This is the third in a series of six posts about the recent report, Bangladesh: Towards Accelerated, Inclusive and Sustainable Growth. The last post, The Paradox That Bangladesh Isn’t, explained the sources of GDP growth over the past two decades. Next week's post will look at how the country can achieve its goal of middle income status by 2021.

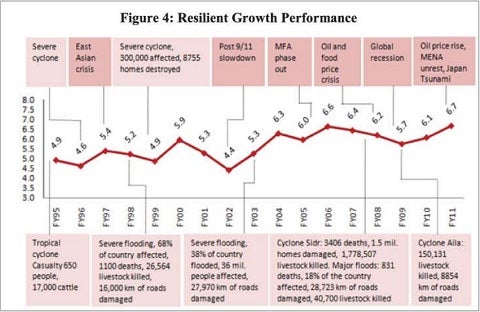

Several factors explain Bangladesh’s resilience to global shocks. These include strong fundamentals at the onset of the crisis, the resilience of its exports and remittance, relatively under-developed and insulated financial markets, and pre-emptive policy response. Booming exports and remittances in the years immediately preceding the crisis helped build foreign-exchange reserves to a comfortable level while prudent fiscal management reflected in low deficit and debt had preserved space for policy response. Notwithstanding fears of shrinking markets, factory closures, and large-scale bankruptcies, Bangladesh’s exports have coped well particularly in the US market due to the so called Walmart effect. Consumers in the US and EU continued purchasing ready made garment (RMG) products as they switched from more expensive to cheaper products offered by chains like Walmart. The latter is the single largest buyer of Bangladesh’s RMG products. Bangladesh’s low-end exports also benefited from rising labor costs in India and China. China, in particular, has been losing its competitive edge in the low-end RMG market due to the appreciation of its currency, rising labor costs and labor shortages. This has enabled the knitwear sector to maintain the production volume at levels prior to the onset of the financial crisis.

Resilience to shocks cannot be taken for granted. Merchandise exports suffered setbacks in 2010 and 2012. Bangladesh’s garment exports withstood the first round effects stemming from the global economic crisis. However, it has shown to be vulnerable to the second round effects working through the transmission mechanism of reduced trade. Market share in the EU was affected by competition from China on the back of withdrawal of quotas and a sharp depreciation of the Euro against the Taka. Several non-garment exports were hit, albeit temporarily, by the recession including leather, frozen food and jute. Frozen shrimp, a major export item, suffered a steep decline in price. In addition, shrimp exporters and farmers in the southwestern coastal region of Bangladesh were hit hard by cyclone Aila (end of May 2009). Exports of finished leather products suffered a steep decline in 2009. A sharp recovery in exports in 2011 was followed by an equally sharp decline in export growth in 2012 because of weak demand in Europe and the deteriorating efficiency of the trade logistics infrastructure. Slower growth in woven garments, knitwear, and leather and decline in export of frozen food and jute goods underpinned the slower export growth.

Meanwhile, the demand for Bangladeshi labor abroad weakened. While the global recession and resulting decline in international oil prices contributed to weakening the demand for migrant labor, Bangladesh’s problem was compounded by the moratorium on new work permits and their renewal imposed by the Saudi Arabian and, more recently UAE, governments. As a result, a large number of Bangladeshi workers lost their legal status, forcing many to return home. A similar problem arose in Malaysia. The Malaysian government also put an embargo on recruitment of Bangladeshi workers.

Capital flight has persisted. One striking trend during last two decades has been the persistence of export of capital from Bangladesh. National savings have exceeded domestic investment in most years. While the excess of savings over investment had been relatively small during the 1990s and the first half of the decades of 2000s, it has increased significantly since fiscal 2005. This partly reflects a rise in gross national savings due to rapid growth in remittances, but it is also a reflection of feeble growth in private investment and declining public investments.

How then can the continued dependence of Bangladesh on foreign financing be explained? The government’s budget has remained dependent on net foreign financing (including official grants) or about a third to half of public investments. In addition, the large NGO sector is heavily dependent on foreign grants. Part of the excess savings has gone into foreign reserve accumulation. During last five years the annual increase in foreign reserves amounted to around 1% of GDP. But this cannot explain it all. The only other avenue is private capital outflows. Official accounts do not fully capture all the outflows––payments extracted from public import procurements and investment contracts as well as under-invoicing of imports motivated by tax evasion and insurance against uncertainty. Aggregate capital flight suggests that overall investment in the country is not constrained by the supply of investible resources. Weak incentives to investment appear to be the more binding constraint. Bangladesh has not succeeded in improving the investment climate to an extent sufficient to absorb its entire national savings and, in addition, attract foreign savings.

Current growth rates would be hard to maintain without addressing the weak incentives to invest.

Join the Conversation