This is the 21st in this year’s series of posts by PhD students on the job market.

It is common for governments around the world to impose restrictions on rural land markets. Restrictions take many forms, such as “use it or lose it” customary rights where uncultivated land might be reassigned to someone else, the imposition of ceilings on the total amount of land someone can own, or outright bans on the transfer of ownership. Such practices are often rationalized on grounds of equity, but most economists will feel compelled to point out that restricting land markets can harm agricultural productivity. At the same time, it is common for farmland in developing countries to be concentrated in large, underutilized estates. Concentration and underutilization may reflect the ability of large landholders to exert market power and keep rural wages low. Is the presence of market power a large enough concern to merit the restriction of land transactions?

In my job market paper, I study this question by estimating how a law restricting land accumulation impacted local land and labor markets, land concentration levels, and agricultural productivity in Colombia. Aiming to reduce land inequality, Law 160 of 1994 imposed limits on how much rural land could be bought by any single individual. This limit was meant to represent the amount of land needed for a household to earn a given income, so the law established that the height of these land ceilings should vary across municipalities to account for differences in land quality. In addition, these ceilings were ruled only to apply for some land—plots originally owned by the state but granted at some point to an individual during the course of the country’s longstanding land allocation policy. These particularities in the design of the law led to variation in the strength of market restrictions across municipalities. I take advantage of this variation and define a measure of market restriction stringency—the combination of (inverse) ceiling height and share of total farmland under restriction—to estimate how constraining land markets affected local rural economies.

A new dataset on agricultural productivity

To measure the law’s impact on the agricultural sector, I collected and digitized hundreds of distinct archival government publications to build a new dataset of detailed information on crop-specific agricultural yields at the municipality-year level for the 1988–2004 period. This dataset constitutes the first comprehensive collection of municipal-level figures on agricultural output and area planted in the country for this time period. It consists of more than 135,000 crop-semester-municipality observations organized in an (unbalanced) panel of 859 municipalities across 17 years—covering roughly 76% of the country’s rural population in 2005. I combine this dataset with information on the universe of public-land allocations, as well as with several other sources of administrative data on individual land sales, the distribution of farm sizes, and agricultural workers’ earnings and employment to build a municipality-year panel with information before and after the enactment of the law.

I evaluate how these outcomes vary with degree of restriction stringency. This measure is potentially correlated with regional geographic characteristics, so my estimation restricts to comparing municipality pairs that share a common border. The identifying assumption is that endogenous characteristics vary smoothly across municipal borders, while discrete differences in both ceiling height and the share of farmland under restriction across neighboring municipalities serve as a source of plausibly exogenous variation in the stringency of market constraints. My econometric strategy therefore follows a differences-in-differences approach that leverages within-municipality-pair variation in the severity of restrictions.

Land market restrictions lower agricultural productivity, but also increase wages and employment

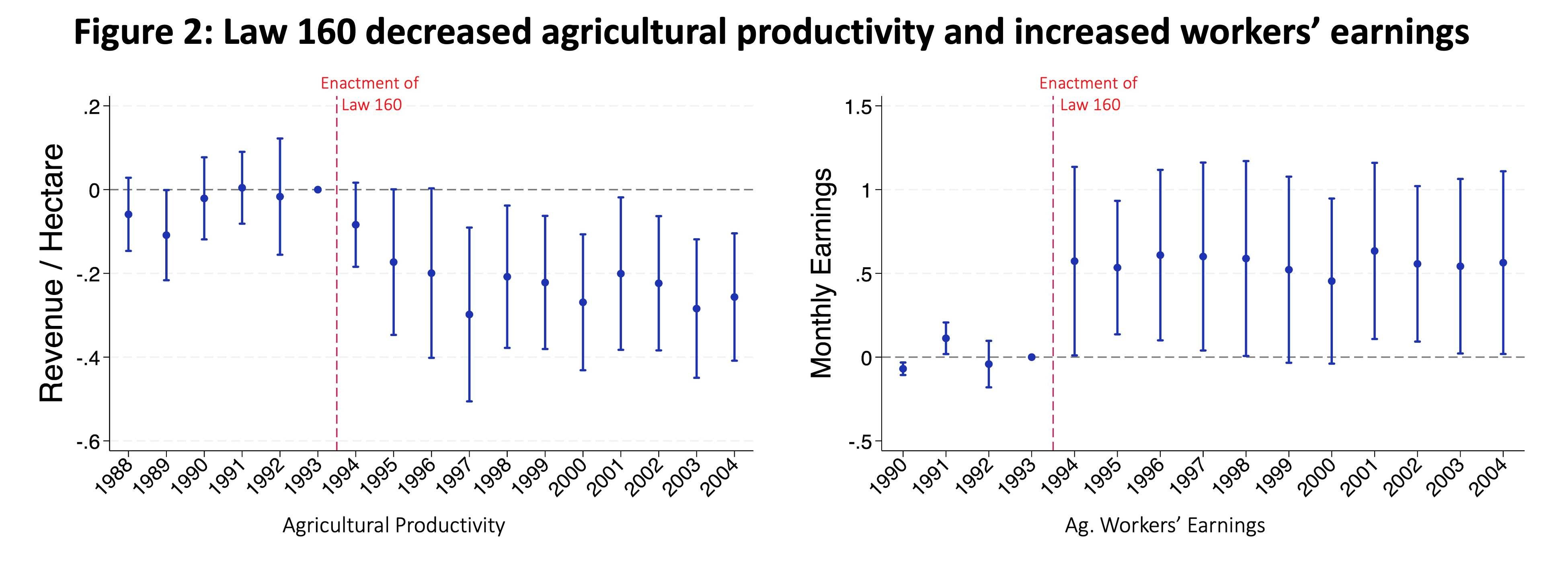

I find that more stringent restrictions led to slight reductions in overall land inequality, but caused a permanent drop in agricultural land productivity. After the passing of the law, municipalities where average restriction-stringency levels were imposed had a reduction of 4% in its land ownership gini index (at mean values, a drop of about a sixth of a standard deviation), but also suffered a persistent 14% decrease in revenue per hectare during the following ten years—a drop of roughly a ninth of a standard deviation from the mean.

Despite the decrease in land productivity, restrictions also led to substantial increases in the earnings and employment of agricultural wage workers. Municipalities with average restriction levels saw increases of 15% in their share of workers occupied in agriculture, and had increases of 41% in monthly earnings per agricultural worker—an increase of, respectively, about a third and a fourth of a standard deviation from mean values. The combination of reductions in productivity with increased worker earnings and employment is indicative of restrictions having led to a reduction in the labor market power of large landholders. These findings suggest that the policy of restricting land transfers may have, on average, held back the efficiency of the Colombian agricultural sector, but that it has likely benefitted landless wage laborers through increases in wages.

Restrictions are less harmful for productivity in places with higher initial land concentration

I test for heterogeneity in the agricultural productivity effects of market restrictions based on initial land concentration following a land survey carried out ten years before the enactment of the law. Productivity declines across the distribution of initial land concentration, but the magnitude of the negative effect depends on the degree of pre-reform land concentration present in the local economy. A 10% increase in restriction stringency led to a reduction in productivity of about 4.2% in municipalities with low initial levels of land concentration, but this effect is attenuated by 3.2 percentage points in municipalities with high (above median) initial concentration levels. Heterogeneity in the effect on productivity between municipalities with high or low initial concentration levels is consistent with a model in which market power distortions are larger in more concentrated economies.

These findings are consistent with market power exerted by large landholders

These findings are consistent with an economy where large landholders exert market power in both land and labor input markets, and where the imposition of land market restrictions lowers their capacity to do so. I formalize this idea in a model of equilibrium land transactions, prices, and productivity in local economies with large landholders exerting market power, and then introduce government-imposed limits on land accumulation. Numerical simulations show how simultaneous, opposing effects on productivity on one hand and wages and employment on the other arise from the tension between two distinct sources of market distortions. Restrictions on land accumulation can hinder reallocation to more productive owners, but also limit the scope for market power. The model also shows why the effects of restrictions are heterogeneous according to initial concentration levels.

What are the policy implications?

Restricting the free transfer of assets between individuals can strike many economists and policymakers as both paternalistic and inefficient. However, when designing land property right reforms, policymakers should be aware of the potential for distortions caused by market power in rural economies with high levels of land concentration. The decision to impose (or lift) restrictions on land markets can have ambiguous effects on the economy, and there are important distributive implications related to the decision to place such constraints in contexts where imperfect competition might be prevalent. Regulatory policies should allow markets to aggregate information and allocate resources, but should also be capable of addressing distortions being caused by excessive concentration.

Julián Arteaga is a PhD candidate in the Department of Agricultural and Resource Economics at the University of California, Davis; https://julian-arteaga.github.io; twitter: @Arteaga_Jul

Join the Conversation