Financial background of stock and coins | ©shutterstock.com

Financial background of stock and coins | ©shutterstock.com

International spillovers in corporate taxation have become a prominent policy concern in recent years. This reflects the growing recognition that a country’s tax policies can impact both activity and tax revenues in other countries, creating potentially damaging tax competition. These concerns brought about the G20/OECD-led project on Base Erosion and Profit Shifting (BEPS), culminating in the agreement on a fundamental reform of the international tax architecture among nearly 140 countries in October 2021. A key and unprecedented aspect of this agreement is the global minimum effective rate of corporate tax of 15 percent, due to take effect in 2024.

One would have expected these policy debates to be informed by a careful analysis of the effects of international tax reform on cross-border investment. After all, attracting inward investment—including through tax system design—is a major concern in many countries, which see this as a route to both employment and growth-enhancing knowledge spillovers. There is a large body of literature on the topic of foreign direct investment (FDI) and taxation, with meta-studies from 2003 and 2011. Much of this work, however, uses FDI data which records financial flows contaminated by artificial routing though tax-favored conduit countries. This may convey a misleading impression of real investment flows between ultimate parent countries and those hosting the productive investment.

Real cross-border investment data. A recent paper uses a newly assembled dataset on foreign affiliate investment (FAI) which does not suffer from the limitations of FDI data. Guided by an analytical framework that highlights the effects of multinationals’ real investment decisions by implicitly shifting their profits between jurisdictions, our work revisits the questions of to what extent, and precisely through which channels, international corporate tax arrangements affect aggregate cross-border tangible investment. We find strong effects from cross-country differences in statutory tax rates—stronger than much of the FDI-based literature. We then use these results to gauge the potential implications for tangible investment of the most profound reform to the international tax system for a century or more: the adoption of a global minimum corporate tax.

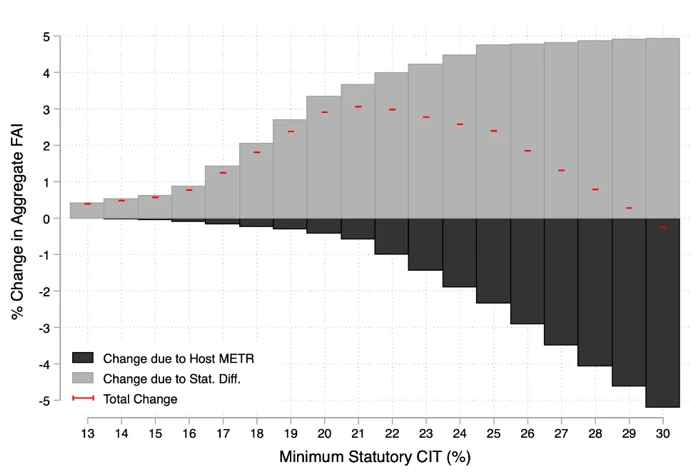

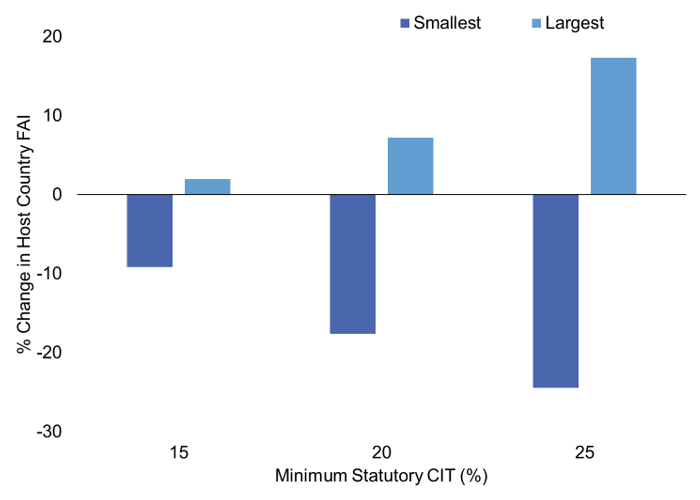

Policy implications. Applying our results to the analysis of the global minimum tax, the strength of the spillover effects through statutory tax rates that we find means that FAI into the (relatively high rate) host countries in our sample would be expected to increase with the imposition of a minimum rate at the proposed level of 15 percent. While the overall effect is fairly modest—an increase in aggregate cross-border tangible investment of around 0.6 percent at the minimum rate of 15 percent—for some countries it is quite marked with decreases of 5-10 percent for a few. If the minimum were to be assessed at a higher level, as many have argued appropriate, the effects become even more marked (figures 1 and 2). This argument is in sharp contrast to a view that sees an increase in marginal effective rates as a consequence of the minimum that will tend to depress real investment.

Figure 1. Aggregate FAI and Minimum Tax Rates

Notes: This figure plots the percentage change in aggregate FAI into the 32 host countries at minimum tax rates ranging from 13 to 30 percent. These results correspond to corporate tax rates and FAI for the year 2016. The light grey bars show the impact of the minimum rate through the statutory rate differential, the dark grey bars show the impact through the host METR, and the red lines show the total impact.

Figure 2. Range of Investment Impact and Minimum Taxation

Notes: This figure plots the percentage change in inward FAI for the countries with the smallest and largest changes among the 32 host countries in our sample, along the corresponding minimum rates of 15, 20 and 25 percent, respectively. The simulation uses FAI for the year 2016.

Many open issues remain. Nonetheless, this analysis helps us to better understand how fundamentally changing the international tax system can affect aggregate tangible cross-border investment. As developing countries tend to be more adversely affected from profit shifting, implications for developing countries raise unique concerns, and would require additional data on tangible foreign affiliate investment to apply the framework developed here.

Join the Conversation