Construction workers in South Africa. Photo: Trevor Samson / World Bank

Construction workers in South Africa. Photo: Trevor Samson / World Bank

Policy makers and practitioners are increasingly paying attention to the potential catalytic role of public procurement to promote economic growth and inclusive and sustainable development, for example, through participation of small and midsize enterprises (SMEs) and women-owned firms in this market.

How can we generate evidence on firms’ perceived challenges when participating in public procurement?

A recent World Bank publication shows how firm-level survey data captures views of firms that cannot be observed from e-government procurement (eGP) data. The findings help study firms that have never entered the public procurement market, and countries that have not adopted an eGP system yet.

In this blog, we present some of the statistics and stylized facts that can be generated from the existing World Bank Enterprise Surveys data.

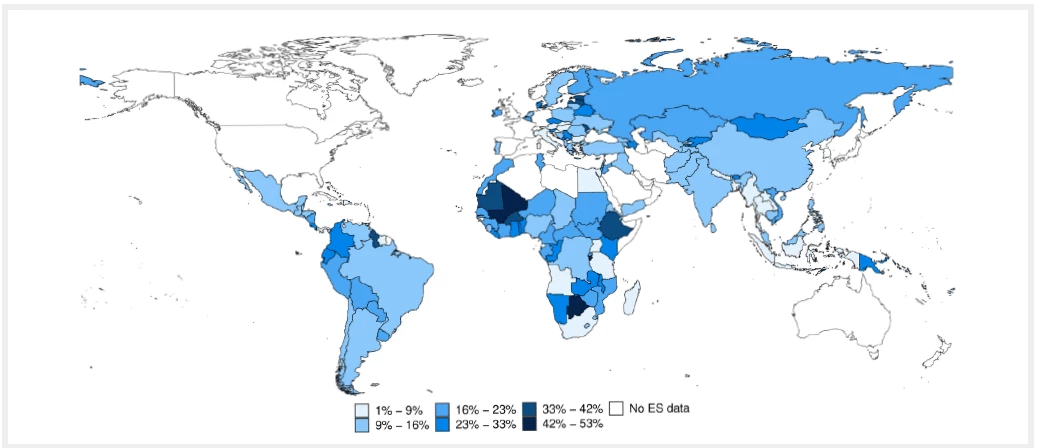

On average across 150 countries where Enterprise Surveys data are available, the firms’ participation rate in public procurement is 18 percent, ranging from 12 percent in South Asia to 22 percent in Sub-Saharan Africa. Figure 1 below shows how the participation rate varies across countries. Not surprisingly, the business sectors with the highest participation rates are construction and IT services.

Figure 1: Country-Level Participation Rates in Public Procurement

Source: World Bank Enterprise Survey.

Note: N = 90,199. The intervals are computed using Jenks natural break. Statistics are computed using the latest ES wave available for each country and using sample weights.

Relative to larger firms, SMEs participate significantly less in public procurement. Even after considering differences due to the main firm characteristics – such as firm age and productivity, and the main sector – SMEs are on average 12 percent less likely to participate in public procurement than larger firms.

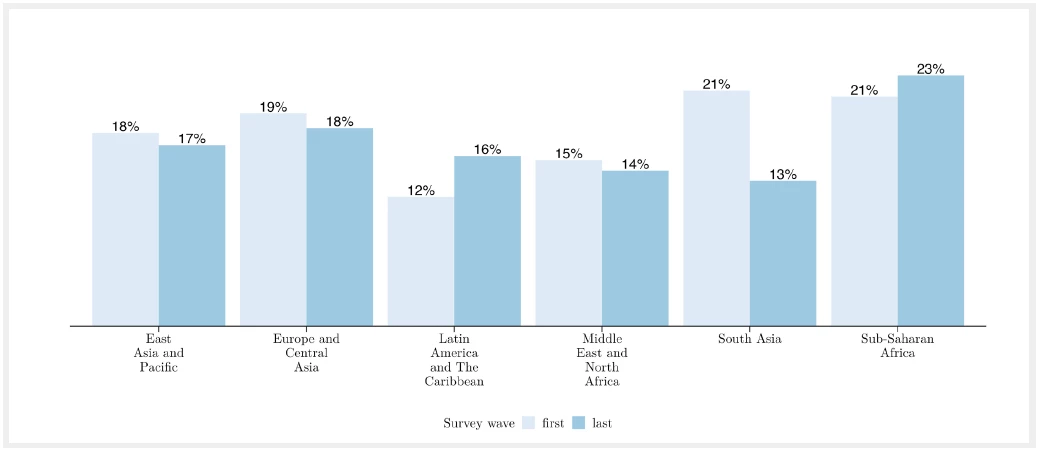

Overall, participation rates in public procurement have remained approximately stable over the last decade. Between 2007–2013 and 2014–2020, the participation rate increased only in Latin America and the Caribbean and in Sub-Saharan Africa, whereas it decreased in the other regions (Figure 2).

Figure 2: Regional Trends in Participation Rates of Private Firms in Public Procurement

Source: World Bank Enterprise Survey.

Note: N = 33,853 (first wave). N = 58,339 (last wave). First waves range from 2009 to 2014 for EAP, from 2007 to 2014 for EAC, 2010 for LAC, from 2010 to 2013 for MENA, from 2007 to 2009 for SA, and from 2007 to 2011 for SSA. Second waves range from 2015 to 2019 for EAP, from 2018 to 2020 for EAC, 2016 to 2018 for LAC, from 2013 to 2020 for MENA, from 2013 to 2015 for SA, and from 2013 to 2020 for SSA. Statistics are computed using the latest ES wave available for each country and using sample weights. Regions are not necessarily consisting of the same countries in different waves.

Evidence on barriers to and challenges of participation in public procurement from the perspective of firms. A procurement questionnaire module was added to the COVID-19 Follow-up Enterprise Surveys and piloted in Croatia, Poland, and Romania in May–June 2021. The data shows that, in these countries, administrative barriers before contracts are signed are the biggest obstacle to attempting to secure a government contract. In particular, the main administrative obstacle before contract signature is the effort needed for bid preparation in Croatia (44 percent) and Romania (55 percent), and the length of the process after bid submission in Poland (40 percent).

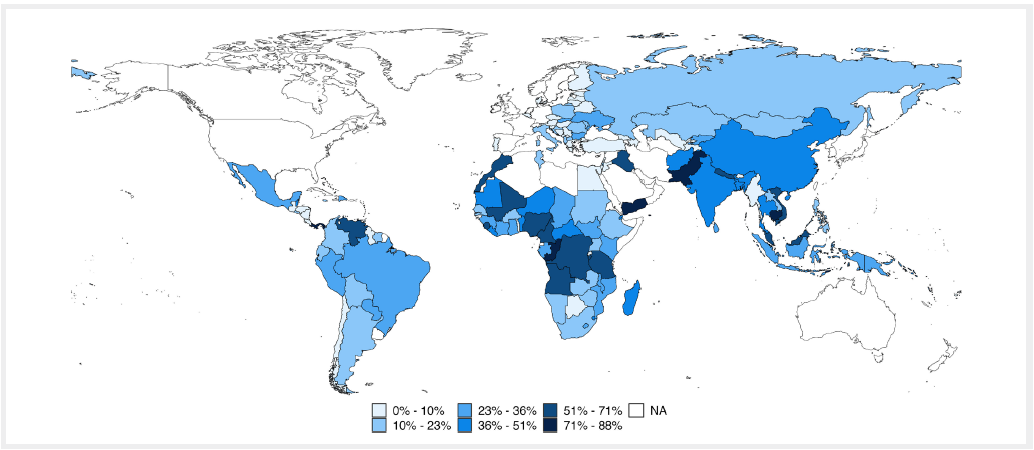

Evidence on the experiences of bidders and suppliers: corruption risks. Globally, 21 percent of firms that secured or attempted to secure at least one government contract in the 12 months prior to the interview state that similar firms typically make informal payments or give gifts to secure government contracts (country-level rates are shown in Figure 3). Thus, corruption may be an important deterrent for firms to apply for a government contract and may distort the efficient allocation of contracts across firms.

Figure 3: Country-Level Rate of Firms Expected to Give Gifts to Secure a Government Contract

Source: World Bank Enterprise Survey.

Note: N = 13,666. The intervals are computed using Jenks natural break. Statistics are computed using the latest ES wave available for each country and using sample weights.

The World Bank Enterprise Surveys data can provide useful information on public procurement from firms’ point of view. Tailored questionnaire can be developed to investigate in more detail the market from the perspective of firms. For example, an ongoing study on public procurement in Romania combines the analysis of eGP data, complaints data, and firm-level survey data to investigate the determinants of competition in public procurement, in the construction of transport infrastructure sector. Another example is the ongoing Methodology for Assessing Procurement Systems (MAPS) assessment for Montenegro complements the legislative, regulatory, and institutional review with a firm-level survey conducted with existing bidders and suppliers as identified from the eGP system.

As the World Bank is expanding its effort to collect firm-level survey data through the Enterprise Surveys, data on participation in public procurement and firms’ experiences with government contracts will become more frequent and will cover almost the whole globe, facilitating new research on this topic.

Interested in conducting a survey with firms with a focus on public procurement? This paper contains specific guidance, key decisions, and additional resources on how to do this. Let us know what you think by leaving a comment below!

Join the Conversation