This is the fifth in this year’s series of posts by PhD students on the job market

Imagine that you run a small firm in a rural town in Tanzania. You might be retailer who sells food grains, vegetables, or other basic household commodities. Or, you might provide services - like tailoring, welding, milling, or fixing bikes and motorcycles. You are situated toward the end of a supply chain that sources business inputs from urban areas and delivers them the ‘last-mile' to rural consumers. Like any business situated at the end of a long supply chain, rural firms in developing countries face input and output market search and information frictions. They face search frictions when they source inputs from suppliers. At the same time, they face search frictions to locate and communicate with customers. These frictions can raise barriers to acquiring new information about prices, quality, availability of goods, and changes in demand, ultimately lowering productivity.

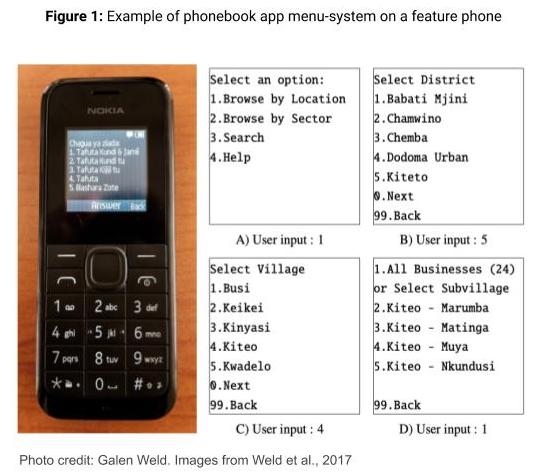

One solution that emerged to help buyers and sellers coordinate transactions was the phonebook - or ‘yellow pages' - that lists contact information for all types of firms located within a specific geographic area. My job market paper uses a randomized experiment of 500 firms to study the effect of introducing a mobile phone based digital phonebook to rural firms in central Tanzania. This phonebook ‘app' is accessible on any type of phone through a text-based menu (see picture below) - making it an ideal technology for rural firm owners in the ‘last-mile' supply chain. The research design generates variation in the probability that a firm will meet either new suppliers or new customers. But, when it is easier to make new contacts, it can change incentives to interact with pre-existing contacts, including relational contracting. My primary question is whether lowering search costs changes how firms source and sell goods and engage in relational contracting with their suppliers and customers.

Intervention: A Phonebook App

The phonebook – called eKichabi (electronic business book in Swahili) – is a researcher-developed mobile app that lists the location, sector, and phone number for all types of firms located along urban-to-rural supply chains in Central Tanzania. We invited 615 firms in 25 rural towns to list their business in the app, and 507 agreed to participate (an 82% participation rate). The phonebook treatment affects firms in three ways. First, firms listed in the phonebook are visible to other users. Second, firms themselves can search within the platform. Third, firms respond to the knowledge that they are listed and update their expectations for engaging with business contacts. Participating rural firms were split into a control group of 168 firms and treatment groups with two variations:

1) Upstream treatment: 169 firms included in a phonebook listing that is visible to firms in urban areas and the ability to search for urban firms. 348 urban firms agreed to be listed and to be potential users.

2) Downstream treatment: 169 firms included in a phonebook listing that is visible to customers in rural areas. 540 customers in local communities were given this listing.

Both treatment arms also had the option to search for other rural firms in their same treatment arm and view their own listing. The control group was not listed in the phonebook and could not search within the relevant area.

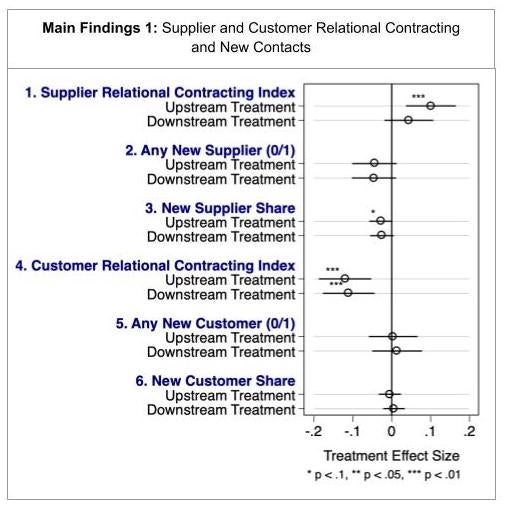

Main Findings 1: Relational contracting changes with suppliers and customers - but in opposite directions

I define relational contracting to include benefits that firms provide to their customers and receive from suppliers that are not readily provided through anonymous transactions in a spot market. Firms engage in relational contracting with their suppliers by receiving credit on input purchases, arranging shipping of inputs, and receiving price discounts. For their customers, firms provide credit on goods or services purchased, arrange sourcing of goods, and give price discounts to frequent customers. A priori, whether lower search costs would lead to more or less relational contracting is ambiguous because it depends on how firms assess their bargaining power relative to suppliers and customers. On the supplier side, the value of existing relationships remains high because firms have already formed relationships and have a history of transactions. Since it becomes less costly to locate new suppliers, firms can leverage the credible threat of divesting from relationships to gain new benefits from their existing suppliers. But, firms might also exercise the option to start new supplier relationships, decreasing the net provision of relational contracts from suppliers. On the downstream side, if firms anticipate having more contact with customers, they might reduce their relational contracting benefits if firms assess the cost of maintaining relational contracts with customers as too high and are willing to reduce it once it is easier to connect with new customers. Or, if firms have to compete for new or existing customers, they might increase their provision of relational contracts in order to keep them as customers. By examining the net effect on relational contracting in the short-run, empirical results resolve this ambiguity and suggest that it moves in opposite directions.

Using an index of relational contracting activity, I find that being listed in the phonebook causes firms in the upstream treatment group to increase relational contracting with their suppliers by 0.10 standard deviations compared to the control group. Yet, upstream treatment firms have fewer new suppliers compared to the control group and both treatment groups marginally decrease contact with new suppliers as a share of all suppliers, although it is not precise. With respect to customer relational contracting, treatment effects go in the opposite direction - both treatment arms decrease provision of relational contracting benefits by about 0.11 standard deviations compared to the control group. However, there is no strong evidence that the quantity of new customers increases compared to the control group, according to two measures of transacting with new customers. Importantly, firms in both treatment arms could check their own listing and did not know otherwise know their treatment status. The fact that both treatment arms decreased customer relational contracting suggests that firms anticipated reaching new customers. It is consistent with the idea that being listed in the phonebook caused firms to update their valuation of relational contracts and respond by negotiating better terms with known suppliers and customers.

Main Findings 2: Service firms change their input search behavior

To unpack input sourcing behavior, it is worth considering which types of firms are more likely to transact in urban areas and which are more likely to search locally. Differences in firm type can be simplified into retail and service firms. Retail firms are characterized by purchasing inputs and selling them at a mark-up to local customers. Service firms, on the other hand, purchase inputs and then engage in value-added production to provide a service to their customers.

An important aspect of search costs for rural firms are transaction costs that are paid each time they source inputs - including transportation costs and travel time. Retail firms maintain larger inventories and have lower per-unit transportation costs than service firms. The cost of maintaining supplier relationships in cities is less costly for retail firms than for service firms because transport costs can be spread over larger order sizes. After pooling both treatment arms, results show that treatment causes service firms to engage in substantially less search activities, pay higher input prices, pay lower transport costs, and purchase inputs locally. It is consistent with the idea that firms' per-unit transaction costs drive much of their input search behavior and helps determine whether it is more worthwhile to pay higher input prices by searching locally to save time and transport costs.

How valuable is this for firms?

The survey data revealed that firms’ customer base did not increase. However, the usage data generated by the app showed that 58% of downstream firms were found by a customer at least once throughout the intervention, although I do not observe if the user called or visited the business. It is possible that firms communicated with new customers, but it was not frequent or substantial enough to show up in survey data. Further, 45% of upstream firms and 69% of downstream firms searched or were found by other rural firms (excluding instances where firms searched for their own listing). And the upstream arm’s engagement with urban firms was lower – only 38% of upstream firms searched or were found by urban firms. Overall, it shows that there was more pent-up demand to search in the app for information from other rural firms. Survey data confirmed that there was no significant impact on revenue. But heterogenous impacts revealed that profits for service firms may have improved through cost savings (transport costs and travel time) and the upstream arm benefited by increasing access to credit.

Policy Implications

This research uses an information and communication technology intervention to understand how supply chains constrain small firm operations. A digital phonebook that is accessible on any type of phone can serve as a bridge technology between feature phones and smartphones that allows users in rural areas to access new contacts and market information. Firms responded to being listed in the phonebook by significantly changing their search activities and their engagement with their pre-existing suppliers and customers. It shows that small changes to the search cost structure have the power to re-shape the way that firms transact along their supply chain.

Jess Rudder is a PhD job market candidate in Agricultural and Resource Economics at University of California Davis.

Join the Conversation