Nicholoya Estate Community Power House. K. Sinnasi. Sri Lanka. Photo: Simone D. McCourtie / World Bank

Nicholoya Estate Community Power House. K. Sinnasi. Sri Lanka. Photo: Simone D. McCourtie / World Bank

The Russian invasion of Ukraine has disrupted global energy markets, generating the biggest surge in crude-oil prices since the 1970s. The consequences for global growth will be significant: higher energy prices alone are likely to reduce global output by nearly 1 percent by the end of 2023, our recent analysis suggests.

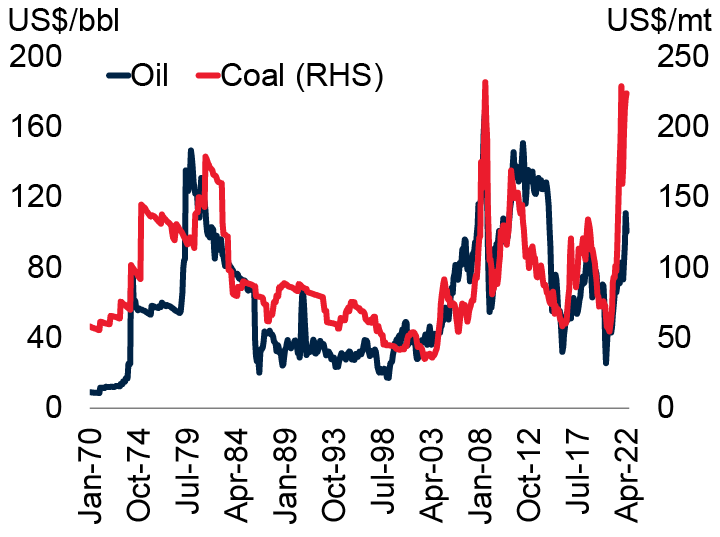

Energy prices have spiked to levels not seen in decades

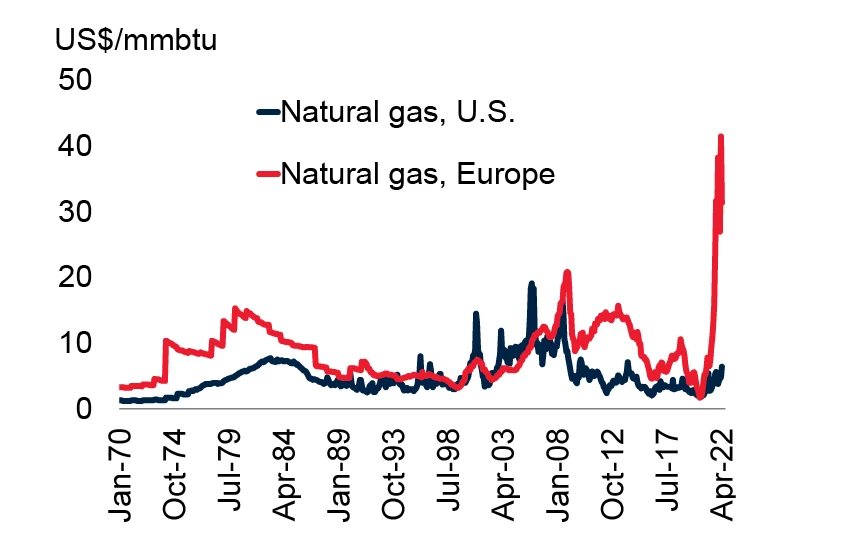

The World Bank’s energy price index increased by 26.3 percent between January and April 2022, on top of a 50 percent increase between January 2020 and December 2021. This surge reflects sharp increases in coal, oil, and natural gas prices. In nominal terms, crude oil prices have increased by 350 percent from April 2020 to April 2022—the largest increase for any equivalent two-year period since the 1970s . Meanwhile, coal and gas prices have all reached historic highs in nominal terms. In real terms, however, only European natural gas prices have reached all-time highs and remain substantially above their previous peak in 2008. Coal prices are close to their 2008 peak, while oil prices remain some way below.

Figure 1. Real coal and oil prices

Source: World Bank.

Note: Monthly data from 1970 to April 2022. Prices deflated by the U.S. Consumer Price Index.

Figure 2. Real natural gas prices

Source: World Bank.

Note: Monthly data from 1970 to April 2022. Prices deflated by the U.S. Consumer Price Index.

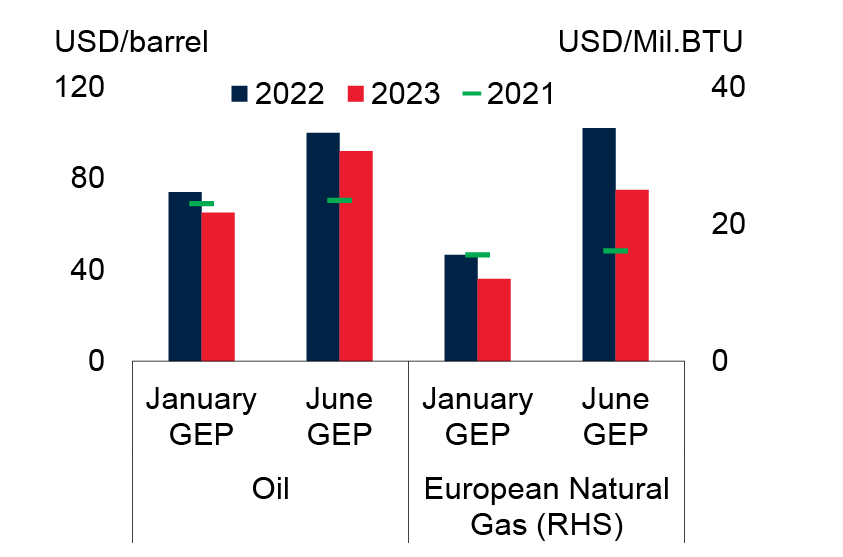

The price shock won’t subside anytime soon

Energy prices are now expected to increase by 50 percent on average in 2022. Coal prices, natural gas prices and crude oil prices are projected to increase in 2022 by 81 percent, 74 percent (average of the European, Japan, and U.S. benchmarks), and 42 percent, respectively. Moreover, energy prices are expected to remain higher for longer. Relative to January 2022 projections, the prices of energy commodities are now expected to be 46 percent higher on average in 2023.

Figure 3. Energy price projections: June 2022 vs January 2022

Sources: Oxford Economics; JP Morgan; World Bank.

Note: GEP refers to the Global Economic Prospects report. Oil price is the simple average of Brent, Dubai, and West Texas Intermediate prices.

A threat to growth and inflation

Energy price shocks affect economic activity and inflation through a variety of channels—with direct as well as indirect effects on energy-importing and -exporting economies . The indirect effects can occur through trade and other commodity markets, through monetary and fiscal policy responses, and through investment uncertainty. Through these channels, energy prices can also have immediate repercussions—even absent discretionary policy responses—on fiscal and external balances.

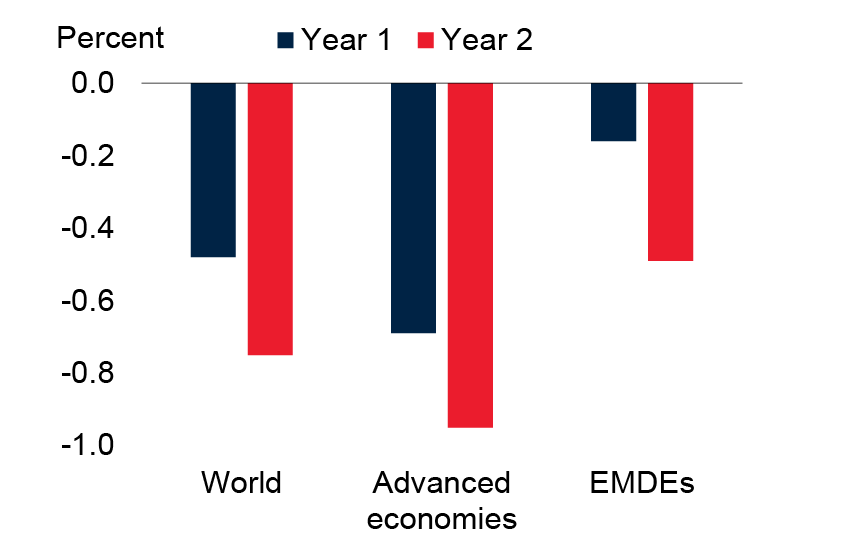

By the end of 2023, global output could be 0.8 percent lower

The combined increase in oil, natural gas and coal prices could reduce global growth by 0.5 percentage points in 2022 and a further 0.3 percentage point in 2023, lowering global output by a cumulative 0.8 percent by 2023. Advanced economies would experience a cumulative reduction in output of 0.9 percent by 2023 compared to a 0.6 percent output reduction in oil-importing Emerging Markets and Developing Economies.

Figure 4: Impact on activity of higher baseline energy price

Sources: Oxford Economics; World Bank.

Note: EMDEs = emerging market and developing economies. Chart combines the impacts on global output of the supply-driven increases in Brent oil prices, natural gas prices, and coal prices. Coal price shock is a supply driven increase in coal prices averaging 87 percent above baseline for two years.

Policy can tackle the supply-demand imbalance

Policy makers need to prioritize policies that encourage greater energy efficiency and accelerate the transition towards low-carbon energy sources . The resulting improvement in the supply-demand balance for energy can help reduce the risk of stagflation and overcome headwinds to growth. In the near-term, to cushion the adverse effects of households, temporary targeted support to vulnerable groups can be prioritized over energy subsidies that could delay the transition to a zero-carbon economy.

Join the Conversation