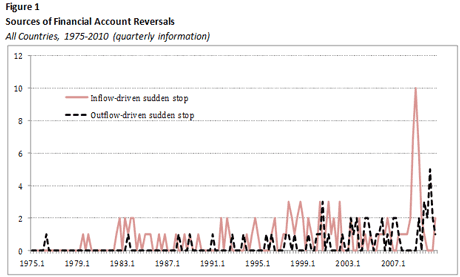

Our paper argues that the decisions of foreign investors versus domestic ones are governed by different sets of determinants. The varying distribution over time of inflow- and outflow-driven sudden stops (Figure 1) and their dissimilar impact on the macroeconomy (Figure 2) may also signal changes in their determinants. If that is the case, preventive policies against these types of stops may vary.

Notes: Sudden stops are defined as a decline in the financial account of one standard deviation below the mean and that exceeds 5 percent of GDP. We use the definition FA0 of the financial account which is the sum of net flows of foreign direct investment (FDI), foreign portfolio investment (FPI) and other investment (OI). We normalize the change in the financial account with (the lagged value of) GDP. The first and second moments in the financial account (that is, average and standard deviation) required to detect sudden stop in capital inflows are computed over the entire sample of countries. To identify gross inflow-driven from gross-outflow driven sudden stops, we use the criteria established by Cowan, De Gregorio, Micco and Neilson (2008). Their criteria relies on the contribution of inflows to the reversal in the financial account. If the fall in the financial account is mostly explained by a decline in inflows (ratio of changes in gross inflows to the change in the financial account greater than 0.75), we classify this event as an inflow-driven sudden stop. If mostly explained by an increase in outflows (ratio lower than 0.25), then we denote this episode as an outflow-driven sudden stop. Finally, note that 1975.1 denotes an observation for the first quarter of 1975.

Notes: We present the dynamic behavior of real output, real credit per capita, and the ratio of current account to GDP over a 17-quarter window centered in the start of the sudden stop, T (net, inflow- and/or outflow-driven). It represents the coefficients from quartile regressions (medians) for the sample of all countries.

Sudden stops in capital flows tend to trigger crisis episodes and have deleterious growth effects (Becker and Mauro, 2006; Cerra and Saxena, 2008). When the sudden stop is mainly explained by a sharp decline in gross inflows, it may render the domestic economy vulnerable to foreign investors’ decision-making process. On the other hand, when large increases in gross outflows drive the sudden stop, such an episode is more consistent with domestic investors switching to a larger position in foreign assets rather than the domestic economy being cut off from international capital markets.

In contrast to previous studies, our analysis has two notable characteristics:

- (a) It shifts the analysis from net to gross financial inflows. Incorporating measures of gross flows provides a more nuanced and richer interpretation of the dynamic analysis of capital flows. Data on gross capital flows enable us to distinguish episodes in which foreign investors cut the access of emerging markets to world capital markets from those episodes in which domestic residents move their assets out of the country.

- (b) It uses quarterly data on actual financial flows rather than annual flows. 1 The identification of net reversals driven by either domestic or foreign investors requires data on actual financial flows. In order to make this distinction, we use the highest frequency available to assess movements in gross capital flows –i.e. quarterly data. 2

Our main findings are the following:

- Reversals in net and gross capital flows as well as their joint occurrence are more likely to take place in developing countries than in industrial ones.

- Sudden stops are associated with and tend to precede currency crises and banking crises.

- Whether a sudden stop is inflow- or outflow-driven does matter for macroeconomic outcomes. A sharp reduction of foreign capital into the domestic economy (inflow-driven stop) puts an additional cost in lower GDP growth, a larger contraction in real credit and a significant reversal in the current account.

- Foreign investors are more likely to stop bringing in their funds or pulling out (i.e. inflow-driven sudden stops) from countries with poor economic performance. Domestic agents, however, are more interested in shifting their portfolio abroad when the domestic economy holds high external savings (current account surpluses) and when the pattern of the domestic economy is especially natural-resource abundant.

- The fragility of the financial system –as captured by excess credit creation and high leverage ratios– is likely to affect the decisions of foreign investors to pour new resources into developing countries.

- Rising financial openness makes the domestic country more vulnerable to sudden stops caused by either local or global investors.

- The decision of foreign investors to allocate their funds into a domestic economy is significantly influenced by “push” factors. The domestic economy is more vulnerable to inflow-driven sudden stops in the event of adverse external shocks such as lower growth in external demand, rising world real interest rates, and heightened global risk aversion.

- In the case of domestic investors, rising risk aversion in world capital markets tends to reduce the likelihood of outflow-driven stops –which may signal a larger propensity towards capital repatriation by domestic investors.

________________________________

1 We have collected quarterly data on gross capital flows for 99 countries from 1975q1 to 2010q4. We have identified 210 episodes of sudden stops over the period 1975-2010 –of which 144 episodes correspond to developing countries and the remaining 66 to industrial countries.

2 We found gross flow information from national sources at a monthly or shorter frequency for only a limited set of countries.

References

Becker, T., Mauro, P., 2006. Output drops and the shocks that matter. IMF Working Paper 06/172.

Calderon, C., and M. Kubota, 2012. “Sudden stops: Are global and local investors alike?” Journal of International Economics, forthcoming

Cerra, V., Saxena, S.C., 2008. Growth dynamics: the myth of economic recovery, American Economic Review, American Economic Association, 98(1), 439-457.

Join the Conversation