This is the 22nd in this year’s series of posts by PhD students on the job market.

Universal Basic Income (UBI), a cash transfer given unconditionally to all individuals at regular intervals, has received increased attention in recent years as a potential anti-poverty policy for developing countries (Banerjee et.al 2019 and Ghatak 2017). These economies face unique financial challenges in implementing UBI, distinct from those in the developed world. In particular, the sizable informal sector in these countries diminishes their tax capacity, casting doubt on the feasibility of financing. With this context in mind, my job market paper addresses the following questions:

Can developing countries with a large informal sector feasibly finance UBI? What are the long-term impacts of such a policy?

I examine the viability and implications of funding a UBI at half the international poverty line, $0.95 a day (2011 international prices), using either labor income taxes or consumption taxes. I find that funding this level of UBI with labor income taxes is infeasible. However, while funding UBI through consumption taxes is feasible, this policy leads to lower output, capital, and aggregate labor in the long run. Despite this, there is increased consumption and higher average welfare, as well as a modest rise in the formal sector's share. Finally, I highlight how UBI and increased consumption taxes affect the size of the formal sector.

Model

I construct a life cycle model with rich heterogeneity where individuals differ in terms of assets, human capital, age, and labor market shocks. These individuals make decisions about consumption, labor supply, and human capital investments. Moreover, I incorporate the choice of joining either the formal sector, which offers higher earnings but imposes labor income taxes and an entry cost, or the informal sector.

The model encompasses most of the key benefits and costs associated with UBI. On the positive side, UBI aids in the accumulation of human capital among young individuals. It also facilitates consumption smoothing in the face of shocks and credit constraints. Conversely, funding UBI introduces tax distortions that can counteract these positive effects. Additionally, there is a pure income effect that reduces labor supply, a primary concern for policymakers. The overall outcome in aggregate depends on the interplay between these benefits and costs, as well as the general equilibrium effects.

Benchmark Experiment

I calibrate the model to the Indian economy using various sources of macro and micro data. To understand the counterfactual implications of UBI, it’s essential to consider the baseline welfare system in India. I focus primarily on the two major programs that account for the most significant spending. The first is subsidies, such as food and fertilizer subsidies, which are aimed at assisting low-income individuals. These subsidies amounted to 1.63% of GDP in the fiscal year 2011-12. The second key welfare scheme is the National Rural Employment Guarantee Scheme (NREGS) program, which offers wages conditional on work.

In the model, the benefits outlined above are available to all informal sector workers. This is a reasonable approximation, as these programs predominantly target poor individuals within the informal sector and exclude anyone in the formal sector. In the benchmark experiment, the existing welfare system is replaced with a UBI set at half the international poverty line. This UBI would be financed through increased taxes and the reallocation of funds from the discontinued programs.

Financing through Labor Income Taxation

Financing UBI solely through labor taxes proves infeasible. This is primarily because such taxes are borne exclusively by formal sector workers, and their response renders this financing method unviable. There are two potential ways to increase labor tax revenue:

i) Increasing the labor tax rate: This prompts individuals to reduce their labor supply and investment in human capital, leading to decreased labor earnings. Consequently, with the tax exemption threshold unchanged, they can qualify for tax exemptions. However, this results in diminished labor tax collections beyond a certain point.

ii) Lowering the tax exemption threshold: In this scenario, individuals choose to leave the formal sector, leading to a reduced share of it in the long run. This shift occurs because the formal sector becomes less appealing to potential participants as they have to pay more in taxes due to a lower exemption threshold compared to the baseline scenario.

Financing through Consumption Taxation

An alternative way to finance UBI would be to increase consumption taxes for everyone. I find that it is possible to fund the UBI by raising the consumption tax rate. The final consumption tax rate increases to 25%, up from the baseline rates of 12% for the informal sector and 18% for the formal sector. The net increase is more for the informal sector, as they enjoyed subsidies in the initial equilibrium, which have now been removed. The results discussed below consider all the forces mentioned in the model section.

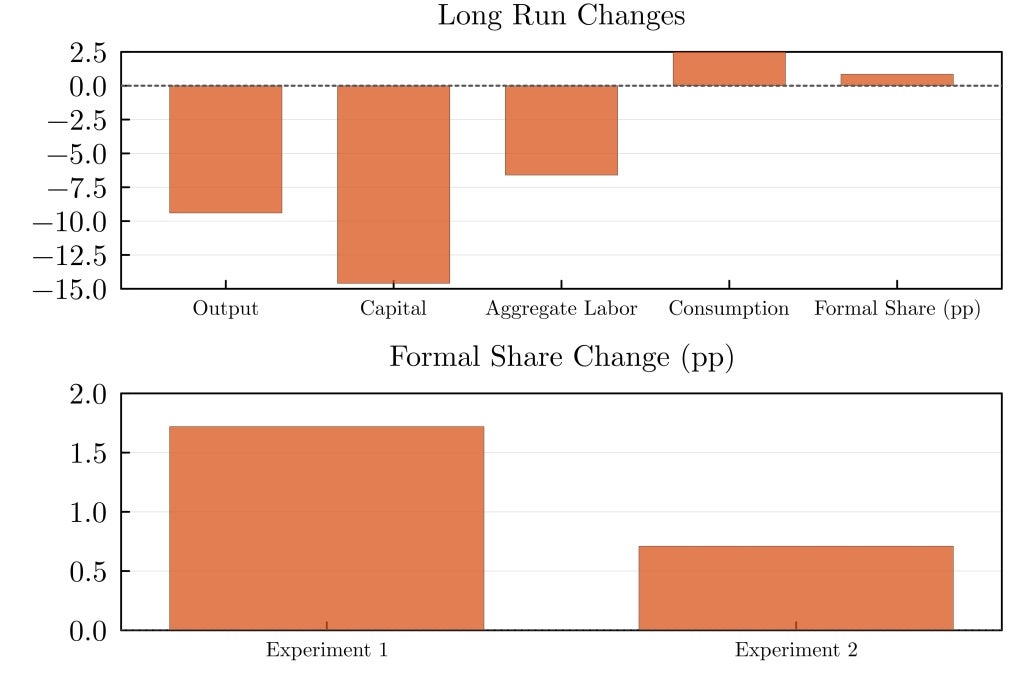

In the long run, as depicted in Figure 1 (upper panel), output, capital, and aggregate labor decrease. The decline in capital supply is largely attributed to reduced precautionary and retirement savings due to the presence of UBI. This fall in capital subsequently leads to a rise in the interest rate and a decrease in the effective wage rate. Furthermore, the fall in aggregate labor results from a decrease in both labor supply and human capital in the economy. I find that the reduction in labor supply is predominantly due to the income effect, a concern often highlighted by policymakers.

Despite these declines, aggregate consumption slightly increases by 2.5% as individuals consume a larger proportion of the output. The share of the formal sector increases marginally by 0.85 percentage points (pp) in the long run, from a baseline of 9.5%. Moreover, due to the better welfare properties of UBI and increased consumption, I find that average welfare also increases. This suggests that a world with UBI and increased consumption taxes would be preferred over the current welfare system.

Informal Share, Consumption Taxation and UBI

In order to understand how consumption taxes and UBI impact the share of the formal sector, I conduct two experiments. In these experiments, I keep prices and human capital constant to what they were in the initial equilibrium, to focus solely on the roles of these specific factors.

Experiment 1: Removing Subsidies, NREGS, and Increasing Consumption Taxes, Without UBI

As consumption taxes increase and NREGS is eliminated, the attractiveness of the informal sector decreases substantially as compared to the initial equilibrium. All else equal, more individuals join the formal sector on the margin. This change occurs because the special benefits of joining the informal sector no longer exist. We can see from Figure 1 (lower panel) that the formal share increases by 1.72 pp (18.1%) compared to the initial equilibrium.

Experiment 2: Introducing UBI

What happens to the share of the formal sector when we introduce UBI in addition to the conditions considered in Experiment 1? To understand this, we need to focus on the choices of the marginal individuals who were indifferent between joining either sector. I find that these individuals now opt for the informal sector. With the price of consumption being the same in both sectors, and the price of leisure being lower in the informal sector, the additional income from UBI allows an individual to get more value for money by opting for the informal sector. Thus, in the presence of UBI, marginal individuals tend to shift to the informal sector. This brings the formal sector share increase to 0.71 pp, a reduction from the initial increase of 1.72 pp.

Key Insights and Caveats

Overall, my research suggests that financing UBI through consumption taxation is feasible, though it largely has a negative impact on macroeconomic aggregates. Despite this, there are welfare gains in the long run due to increased consumption and better welfare properties of UBI. Additionally, the study highlights the potential of UBI to unintentionally reduce the size of the formal sector. In contrast, eliminating welfare policies specific to the informal sector leads to an expansion in the share of the formal sector.

To understand the long-term impact of UBI, any answer would necessarily depend on the model used. The model employed here captures most of the benefits and costs associated with UBI. The intensity of these effects can vary; for example, in a model that includes subsistence consumption, the positive impacts of UBI may be stronger than what is considered here. Moreover, the results discussed are pertinent to a large economy, where both labor and asset markets clear. In contrast, outcomes in a small open economy, which takes interest rate as given, would be different. Overall, the essential lesson for policymakers is the importance of focusing not only on the short-term but also on the long-term consequences of implementing a large-scale policy like UBI.

-Kuldeep Singh is a PhD Candidate at Washington University in St. Louis (https://kuldeepsingh-econ.github.io/

Join the Conversation