The gig economy matches businesses to consumers through digital platforms. It serves local communities such as Tutorama, an Egyptian online platform connecting students with local private tutors. In Jordan, refugee women who have limited mobility are able to make a living by selling home-cooked dishes through Bilforon, a food-delivery platform. In 2018, more than five thousand women domestic workers earned income through SweepSouth, a home cleaning service platform in South Africa.

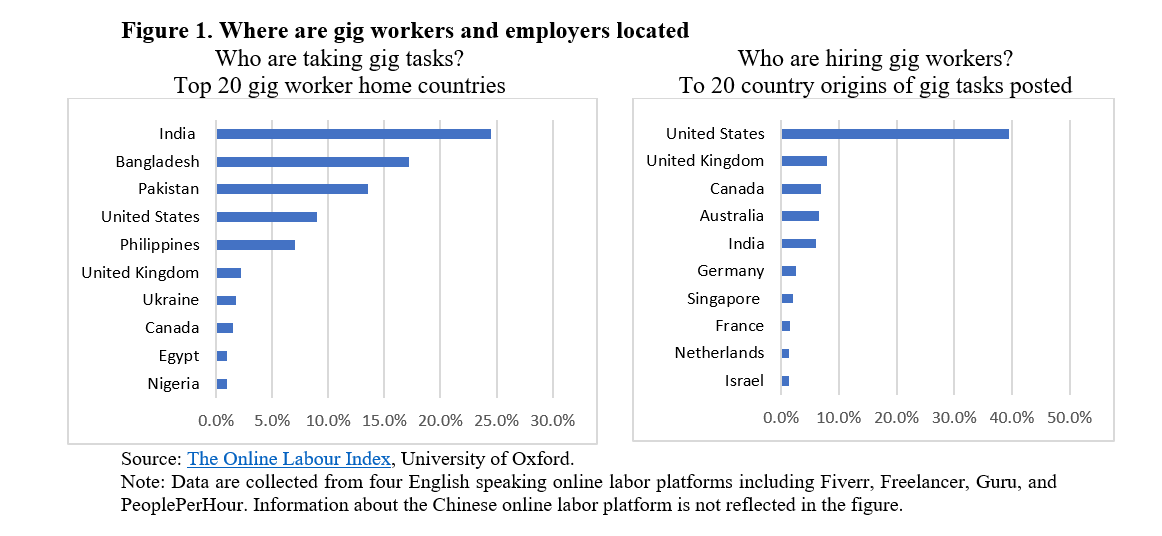

But despite the hype, the gig economy is slow at taking over traditional occupations. The largest three global gig platforms—Freelancer of Australia, Upwork in the United States and Zhubajia in China - have 60 million users in total. According to the World Development Report 2019, 0.3-0.5 percent of the active labor force participate in the gig economy globally. The majority of workers regard gig tasks as a supplementary income source. Data show that only 10 percent of the registered users on the global freelancing platforms are active. Most of these workers are concentrated in a few countries such as India, Bangladesh, Pakistan, United States, Philippines, and the United Kingdom. (figure 1).

The rise in gig work highlights regulatory issues. Income gained through gig work tends to bypass taxation, resulting in another form of informality. For instance, more than half of the workers on freelancing platform oDesk (now acquired by UpWork) agree that gig work offers more tax advantages. As a result, the tax authority in Shenzhen, China is piloting a blockchain project with WeChat Pay, a mobile payment platform many gig workers rely on to receive payments. Transaction information will be shared with the tax authority in real time for tax records.

Gig work also requires a rethink of social protection, as pointed out in the World Development Report 2019. The European Commission recommended in early 2018 that gig workers should have minimum levels of social security protection such as unemployment benefits and maternity leave. One recent proposal in the United States calls for the establishment of a third employment category for gig workers. The proposal suggests granting gig workers some benefits associated with a more traditional employment relationship such as insurance and rights of organization. But given the flexible working arrangements embedded in gig work, benefits that are based on the period of working time, such as overtime or minimum wage requirement are difficult to enforce.

China has resorted to market solutions to address the need for social protection. Ant Financial, the largest fintech company in China, launched in April 2018 a welfare program for small shops and self-employed workers, many of whom are gig workers. These workers are able to receive free health insurance (with a maximum coverage of RMB 20,000, US$3,000) as long as they use AliPay, the payment product of Ant Financial, for transactions. According to Luohan Academy, a new research platform initiated by Alibaba Group, within eight months of the launch, the program has provided coverage for 58 million self-employed workers, making close to three million payouts.

Join the Conversation