The variation in investment among developing countries is truly remarkable. Over the course of the 30-year period between 1980--2010---a period of relative calm in the global economy that is often referred to as the "Great Moderation"[*]---the investment rate in developing countries ranged from a whopping 90 percent (Armenia in 1990) to a dismal 1 percent (Liberia in 2003). This variability is more than twice that of variance in economic growth---a topic that has preoccupied many more generations of researchers---and much of this variability stems from the developing world.

What might account for the broad range of investment rates among countries? One hint lies in the recognition that there is another aspect of developing countries that demonstrates a tremendous amount of variation: their political-economic structures and institutions. One hardly needs to be reminded that, for example, the adherence to the rule of law and impartiality of political institutions has historically been far stronger in developing countries such as Chile and Malaysia, as opposed to others such as Venezuela and Serbia, even though they are all upper-middle economies. Such institutional differences in developing countries far outstrip equivalent institutional variation in the economies of the developed world, where much of the cross-country work on investment activity has been concentrated.

This begs the question, of course, of what sorts of institutions we need to consider. After all, it is perfectly reasonable to argue that the business environment---say, as captured by the strength of legal rights investors possess---is just as important as the promotion of democratic governance, which ensures that icentives to invest are not eroded by the legislative whims of autocratic governments. And the debate often heard in policy circles today on how to revive moribund investment in the United States vaccilates between those claiming the paramount importance of tax reform, versus those who argue that providing financing for small businesses.

Undoubtedly, many of these claims have roots in the academic literature. Many papers have made the case for the importance of financial development in stimulating investment activity, along with financial structure, institutional quality or structure, and the business climate. But for the bewildered policymaker, how does one choose between this veritable panoply of institutional and structural factors that may be reformed?

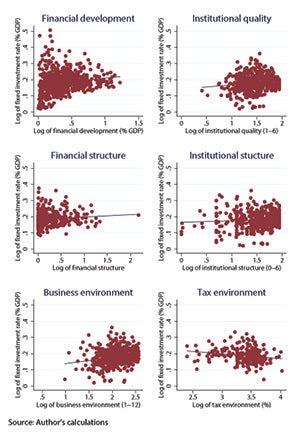

This question was taken up in a recently-released policy working paper. The issue of "choosing" between different cross-country investment patterns is not clearcut: a cursory examination of the bivariate relationships shows no clear "winner" (see figure below). These distinct determinants are thus subject to a more systematic examination by running an econometric "horse race" between the different classes of factors that have been proposed in the literature, and seeing which ones survive in a specification that takes them as many of them into account as possible. The paper takes, as its point of departure, a fairly standard Hall-Jorgenson-style approach to investment (the so-called flexible accelerator model), and supplements the investment equation with a host of additional structural and institutional variables (such as those described above). After accounting for the possibility of endogneity in the regressors,[†] financial development and institutional quality both emerge as reasonably robust determinants of cross-country investment, with the latter a somewhat stronger result (when the possibility of contamination from reverse causality is taken very seriously).

Source: World Bank staff calculations.

Notes: Scatterplots of the fixed investment rate (as a percentage of GDP) to different families of structural variables, unbalanced 5-year average panel, 1980--2009.

What do we take away from this exercise? First, the results are a neat complement to the existing academic literature (and Bank advice!) that both financial development as well as institutional governance are important policy objectives for countries seeking to raise investment activity in their economies. While somewhat obvious on hindsight, it is important to stress that a favorable investment climate is characterized not so much by pro-business policy measures, but by the broader institutional environment in which firms operate, which includes secure property rights and stable rule of law, and an adequate control of corruption. Similarly, investment financing is probably best supported not so much by narrowly-conceived schemes for investment credits and incentives, but with a well-functioning and mature financial system.

*. Following the financial crisis of 2007/08, some authors have claimed that the Great Moderation was largely illusory; however, research for both United States and in G7 countries (PDF) suggest that the crisis may have been a passing storm.

†. We attempt to provide some (weak) control for endogeity using a system GMM specification. Of course, it is impossible to thoroughly exclude the possibility of endogeneity, even in the presence of plausible instruments, with macroeconomic data. The system GMM specification uses internal instruments in the baseline, but in robustness checks, the two key determinants are supplemented with plausibly exogenous external instruments (legal origin for financial development, and both settler mortality and language share for institutional quality).

Join the Conversation