Foundry Worker

Foundry Worker

This blog is the eighth in a series of nine blogs on commodity market developments, elaborating on themes discussed in the latest edition of the World Bank’s Commodity Markets Outlook.

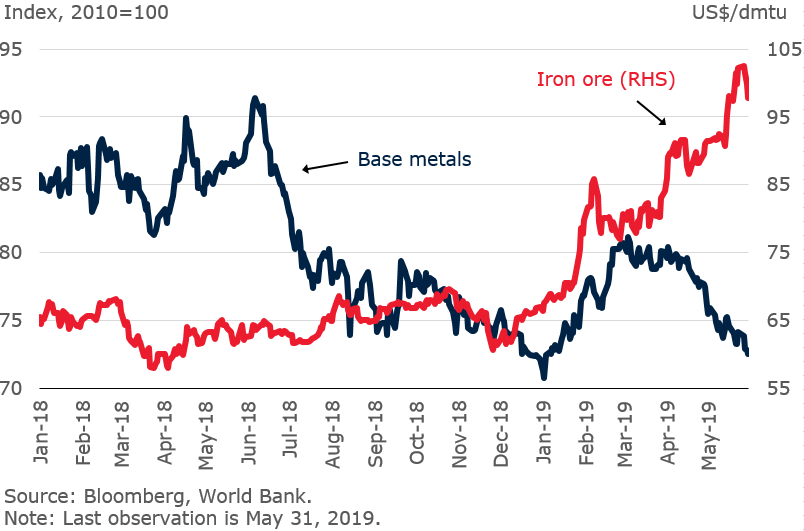

Base metal prices retreated in May 2019 following an escalation in trade tensions, erasing the gains of the first four months of the year. In contrast, iron ore prices continued to surge due to U.S. sanctions on Iranian exports and the closure of Vale’s Brucutu mine in Brazil for the second time.

Most base metal prices are projected to decline in 2019, and iron ore prices to rise, according to the latest Commodity Markets Outlook. Risks to the outlook include China’s policy stimulus, trade tensions, Indonesia’s export policies, China’s scrap imports restrictions and environmental policies, and supply disruptions.

Base metal and iron ore prices

Risks to the outlook

Risk # 1: China’s policy stimulus

Although the recently announced policy stimulus in China is expected to boost metals demand (and hence, prices), it may be less effective than previous stimulus packages because the composition has changed. On the fiscal side, the current stimulus is smaller and focuses primarily on tax cuts, unlike past packages, which increased government spending. Tax cuts are, in general, less effective than direct spending in stimulating aggregate demand. On the monetary side, policy easing is to be implemented via required reserve ratio cuts with no changes to the benchmark lending rate. Monetary stimulus in previous years included the use of both instruments.

China’s policy stimulus packages

Risk # 2: Trade tensions

Further escalation of trade tensions is a downside risk for global growth prospects and the demand for metals. Base metal prices receded following U.S. tariff hikes on $200 billion of Chinese goods in May 2019. China has retaliated by imposing tariffs on $60 billion of U.S. goods. Macroeconomic indicators in China have deteriorated amid heightened uncertainty.

China’s manufacturing PMI and business conditions index

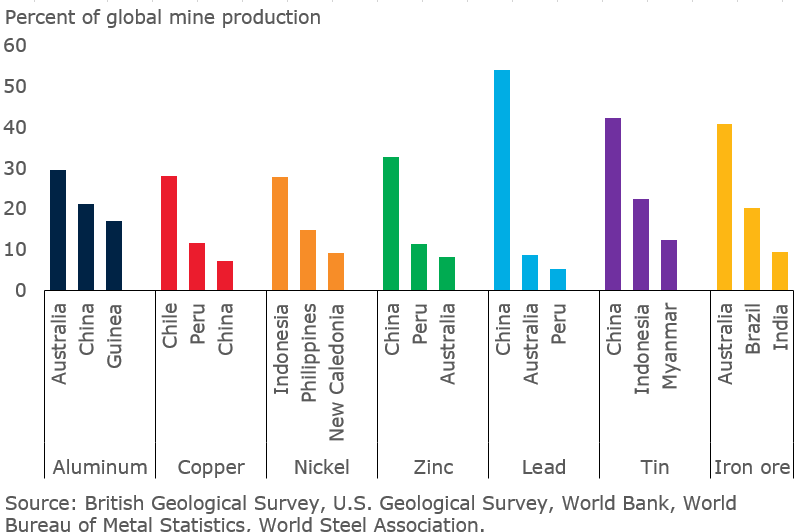

Risk # 3: Indonesia’s export policies

The mining sector in Indonesia—one of the world’s largest producers of nickel and tin—is subject to regulatory ambiguity. There is uncertainty whether an export ban on unprocessed mineral ores, imposed in 2014 but relaxed in 2017, will be renewed. Indonesia tightened rules regarding the granting of export permits for tin producers in 2018. In October 2018, Indonesia’s commodities exchange suspended trading of tin ingots and ores following some sales without permits, leading to shipment disruptions.

Risk # 4: China’s restrictions on scrap imports

China has been clamping down on scrap imports to stop being a dumping ground for waste material. From July 2019, importers of high-grade aluminum, copper, and steel scrap will have to apply for import licenses and quotas. There is considerable uncertainty around the impact of the new rules on global scrap trade and supply chains, and on metal prices. China, which accounts for one-half of global metals demand, is also the world’s largest importer of scrap metals. In particular, copper scrap imports account for about 10 percent of China’s copper consumption.

Risk # 5: China’s environmental policies

Stricter environmental policies in China are an upside price risk. Aluminum production could be curtailed by environmental restrictions following a red mud spill in the key production base of Shanxi Province. Despite growing zinc ore supply, environmental constraints could limit ramp-up of smelter capacity and hence refined metal production. Tougher enforcement on illegal lead-acid battery recycling to address pollution could affect supply (recycled lead materials make up more than two-fifths of refined lead supply).

Risk # 6: Supply disruptions

Larger-than-expected supply disruptions are an upside price risk, especially with near-record low metal inventories at present. Production disruptions in Chile’s top copper producer Codelco and liquidation of Zambia’s largest copper mine further add to supply concerns amid a thin global pipeline of copper mining projects.

There are also uncertainties in the iron ore market, following supply disruptions from Vale’s tailings dam disaster in Brazil, tropical cyclone Veronica that delayed shipments from Australia, and U.S. sanctions on Iran.

Inventories at metal exchanges

Top producers – mining and metals

Join the Conversation