The recent reversal of capital flows to emerging markets has pointed to the continuing relevance of the sudden stop problem when capital inflows dry up abruptly.

In a recent paper as well as a Vox column, we analyze these episodes in emerging markets over the past quarter century. We contrast their incidence, impact, correlates, and policy response before and after 2002, and establish similarities as well as differences.

The frequency, duration and impact of sudden stops have remained largely unchanged over time. These episodes last on average for four quarters. Capital outflows during sudden stops average about 1.5 percent of GDP per quarter (cumulatively 6 percent of GDP for the duration of the sudden stop) compared to inflows of about 1.7 percent of GDP a quarter over the preceding year. This implies a swing in capital flows of some 3 percent of GDP in a quarter, which is a large amount.

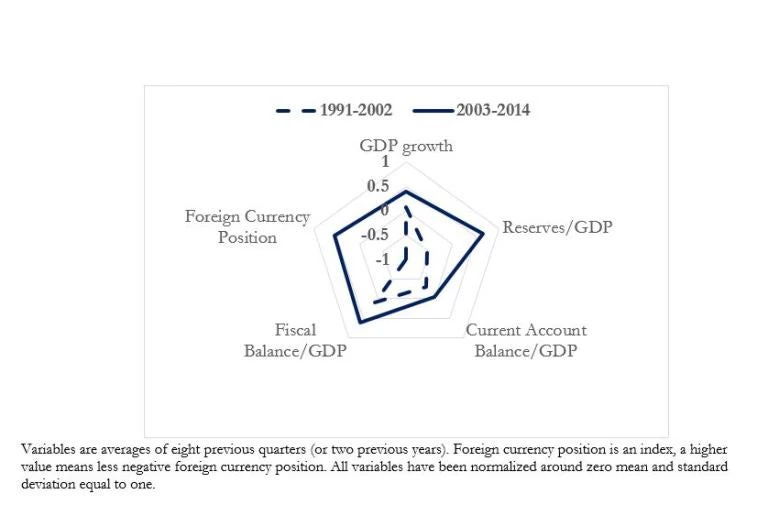

Sudden stops have both financial and real effects. The financial effects show up first: the exchange rate depreciates, reserves decline, and equity prices fall; GDP growth then decelerates, investment slows, and the current account strengthens. The GDP growth decelerates by roughly 4 percent year on year in the first four quarters. Because the fall in investment is proportionally larger than the fall in GDP and, by implication, than the fall in saving, the current account strengthens. While the impact on financial variables peaks in the first two quarters, the impact on real variables like the current account, GDP growth and investment peaks later, Figure 1.

Figure 1: Financial and real impacts of the sudden stops

There are three main differences evident over time. First, the relative importance of domestic and global factors in their incidence is now different. Global factors appear to have become more important relative to country-specific characteristics in explaining the incidence of sudden stops. They now tend to affect different parts of the world simultaneously rather than bunching regionally, indicating the growing importance of global factors.

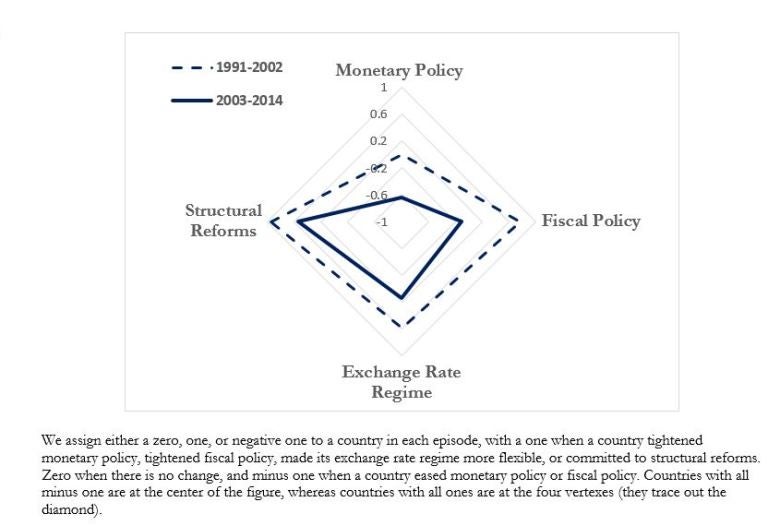

Second, domestic vulnerabilities have played a less consistent role in recent years, when sudden stops have occurred even in the presence of relatively strong economic growth, large reserve cover, low foreign currency exposure and flexible exchange rates, Figure 2.

Figure 2: Sudden Stops in recent years have occurred amidst strong domestic conditions

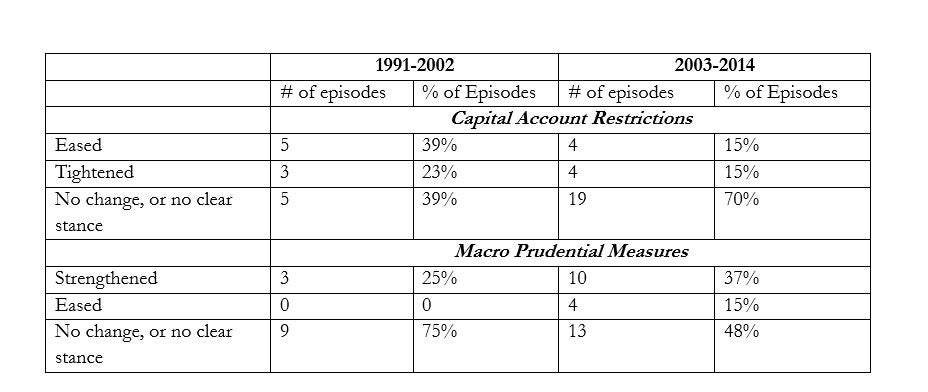

A third difference is in the way sudden stops have been handled. The conventional wisdom is that countries tighten monetary and fiscal policies to counter the drop in the exchange rate and in an effort to restore confidence. In extreme cases, they tighten controls on capital outflows and appeal to the International Monetary Fund for emergency assistance. However, this conventional response is evident in only a minority of cases. In only 8 of the 43 cases considered did countries in fact tighten both monetary and fiscal policies in response to sudden stops. Monetary policy was eased in response to sudden stops more often than it was tightened. Instead governments respond to sudden stops with a variety of other measures targeted at buttressing the stability of their domestic financial system, signaling to investors their commitment to sound and stable policies.

Countries responded in the 1990s by stepping down the exchange rate, sometimes floating the currency, and then supporting that new exchange rate or float with a tighter monetary policy. In the worst-hit cases there was also resort to an IMF program, extension of which typically entailed trade reforms, fiscal tightening, and privatization of public enterprises. In the second sub-period, there was even less of a tendency to tighten both monetary and fiscal policies. Indeed some countries were actually able to reduce policy interest rates as a way of supporting economic activity and financial markets.

Figure 3. Policy Tradeoffs in Sudden Stop Episodes

These choices are consistent with the changing nature of the sudden stops and of the position of countries experiencing them: In the 1990s sudden stops were heavily associated with weak macroeconomic fundamentals, whereas episodes in the subsequent decade were associated more with external factors and occurred despite stronger domestic economic and financial fundamentals. In the second subperiod countries experiencing sudden stops had smaller budget deficits and public debts (as shares of GDP) and significantly lower rates of inflation. Their international reserves as a share of GDP were more than twice as high as in the first subperiod. These stronger fundamentals made IMF support less imperative and gave them some additional leeway to adjust in ways that provided more support to domestic economic activity and the financial system, in some cases loosening monetary policy and limiting the extent of fiscal consolidation.

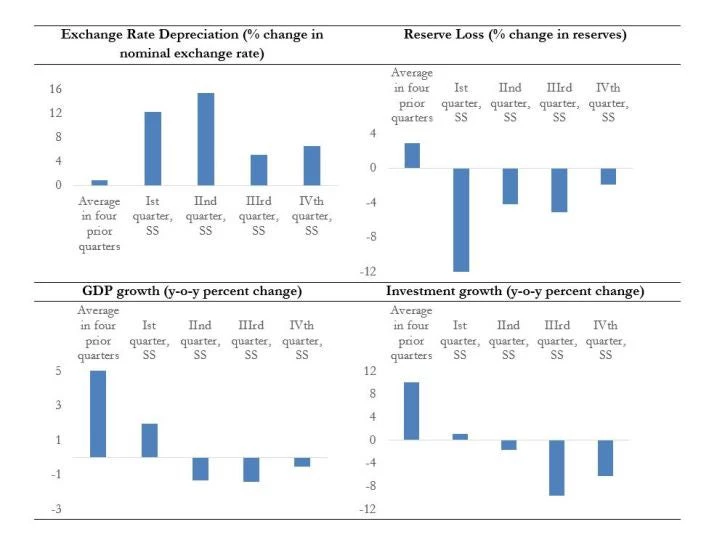

Interestingly, contrary to popular assertion there has not been much of a tendency to change capital account restrictions (to loosen, tighten or reimpose capital controls) in response to sudden stops, Table 1. There is however an increasing recourse to other macroprudential measures.

Table 1: Capital account and macro prudential measures during sudden stops

While stronger macroeconomic and financial frameworks have allowed policy makers to respond more flexibly, these stronger positions and more flexible responses have not guaranteed insulation from sudden stops or mitigated their impact. Any benefit from stronger country fundamentals has been offset by larger external shocks emanating from the rest of the world. It is troubling that neither national officials, with the increased policy space, nor international financial institutions, with their proliferation of new financing facilities, have succeeded in cushioning emerging markets from these effects. Our findings suggest that the challenge of understanding and coping with capital-flow volatility is far from fully met.

Join the Conversation