Infrastructure Governance

Infrastructure Governance

Weak governance often has serious consequences for infrastructure projects. Take for example Boston’s “Big Dig,” which rerouted an interstate highway into a 1.5-mile-long tunnel and included the construction of a new tunnel, bridge, and greenway space. With construction beginning in 1991, it was the most expensive highway project in the U.S. and was plagued with poor governance. This included a lack of strategic long-term planning leading to cost overruns, delays, leaks, and design flaws. The project was also beset by fraud and corruption problems, including the use of substandard materials, which led to six criminal arrests. The project was originally scheduled to be completed in 1998 at an estimated cost of $2.8 billion, but it was only finished in December 2007 and cost over $24 billion.

The Big Dig project exemplifies how it is often governance, rather than scarce financing, that is the main impediment to efficient, effective, and sustainable infrastructure services. Many countries struggle with such governance-related issues, on average wasting about a third of their infrastructure spending due to inefficiencies. This loss can surpass 50 percent in low-income countries, according to the IMF.

To make matters worse, during the COVID-19 pandemic many governments rapidly increased their expenditure on healthcare infrastructure using emergency procurement measures, risking corruption and inefficiency in the process. The pandemic forced many governments to borrow and spend on much needed stimulus and emergency measures. We now see a rapidly expanding debt burden and slowing global growth which will further limit government action in the future. The Global Infrastructure Hub estimates that of the $94 trillion needed to meet global infrastructure needs by 2040, there will be a $15 trillion investment gap. Part of this gap can hopefully be bridged by doing things more efficiently and effectively. The good news is that efficiency losses, increasing debt, and wasteful spending in infrastructure are not inevitable.

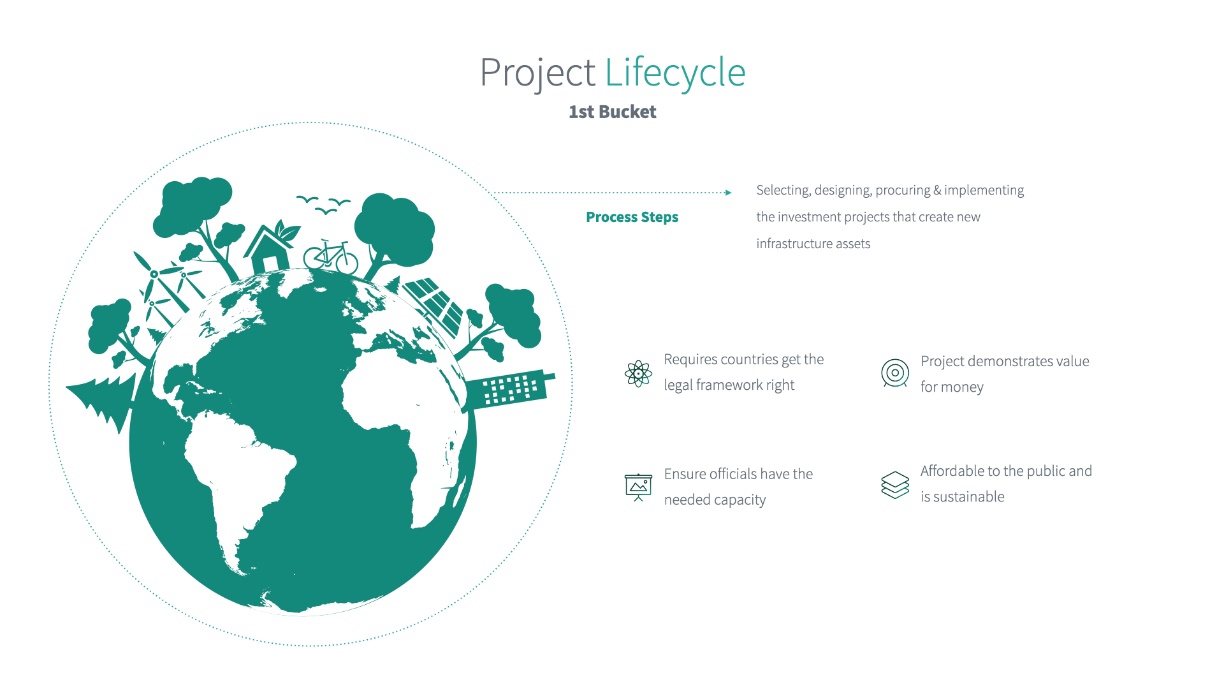

The Infrastructure Governance Framework, or InfraGov for short, was developed by the World Bank to help countries overcome these governance bottlenecks around infrastructure and enable them to get more bang for their infrastructure buck. The approach groups the key dimensions that countries need to get right into three buckets. The first bucket concerns the project lifecycle. This relates to selecting, designing, procuring, and implementing investment projects that create new infrastructure assets. It requires countries to get the legal framework right and ensure officials have the needed capacity. The project must demonstrate that it offers value for money; that it is affordable for the public purse and users; and that it is sustainable.

The second bucket identifies a number of cross-cutting issues for good infrastructure investment. These include ensuring that social, environmental and climate change considerations are fully integrated into every phase of the project’s life. It also includes issues around how to fight corruption and ensure that important information is made available for the public to scrutinize.

The final bucket looks at how ongoing infrastructure services are provided to citizens. This includes ensuring that there are relevant and independent regulatory frameworks for sectors such as power, water and transport. It also requires governments to ensure that State-Owned Enterprises (SOEs) and other state bodies involved in service provision, have clear roles and responsibilities, manage their risks and that there is a level playing field with respect to them and other market players.

The World Bank is on track to complete 20 InfraGov assessments by the middle of 2022.

The InfraGov assessment of the Dominican Republic, completed in 2020, is already showing positive results. The project aimed to increase levels of private participation and increase the performance of SOEs. This will improve the service provision of water and electricity and ensure more cost efficiency in a transparent manner.

The findings of the assessment are currently being rolled out in the Dominican Republic. This includes the creation of a new PPP unit and enhancing public processes and sector skills in developing infrastructure projects.

Ultimately, improving infrastructure governance contributes to the wider goal of successfully delivering public services to citizens, ensuring such service provision is cost efficient, sustainable, and transparently built and operated. Not only is infrastructure investment important for fostering sustainable economic development, but it is also a key lever for achieving the Sustainable Development Goals, responding forcefully to the climate change crisis and recovering from the COVID-19 pandemic.

As the world moves into what could be more turbulent economic waters, the World Bank is committed to helping countries ensure that infrastructure is governed effectively to bring about a more equal, inclusive, and sustainable future.

For more information, visit worldbank.org/infragov.

Join the Conversation