This is a joint post with John Gibson.

In October 2011, after a cruel 24 years in which New Zealand was typically the best in the world every 3 out of 4 years only to choke/be food poisoned/suffer from dodgy refereeing/or even be fairly beaten every 4th year, the New Zealand All Blacks won a gripping rugby World Cup final against France 8-7. This was a cause of major celebration in New Zealand, especially since it was the host nation, and a huge positive boost to national mood. As New Zealanders we shared in this joy – while as economists we wondered if we could measure its economic impact.

Our approach is to look at the reaction of the stock market to the news of this win. This is analogous to Ray Fisman’s work looking at the value of political connections in Indonesia by examining the reaction of stocks owned by Suharto’s relatives to his health shocks; and similar in spirit to Klein et al. (2009) who use betting odds to look at the impact of national team soccer results on stock market indices in Europe (finding no effect).

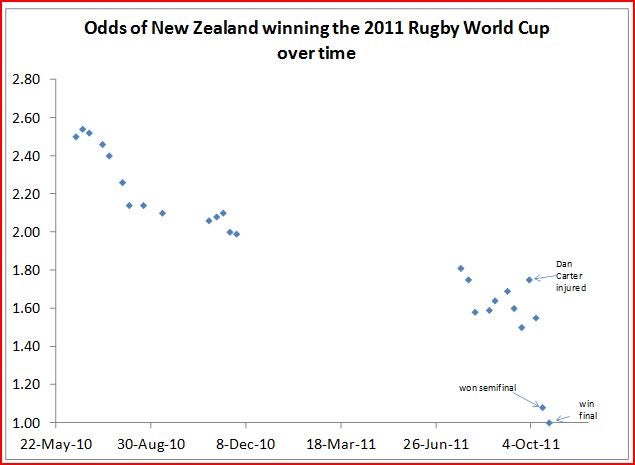

There are two challenges in trying to do this. The first is that we have to define what the “news” was. New Zealand were heavily favored to win the final, with bookmakers offering only $1.08 on a $1 bet at the time of the final against France. If this were a fair bet, the implied expected probability of them winning, once they had made the final, was 92.6%. We therefore collected bookmakers odds from the UK and New Zealand going back to the start of 2010, covering the 2010 and 2011 rugby seasons. We then look at the change in the odds after each of the 25 games the All Blacks played in 2010 or 2011, as well as the other major news event – when New Zealand star Dan Carter got injured during the World Cup finals. These odds (expressed as dollars won per dollar bet) are plotted below:

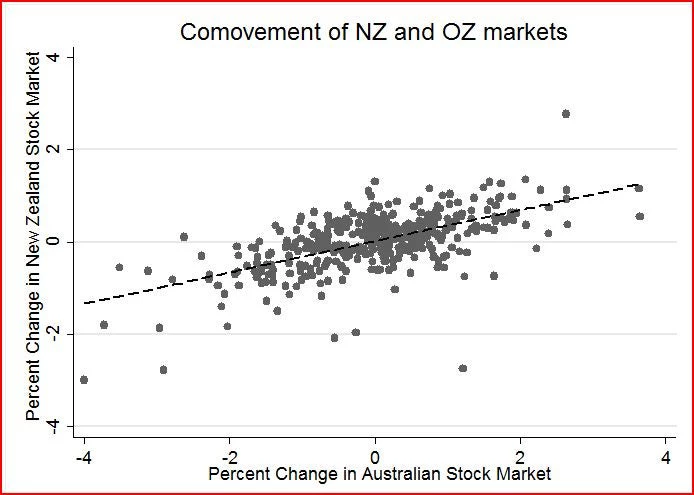

The second challenge is that stock markets are very volatile, with lots of other things going on that may swamp the impact of small changes in the probability of winning. One way to try and capture some of the aggregate events is to control for the change in the Australian stock market, since the two markets tend to move together:

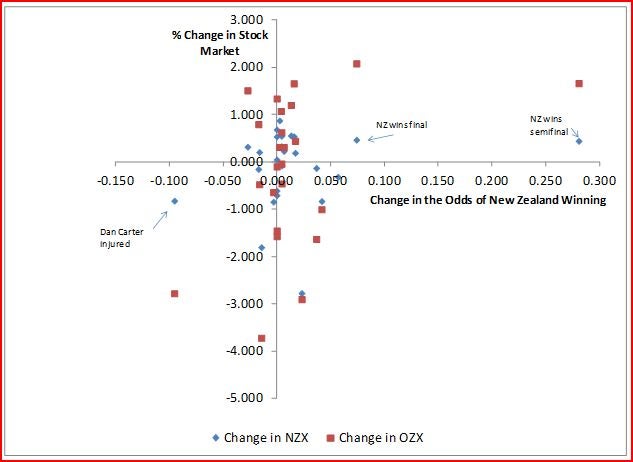

We then need to deal with the fact that a 10 cent change in the betting payoff from winning reflects a smaller change in probability when the bet is paying $2 for a win versus when it is paying $1.50. We therefore convert the odds into probabilities of winning assuming fair bets, and then calculate the change in the probability of winning according to betting markets with each win event, and the change in the New Zealand stock market and Australian stock market with each win event. A scatterplot shows the relationships.

We see that i) most of the data involve only small changes in the probability of winning; and ii) while the New Zealand stock market rose the first opening day after both main positive news events (beating Australia in the semi-final and France in the final) and fell on the day of the largest negative news event (Dan Carter getting injured), the NZ market actually rose less than the Australian market on these good news days, and fell by less than the Australian market on the bad news day. We're ruling out here that Australians love seeing New Zealand win by more than New Zealanders do as the explanation.

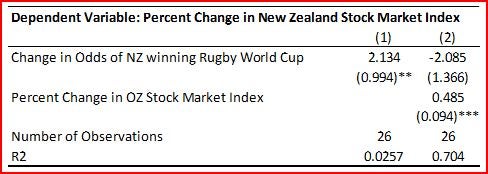

So putting this all together, and running a regression of the change in the New Zealand stock market on the change in the odds of winning, with or without controls for the Australian stock market, gives the following result:

So if we don’t control for the Australian stock market, there is a positive and significant (p=0.042) impact of New Zealand winning, although explanatory power is low. Controlling for the Australian stock market’s movements changes the sign and makes it insignificant. Ultimately we see from the above scatterplot that there just isn’t that much variation to play with, so we can’t obtain a precise impact.

Overall the problem is that there is not just enough news in New Zealand winning to generate a large enough change in the odds to precisely detect an impact. So we’ll console ourselves with the thought that New Zealand is just too good for the impact of its win to be known! Nevertheless, our results are consistent with the work of Glenn Boyle and Brett Walter who find over the 1950 to 1999 period that stock market performance in New Zealand is uncorrelated with whether or not the All Blacks win – so maybe the impact is just on our mental health!

Join the Conversation