This is the third in this year’s series of posts by PhD students on the job market.

Many low-income households in developing countries make large expenditures on festivals and ceremonies. In a paper titled “The Economic Lives of the Poor,” Banerjee and Duflo document that, in Udaipur in India, more than 99 percent of the poor households spend on festivals, with their median expenditures on festivals being 10 percent of their annual household consumption. Conditional on having such a ceremony, its significance for a household's budget is evident: wedding costs in India in 1994 cost roughly 30 percent of GDP per capita (Bloch et al.; 2004), and, in South Africa, the average funeral's cost amounts to 40 percent of an average household's annual budget (Case and Mennedez; 2011).

But many households in developing countries have low income and face various constraints such as credit constraints, and behavioral biases such as present bias. How do they fund the expensive ceremonies and festivals? And if such events impose a large financial stress on households’ budgets, then what are the economic consequence of such events? These are important questions to understand how households manage large expenditures and what roles festivals and ceremonies play in developing countries. My job market paper addresses these questions by using a ceremony in Latin American culture, the quinceañera.

Endogenous timing of ceremonies

One empirical challenge to answer these questions is the endogenous timing of ceremonies. For example, households may decide the timing of marriage based on available resources. Also, the death of a household member could be related to income shocks to the household.

Endogenous timing makes it challenging to identify the causal impact of festivals and ceremonies on economic outcomes. For example, if a household borrows more money when it has a funeral, is it because the household is borrowing to pay for the funeral? Or does a negative income shock cause the death of a household member and also force the household to borrow money to deal with its minimum necessities (in other words, does an income shock cause a spurious correlation between a funeral and borrowing)? To study the causal impact of festivals and ceremonies on economic outcomes, it is necessary to overcome this issue.

In my job market paper, I overcome this endogenous timing issue by using a quinceañera. It is a traditional ceremony in Latin culture celebrating a girl’s 15th birthday. Quinceañeras are costly and hence potentially affect various aspects of households' lives. This makes it important to answer how households afford the ceremonies and what the consequences are.

Quinceañeras have two features that help me answer my research questions. First, the timing is fixed and clearly determined. This helps me avoid the endogenous timing issue and empirically analyze the causal impact of quinceañeras. The fixed timing also allows me to identify whether a household had a quinceañera in the survey year based on the age of a girl in the household.

Second, only households with a 15-year-old girl hold ceremonies, not those with a boy of the same age or those with a girl of different ages like 14 or 16. This allows me to use a difference-in-differences analysis for identification. The first difference is in the outcomes between households with a girl who is age 15 and households with girls of other ages. However, just comparing them can capture the difference in outcomes due to children’s ages. Hence, as the second difference, I use households with girls and those with boys of the same age. This allows me to rule out the differences due to the ages of children in households and to identify the effect of having a quinceañera on the outcomes of interest.

Households use savings, transfers from other households, and increased labor supply by mothers

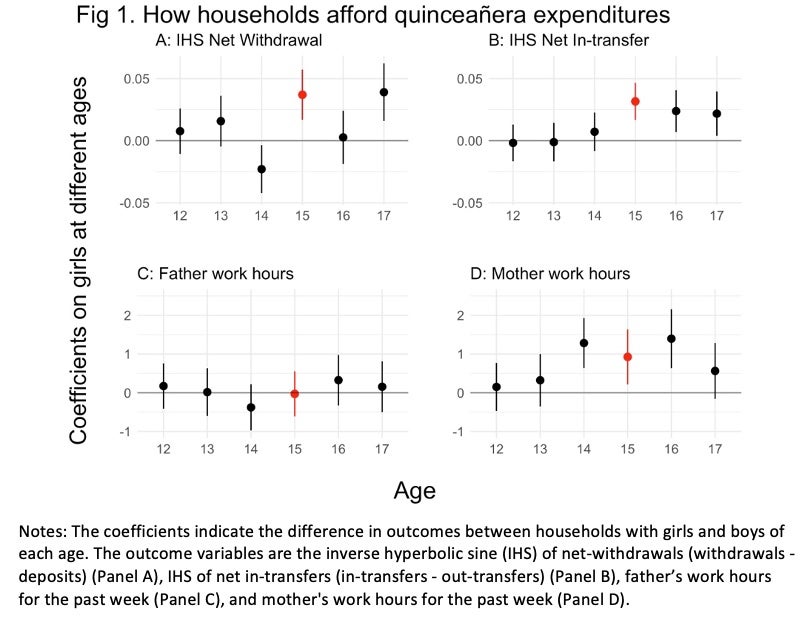

With Mexican repeated cross-section data, National Survey of Household Income and Expenditure, I obtain the following empirical results. First, I find that households deposit more in their saving accounts when their daughters are 14 years old and withdraw more when their daughters are 15 years old. This suggests that households save money one year before the quinceañera ceremonies and use the money when they have the ceremonies. Anukriti et al. (2021) obtain a similar finding that households use savings for future dowry payments in India.

I also find an increase in monetary and in-kind transfers from other households. This suggests that households fund the quinceañera ceremonies using support from other households. This is consistent with local tradition. In Mexico, in large events such as quinceañeras and wedding ceremonies, friends and relatives are chosen, and they are expected to support the households holding the ceremonies. My findings may capture this support.

Another finding in my study is the increase in mothers’ work hours (by 5 percent) but not in fathers’. This is in contrast to Anukriti et al. (2021)’s finding that, to prepare for future dowry payments, fathers increase their work hours, but mothers do not. This difference could be born out of the difference in the labor markets for female workers. In India, female labor force participation is much lower than in Mexico. Hence, Mexican women may find it easier to adjust their work hours according to their needs.

… and they are less likely to engage in non-agricultural business

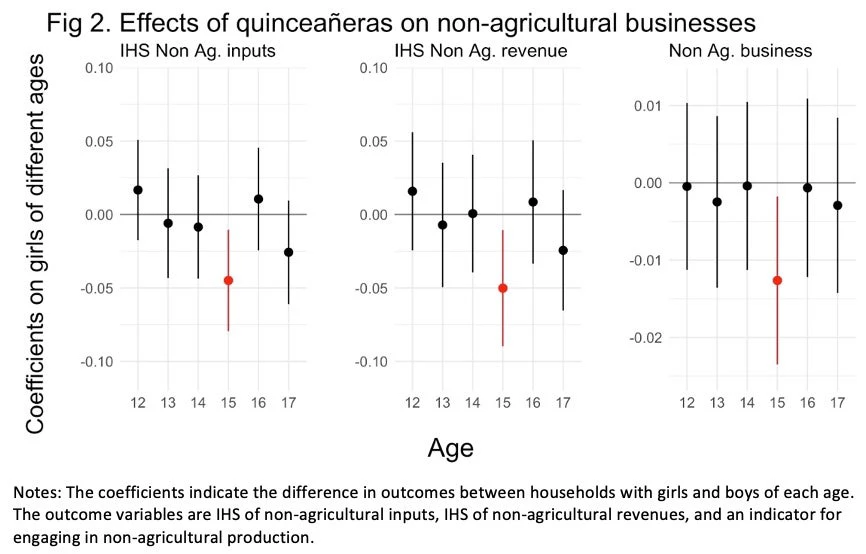

Another thing that households could do to fund ceremonies is reduce their business inputs. I found that, in the year of quinceañeras, households are less likely to operate non-agricultural businesses (manufacturing, retail, or service) by 1.3 percentage points (or 5 percent). This suggests the crowding-out effect of quinceañeras: for example, if business operation requires fixed costs (e.g., purchasing machines or equipment) and households are credit constrained, then they cannot pay the costs and may be forced to shut down their businesses. Through the regressions by the wealth level, I find that the crowding-out effect is larger for poorer (presumably more credit-constrained) households, which supports this argument.

While the “death” or shutdown of small and medium enterprises (SMEs) in developing countries has been understudied, McKenzie and Paffhausen (2019) find that economic shocks (e.g., a reduction in product demand and increases in input prices) and household shocks (e.g., illness of household members) are the main causes for households to close their non-agricultural businesses. Whereas quinceañeras are anticipated unlike these unanticipated shocks, I find the ceremonies’ negative impact on the businesses. This suggests the households’ saving constraints such as the lack of access to financial institutes to save in or present bias, making it difficult for them to save for the ceremonies in advance and reduce their impact on business operation. The authors also find that such business shutdowns are not permanent; within a short period, households restart their businesses. This resonates with my finding that, after the year of the quinceañera itself, households with girls and boys again have similar probabilities of operating non-agricultural businesses.

Importance of access to credit and support for SMEs suffering economic difficulties

This study contributes to several strands of literature, including the literature on conspicuous consumption and on how households in developing countries cope with income shocks or large economic needs. My findings can have direct implications for other Latin American countries with quinceañeras and countries with similar coming-of-age ceremonies (e.g., the debut in Philippines). This study also provides several policy implications. First, my results offer insights into the role of financial institutions in the context of developing countries to deal with large expenditures. The results indicate that saving opportunities allow households to smooth their consumption over time, making it easier to afford large expenditures for quinceañeras. As highlighted in the previous studies such as Collins et al. (2009), my study demonstrates the value of access to credit for low-income households. Secondly, my findings have implications for the aid of small and medium enterprises in response to large economic needs, which in my study are expenditures for quinceañeras. Since self-employment is an invaluable income source for many households in developing countries, relaxing their credit constraints to deal with economic difficulties is crucial.

Mizuhiro Suzuki is a PhD candidate in Agricultural and Applied Economics at the University of Wisconsin-Madison. More details about his research can be found here.

Join the Conversation