The Philippines is at a fork in the road. Despite good results on the growth front, trends observed in trade competitiveness, Global Value Chain (GVC) integration and product space evolution, send worrisome signals. The country has solid fundamentals and remarkable human assets to leapfrog into the 4th Industrial Revolution – where the distinction between goods and services have become obsolete. Yet it does not get the most out of this growth, especially with regards to long-term development prospects. In order to do so, the government will have to make the right policy choices.

The Philippines seemingly performs well. From 2011 to 2015, the Philippines grew on average at 5.9% a year and in 2016 growth reached nearly 7%. At the same time, the manufacturing sector resurged with an average 6.9% growth from 2013 to 2015—surpassing services that posted an average 6.4% growth. However, the recent World Bank Philippines Economic Update illustrated trends in recent export performance and GVC integration which could be read as early warning signs:

- Increasingly remote in GVCs, the Philippines has become a supplier of intermediate goods to China, exposed to demand fluctuations, and has not penetrated new markets;

- The Philippines has not diversified its exports basket, if only to move away from sophisticated products, with little domestic transformation;

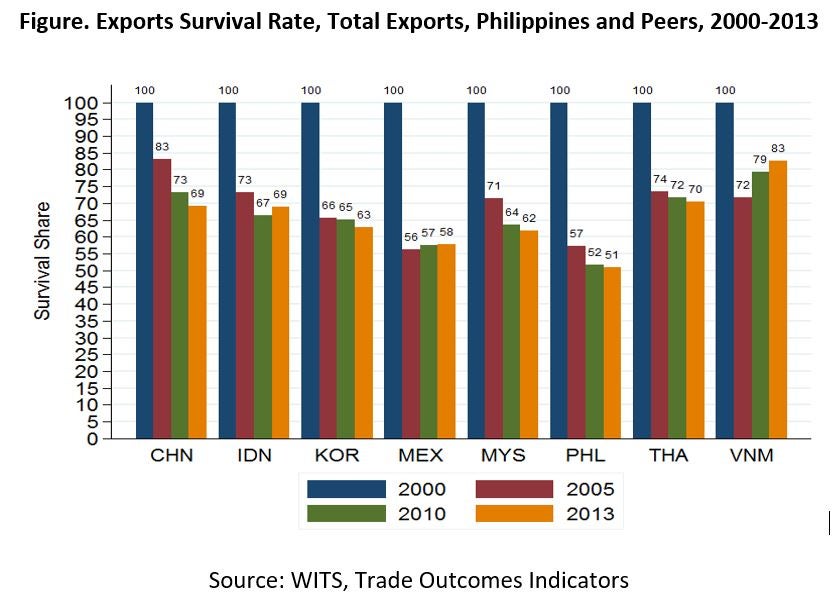

- This move will make future upgrading and innovation more difficult, as illustrated by the low export survival rates (Figure), including for sophisticated products.

To avoid short-term growth that translates into long-term downgrading prospects, quick action would be required. The government has already initiated a number of programs (e.g., for the resurgence of industry or the support of small and medium enterprises) as part of the Presidential Socioeconomic Agenda, and launched vast consultations to design trade roadmaps in 40 different sectors. These are excellent first steps, but additional efforts will be needed, and the experience of other countries that have found themselves in the same corner could help in identifying the right solutions.

But there are preconceived ideas about trade and GVC integration that could lead to strategic mistakes. For example, governments often focus on increasing domestic value added—which is a good and legitimate objective—but attempt to do so by using inappropriate methods, e.g., by introducing import substitution or imposing more- restrictive-than-necessary rules on trade on local content. The impact could be harmful to investment attractiveness and industry competitiveness. It is about positioning the domestic industry or services providers in the right segments of the value chain: Vietnam, for instance, reduced the share of domestic value-added in its exports from 45 to 30% between 1995 and 2011, but increased the volume of its exports from $0.2 to $3.8 billion (World Bank, 2016). Other ideas include the necessity to add more incentives, when their effect is not obvious and economic development policies are more productive when focused on improving the country’s fundamentals.

A number of good solutions have been tested elsewhere that could help the Philippines move back to a more sustainable and inclusive growth path. For example, “servicification”, with the development of higher services content in goods, has become a major path to competitiveness and diversification in the 4 th Industrial Revolution.

The Philippines is a services economy and a lead exporter of services; paradoxically, however, efficient linkages between services and other sectors of the industry (manufacturing and agriculture) are lacking. Clearly, the Philippines cannot compete on prices only to attract foreign investment—ending the “race to the bottom” to attract lead firms would require, for example, putting in place an environment able to reduce sustainability risks along GVCs, following the examples of countries like Vietnam or Colombia.

Flexibility, quality of labor, and innovation are key to the Philippines’ future success. While the Philippines innovates a lot, it does so in areas where there’s little impact on trade performance. In areas where chances of being competitive and surviving are lower for innovation strategies, a look at successful Philippine companies would show that they have identified the right niches (technology or skill-based) and could go around the competition of low-cost emerging countries. Support for SMEs will also be a determinant in the success of this innovation strategy. The GVC and economic complexity analyses provide some guidance on the way to go. Beyond seeing its evolution in the service and product space as a linear process, considering a third dimension—increased innovation and services content—will allow the Philippines to make a double leap in value added and technology.

Boosting the Services Sector

Join the Conversation