Arabica coffee berries with agriculturist hands

Arabica coffee berries with agriculturist hands

This blog is the fifth in a series of nine blogs on commodity market developments, elaborating on themes discussed in the latest edition of the World Bank’s Commodity Markets Outlook.

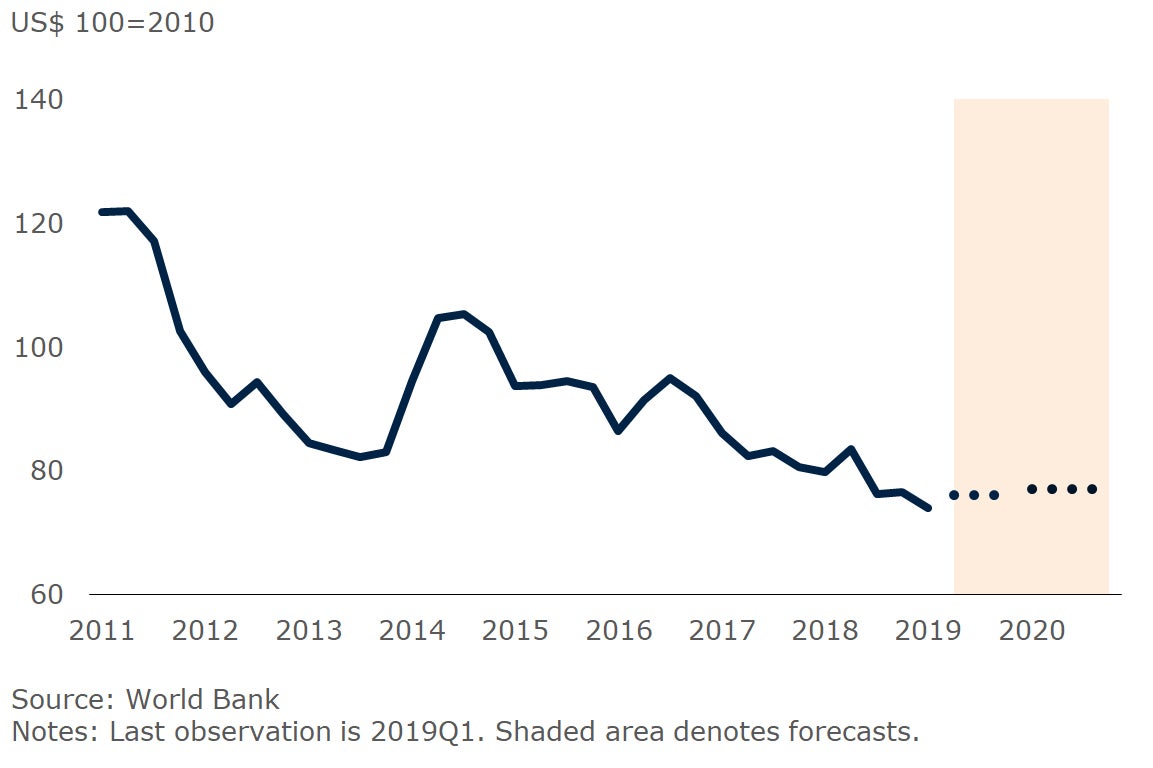

Beverage prices declined more than 3 percent in the first quarter of 2019, down 7 percent from a year ago, with coffee (Arabica and Robusta) and tea all experiencing significant price drops. The World Bank’s Beverage Price Index is projected to decline almost 3 percent in 2019 before a modest recovery in 2020, according to the latest Commodity Markets Outlook.

Beverage prices to remain soft

Beverage price index

Coffee

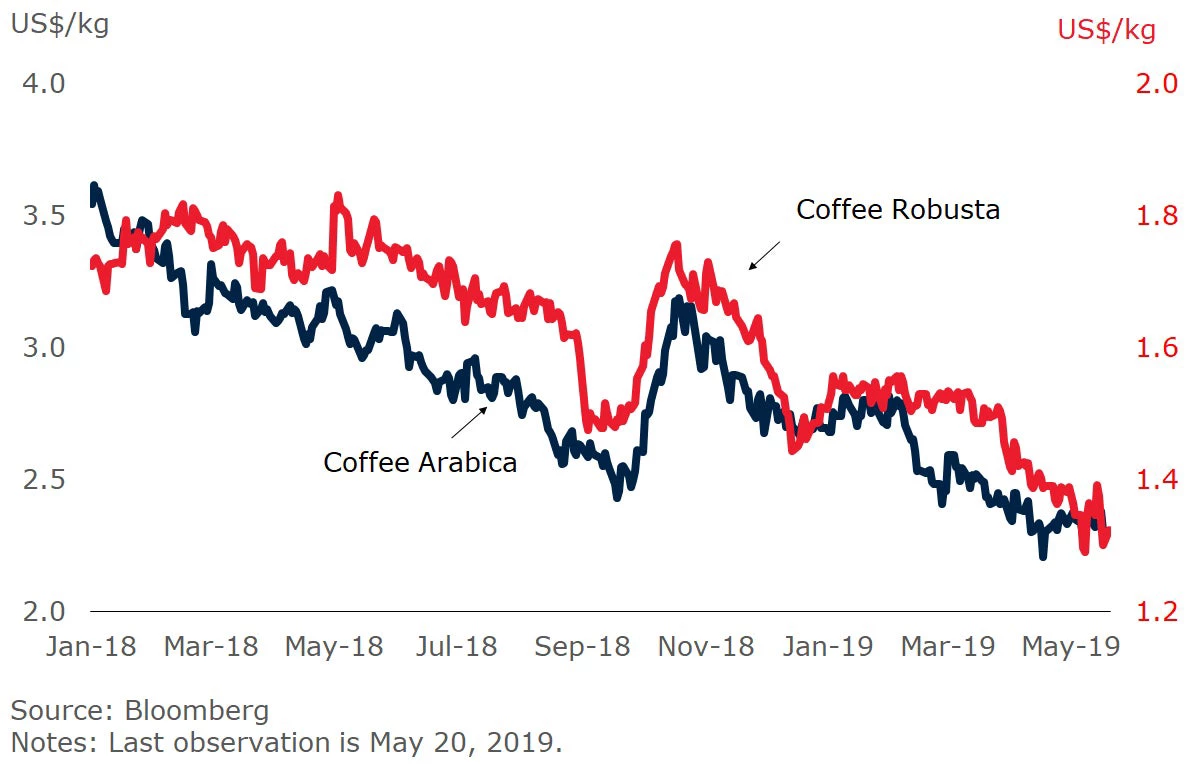

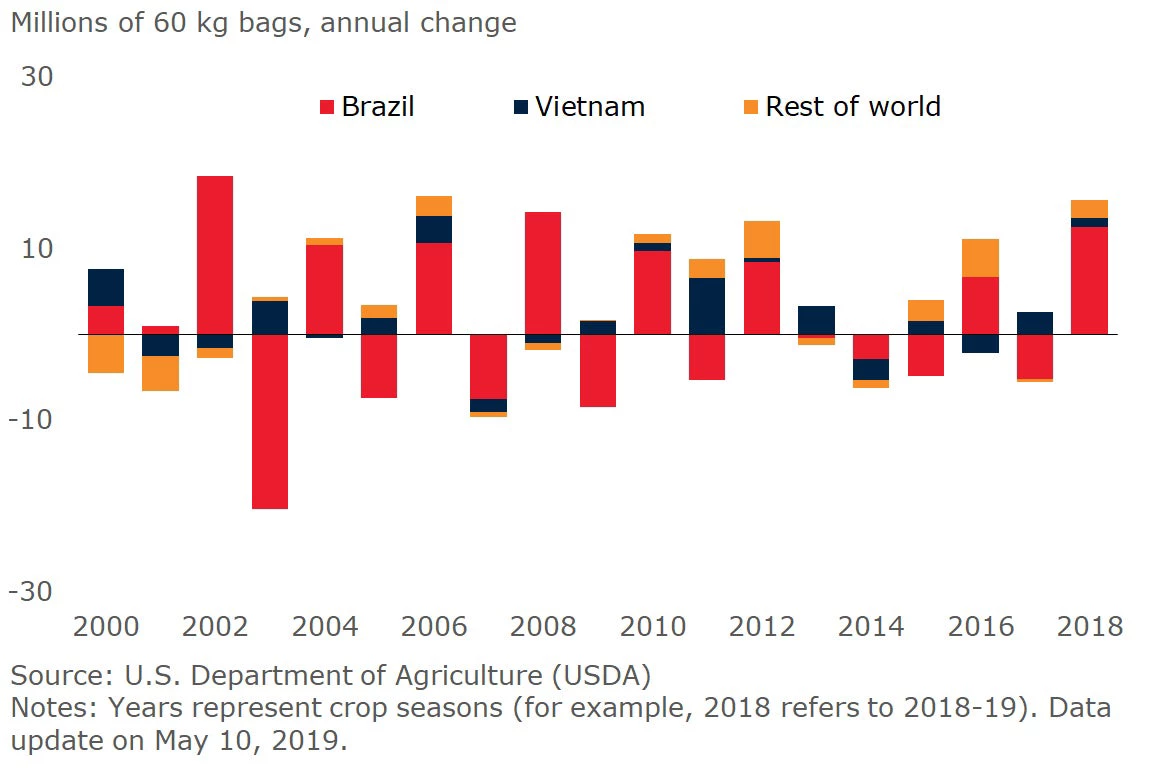

Both Arabica and Robusta prices declined sharply in the first quarter (down 5 percent each), with the former reaching an 11-year low. The price drop reflects record global production, which reached 172 million bags, up from last year’s 158 million bags, and led to an increase in inventories of 10 million bags. The supply glut reflects large crops in Brazil and Vietnam—the world’s largest Arabica and Robusta suppliers, respectively—and weak consumption. Estimates for the ongoing crop year also point to record supplies, especially in the Robusta market. Arabica and Robusta coffee prices are expected to average $2.85/kg and $1.75/kg in 2019 (representing 3 and 6 percent declines from 2018), followed by a marginal increase in 2020.

Coffee prices

Coffee production

Cocoa

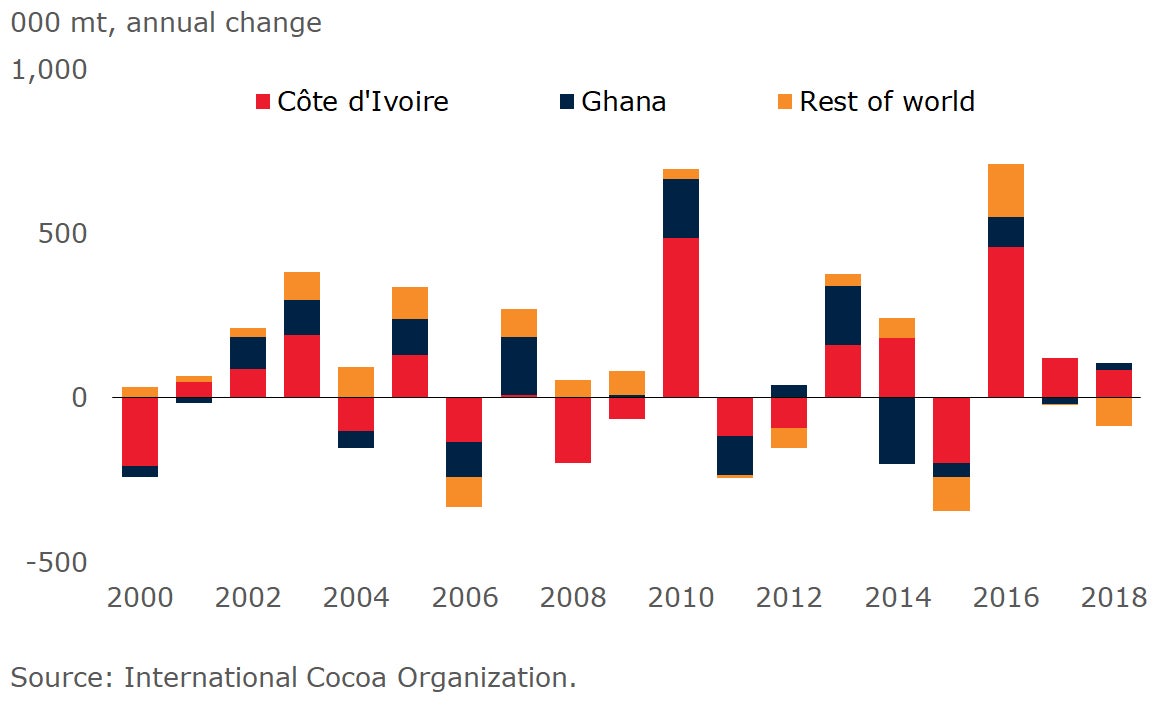

Cocoa prices, which rose 3 percent in the first quarter, have been relatively stable during the past three quarters. The global cocoa crop experienced no change in 2018/19 as gains by Côte d’Ivoire and Ghana—which account for two-thirds of global supplies—were balanced by declines elsewhere, including Brazil, Cameroon, Indonesia, and Nigeria. Cocoa prices are expected to remain at current levels in 2019, before gaining 2 percent in 2020.

Cocoa prices

Cocoa production

Tea

Tea prices, especially those set in Kolkata and Mombasa, plunged 23 and 7 percent, respectively, in the first quarter of 2019, and stand 7 and 25 percent lower than a year ago. The Kolkata auction price dropped to an 11-year low. Large tea crops due to favorable weather conditions in East Africa (especially Kenya) and India have caused the price collapse. In response, the Indian Tea Board ordered a suspension of tea production in December. Tea prices (3-auction average) are expected to decline 14 percent in 2019, before making marginal gains in 2010.

Tea prices

Join the Conversation