Photo by: B.Zhou/Shutterstock

Photo by: B.Zhou/Shutterstock

The spread of the coronavirus (COVID-19) pandemic is unleashing widespread economic damage. Some sectors like accommodation and food services (AFS) have been affected more adversely than others. Popular tourist destinations usually humming with activity are now disconcertingly silent.

Not only did these sectors lead the fallout in terms of timing, their return to normalcy is likely to lag behind the recovery elsewhere. It is quite possible that consumers and businesses will continue practicing safety measures of some form even when containment measures are relaxed. Multiple surveys in the United States report that more than 2 in 3 people will not engage in travel- and entertainment-related activities even if authorities permit them. Recognizing this, governments and institutions are paying special attention to help businesses in these sectors navigate the crisis.

Yet, the fallout from a decline in the final demand for goods and services produced by a sector can spill over to related sectors. For instance, consider the operations of restaurants and bars. In the US, the industry’s expenditure on intermediates constituted roughly half of their gross output in 2018. Renting, leasing and management of real estate account for around 20 percent of intermediate payments. An almost identical amount is spent on manufactured food and beverage products. Hence, a slump in the final demand for services provided by restaurants and bars will translate into a decline in intermediate demand, affecting associated sectors.

An accounting framework that uses the input-output data of national accounts is a useful first attempt at gauging the quantitative significance of such negative spillovers. Conducting this analysis for Italy shows that negative spillovers often extend to most sectors of the economy. For instance, a domestic demand shock that affects the transportation and storage (TST) sector will flow over to almost all other sectors. Figure 1 shows the cross-sectoral variation of spillovers. The dark (light) bars represent the percentage change in the value-added of a sector relative to that in TST due to a domestic (external) demand shock in the latter.

Figure 1: Relative change in value-added due to change in final demand for Transportation and storage (TST)

Though expansive in scope, the spillovers are usually mild. For most sectors, the percentage contraction in value-added is less than a twentieth of that in TST. Still, for some sectors, the effect can be substantial. In an extreme case, the relative change in value-added of mining of energy-producing products (MEP) surpasses that in TST. Percentage change in three other sectors also exceeds a quarter of the percentage change in the value-added by TST. An investigation of AFS and the arts and entertainment (AER) industry also yields similar conclusions.

At a time when final demand in many sectors is weakened, demand in others will find support or may even surge. First, demand for hospitals and health services will rise substantially. Similarly, expenditures on medicines and pharmaceuticals will see a jump as well. Second, fiscal responses to the crisis will translate into an expansion of the government's final consumption and investment outlays.

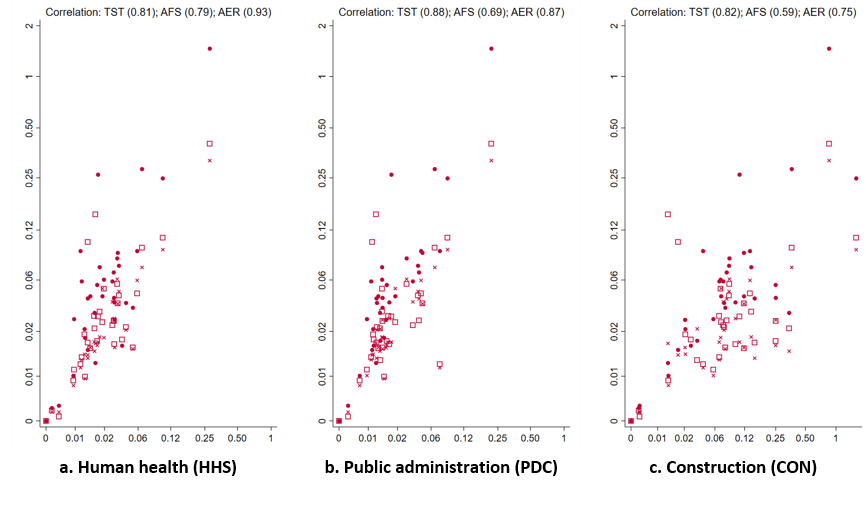

Can the positive spillovers created by these sectors partially offset the negative spillovers? The negative spillover flowing to a sector will get at least partially arrested unless it does not feature in the intermediate bundle of the sector generating positive spillovers. Nonetheless, a better outcome will entail a positive correlation between the two spillovers so that the sectors most adversely affected reap the largest benefits. Figure 2 plots the relative change in value-added of TST (circles), AFS (squares), and AER (crosses) against the relative change generated by three select sectors (human health (HHS: panel a), public administration (PDC: panel b), and construction (CON: panel c)) – sectors that may experience a surge in their final demand.

Figure 2: Relative change in value-added due to negative and positive changes in final demand of select sectors

A welcome finding is that the two spillovers are positively correlated and statistically significant for each possible pair. Thus, if a natural response to the crisis results in an increased final demand for HHS, PDC or CON, then an endogenous mechanism will increasingly direct positive spillovers towards the sectors that are most affected by the negative spillovers. The degree of success depends on the pair of sectors generating negative and positive spillovers. The spillovers generated by HHS, PDC, and CON, are least effective in administering larger benefits to sectors most exposed to negative spillovers transmitted by AFS. On the other hand, spillovers from TST often bear the highest correlation with those from the horizontal sectors. Among the sectors likely to encounter a positive demand bump, CON always performs worse relative to HHS and PDC. There is no clear winner when it comes to choosing between HHS and PDC.

To summarize, the analysis presents two insights for policy.First, the economic impact will spread beyond the sectors which witness a drastic slump in their final demand. Most of the spillovers, though, are likely to be contained in a handful of sectors. It will be critical to identify these second-in-line sectors and bring them into consideration when designing a support policy. Second, positive spillovers from sectors that see an increase in final demand as a response to the crisis are likely to provide some respite. The effectiveness of such an endogenous response will depend on the sectors involved on either side. As such, the endogenous channel will provide a relatively inadequate buffer for some sectors which will need special attention.

The uncertainty associated with the crisis makes it challenging to determine which sectors will see the most precipitous decline in demand. It is even more difficult to predict the magnitude. The principal objective here is to introduce a framework to analyze how demand shocks realized in one sector will flow to others based on past data. An underlying assumption is that sectoral linkages will remain immune to the general disruption. If the inter-sectoral flow of intermediates faces a rise in distortions, then the effectiveness of the endogenous mechanism that mitigates the negative spillovers through positive spillovers will be severely limited. Similarly, the support provided to any sector will flow to associated sectors only if it translates to a restoration of business operations. Interventions that help fight financial risks will assist sectors in surviving pressures like bankruptcy. But unless they resume production, the benefits of positive spillovers will not materialize.

The findings, interpretations, and conclusions expressed are entirely those of the author. They do not necessarily represent the views of the International Bank for Reconstruction and Development/World Bank and its affiliated organizations, or those of the Executive Directors of the World Bank or the governments they represent. An accompanying online note contains a more detailed discussion.

Join the Conversation